Author: noblehouse

High fashion has long been associated with exclusivity, luxury, and incomparable artistry. The use of rare resources that are sourced from the most remote regions of the world is one of the qualities that distinguish their exclusivity. These materials, which are valued for their beauty, uniqueness, and the air of luxury they convey, are frequently essential to producing classic and enduring pieces. Let’s examine some of the priciest and most intriguing materials that have captured the attention of the fashion industry.

Crocodile Skin: A Symbol of Prestige

For many years, crocodile skin has been a mainstay of high-end design, appearing in accessories, shoes, and bags. Each hide exhibits a different pattern, and this material is valued for its toughness and distinct texture. Depending on the species and grade, crocodile leather can cost anywhere from $250 to $1,500 per square foot.

Crocodile leather has become infamous thanks to brands like Hermès and Louis Vuitton. A Hermès Birkin bag made of crocodile leather can cost up to $500,000, and the more uncommon the color and polish, the more expensive it gets.

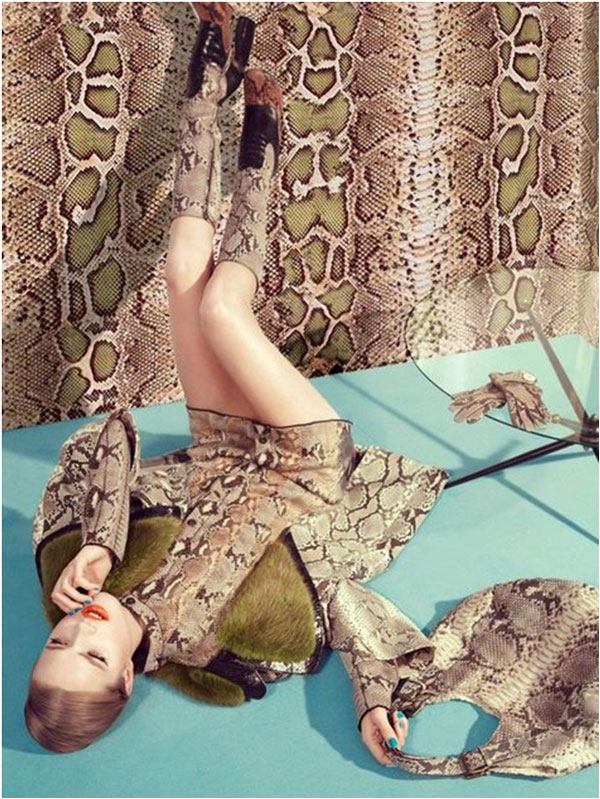

Snakeskin: The Ultimate Exotic Leather

Another popular material within high fashion is snakeskin, which is prized for its smooth and shiny appearance. With costs ranging from $50 to $300 per square foot, python skin is the most widely used material. It is frequently used in high-end purses and shoes because of its versatility, which makes it perfect for intricate designs.

Among the houses that regularly use snakeskin in their designs are Gucci and Prada. Because snakeskin is such an opulent material, limited-edition bags made of it can fetch up to $10,000.

Paraíba Tourmalines: Gemstones of Extraordinary Value

Because of their striking neon blue and green colors, Paraíba tourmalines are one of the most sought-after gemstones in the world. These extremely uncommon stones were found in Brazil in the late 1980s, and the finest specimens are worth up to $100,000 per carat.

Luxurious jewelry brands like Tiffany & Co. and Bulgari have used Paraíba tourmalines in their collections, displaying their splendor in rings, necklaces, and earrings. These jewels are a true sign of exclusivity because of their incomparable beauty and scarcity.

Vicuna Wool: The Softest Fabric on Earth

The finest and rarest wool in the world is Vicuna wool, which is obtained from the Andes in Peru. The llama’s relative, the vicuña, produces a limited amount of fleece per animal and can only be shorn once every three years. Because of this, vicuna wool costs between $300 and $600 per pound, and the final clothing can cost tens of thousands of dollars.

Vicuna wool is commonly used in collections by brands such as Brunello Cucinelli and Loro Piana. Vicuna overcoats, which can cost up to $50,000, are a prestige symbol for the wealthy and well-to-do.

Muga Silk: The Golden Fabric

Native to Assam, India, muga silk is prized for its longevity and inherent golden shine. This labor-intensive silk, which has always been preserved for royalty, can cost up to $6,500 per kilogram. The fabric is renowned for being incredibly durable, frequently outlasting generations.

Muga silk has made an appearance in haute couture, where designers have used it to create elaborate dresses and traditional clothing. It is a treasured material in high-end fashion because of its glowing gloss and historical significance.

Shatoosh: The Featherlight Cashmere

The Tibetan antelope’s undercoat is used to make shatoosh, which is known for its unparalleled warmth and softness. Because the creatures live in isolated, high-altitude areas, the material’s uniqueness comes from where it comes from. Despite weighing only 100 grams, Shatoosh shawls offer remarkable insulation.

Shatoosh shawls can cost anywhere from $5,000 and $20,000, depending on the design and craftsmanship. These items are frequently regarded as heirlooms that have been handed down through the ages.

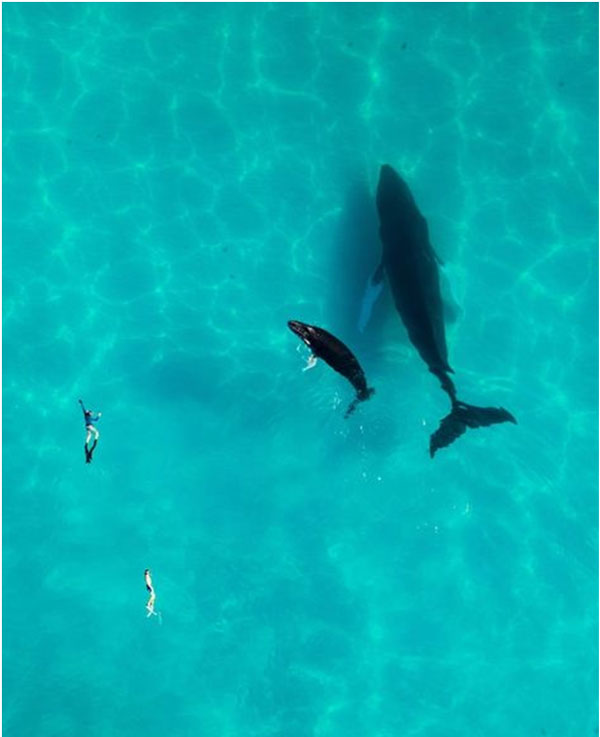

Ambergris: The Ocean’s Treasure

One of the rarest and priciest materials in high-end fragrances is ambergris, a waxy substance made by sperm whales. Ambergris, which is prized for its distinct aroma and capacity to intensify scents, may fetch up to $10,000 per kilogram.

Ambergris has long been utilized in perfumes by high-end companies like Chanel and Dior. It is a highly valued element in the fragrance industry due to its scarcity and connection to the enigmatic ocean depths.

High fashion leans heavily on exotic materials, which represent the ultimate in exclusivity and luxury. These unique materials, which range from vicuna wool overcoats to crocodile skin purses, not only define the style of haute couture but also convey tales of craftsmanship, legacy, and unmatched beauty. The appeal of these remarkable materials endures as fashion changes, securing their status as the ultimate symbols of luxury.

Recent Items

Dubai’s real estate market hits a record high of $89 b

Dubai’s real estate market hits a record high of $89 billion in the first half... Read More

DIFC Real Estate vs Dubai Land (DLD) Real Estate: A Comprehe

DIFC Real Estate vs Dubai Land (DLD) Real Estate: A Comprehensive Guide A comparison between... Read More

Surging Rents & Prices: A Deep Dive into Dubai & A

Surging Rents & Prices: A Deep Dive into Dubai & Abu Dhabi’s Property Boom 1.... Read More

Dubai’s Prime Residential Market Shows No Signs of Slowing

Dubai’s Prime Residential Market Shows No Signs of Slowing Down Dubai’s luxury residential market... Read More

Bluewaters Island: Dubai’s Iconic Waterfront Destination

Bluewaters Island: Dubai’s Iconic Waterfront Destination Bluewaters Island blends luxury residences, world-class attractions like Ain... Read More

Dubai is synonymous with luxury, providing experiences that are unmatched in all aspects of extravagance. The city is home to some of the most opulent spas in the world for those seeking wellbeing. These retreats create a sanctuary for rejuvenation and relaxation by fusing luxury with state-of-the-art treatments. Here’s a closer look at Dubai’s top three priciest spas, which combine wellness and opulence.

Talise Ottoman Spa at Jumeirah Zabeel Saray

The Talise Ottoman Spa, which is perched upon the famous Palm Jumeirah, is a celebration of elegance and tranquility. With its elaborate mosaics, gilded accents, and imposing chandeliers, this spa is a visual marvel that draws inspiration from the splendor of the Ottoman Empire.

Signature Treatment: The 24-Carat Gold Facial, which utilizes products infused with gold to brighten and rejuvenate the skin, is the spa’s most notable offering. It is proposed that gold’s anti-inflammatory qualities promote cell renewal and fight aging symptoms.

Cost: 2,000 AED each session.

Popularity: With thousands of sessions scheduled each year, this treatment continues to be a favorite with famous visitors.

Facilities: One of the biggest spas in the Middle East, covering 8,000 square meters. Relaxation lounges, private hammam suites, snow rooms, and thalassotherapy pools are among the facilities.

The spa’s reputation as a worldwide wellness destination was cemented in 2023 when it reported a 35% rise in reservations from foreign tourists

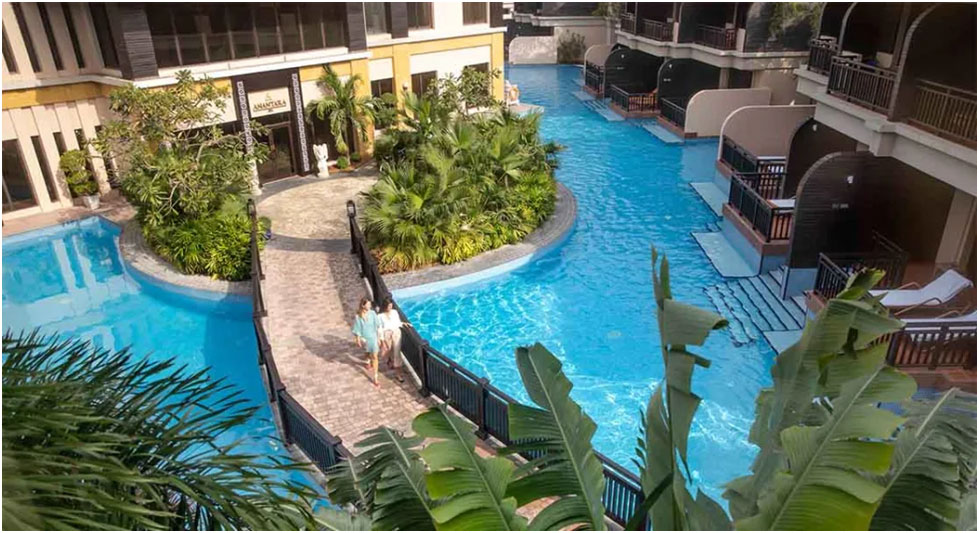

Anantara Spa at Anantara The Palm Dubai Resort

Situated on the serene eastern crescent of the Palm Jumeirah, Anantara Spa offers visitors a journey of holistic rejuvenation by fusing traditional wellness practices with contemporary services.

Signature Treatment: Thai massages, a traditional therapy that uses acupressure and stretching techniques to increase circulation and flexibility, are available to guests.

The cost of an authentic Thai massage is AED 700 per session.

Facilities include hydrotherapy pools, meditation gardens, and private treatment rooms. The spa provides customized wellness programs with Ayurvedic, Thai, and Arabian influences.

International Recognition: Anantara Spa hosted more than 15,000 visitors in 2022, many of whom chose to take advantage of its upscale wellness packages.

Anantara’s wellness business saw a 20% boost in revenue as a result of the spa’s creative offers.

Amara Spa at Park Hyatt Dubai

Amara Spa at Park Hyatt Dubai is a private sanctuary that combines luxury and nature, tucked away along the tranquil Dubai Creek. With lush gardens around every corner, it makes for a perfect place to unwind.

Signature Treatment: The spa is well-known for its Youth-Enhancing Cryotherapy Facial by Natura Bissé, which uses cutting-edge cryotherapy procedures to tighten and revitalize the skin.

Cost: 800 AED each session.

Effectiveness: Research indicates that with repeated treatments, cryotherapy facials can increase skin elasticity by up to 23%.

Facilities: Eight individual treatment rooms with rain showers both inside and outside. Along with a special lounging area with a view of the gardens.

Guest insights: In 2023, 70% of visitors chose facial treatments, underscoring the luxury industry’s rising emphasis on skin-focused wellbeing.

The spa and wellness sector in Dubai contributes more than AED 7 billion to the economy each year, and the market for wellness travel is expanding. Key participants include upscale spas like Talise Ottoman, Anantara, and Amara, which attract customers who appreciate exclusivity and exceptional experiences.

Global Appeal: Of the 16.7 million foreign tourists the city received in 2023, 12% were looking for upscale spa treatments.

Growth of Luxury Spas: By 2027, the luxury spa market in Dubai is anticipated to reach AED 10 billion, growing at a compound annual growth rate (CAGR) of 6.2%.

Client Demographics: High-net-worth individuals from Europe, the Middle East, and Asia make up a sizable share of spa patrons, and many of them spend more than AED 5,000 on wellness treatments while they are there.

Why these spas stand out

The top three priciest spas in Dubai combine wellness, creativity, and innovation in addition to luxury. Each location offers a distinctive experience that appeals to the pickiest visitors, whether it’s the holistic therapies at Anantara Spa, the gold-infused treatments at Talise Ottoman Spa, or the state-of-the-art facials at Amara Spa.

These spas guarantee a memorable excursion into the realm of wellness and luxury for anyone seeking to fully immerse themselves in the height of relaxation and elegance. Dubai keeps raising the standard and solidifying its standing as the world’s most indulgent city.

Recent Items

Dubai’s real estate market hits a record high of $89 b

Dubai’s real estate market hits a record high of $89 billion in the first half... Read More

DIFC Real Estate vs Dubai Land (DLD) Real Estate: A Comprehe

DIFC Real Estate vs Dubai Land (DLD) Real Estate: A Comprehensive Guide A comparison between... Read More

Surging Rents & Prices: A Deep Dive into Dubai & A

Surging Rents & Prices: A Deep Dive into Dubai & Abu Dhabi’s Property Boom 1.... Read More

Dubai’s Prime Residential Market Shows No Signs of Slowing

Dubai’s Prime Residential Market Shows No Signs of Slowing Down Dubai’s luxury residential market... Read More

Bluewaters Island: Dubai’s Iconic Waterfront Destination

Bluewaters Island: Dubai’s Iconic Waterfront Destination Bluewaters Island blends luxury residences, world-class attractions like Ain... Read More

Dubai is renowned for its opulence, and its hotel suites epitomize luxury, offering unparalleled experiences to discerning travelers. As of 2025, the city boasts some of the world’s most extravagant accommodations, each providing unique amenities and services that justify their premium rates.

The Royal Mansion at Atlantis The Royal

The Royal Mansion at Atlantis The Royal, which costs a staggering $100,000 per night, is the most expensive property on the list. This four-bedroom, 11,840-square-foot, split-level suite has expansive views of the Dubai skyline and the Arabian Gulf. A private infinity pool, butler service, and exclusive use of the resort’s amenities are among the perks.

The Royal Suite at Burj Al Arab Jumeirah

The Royal Suite at the Burj Al Arab, which is well-known for its unusual sail-shaped profile, costs about $28,000 per night. This duplex suite embodies Arabian luxury with its gold-plated decor, private library, movie theater, and rotating canopy bed.

The Royal Suite at Four Seasons Resort Dubai at Jumeirah Beach

The 6,000-square-foot Royal Suite, which costs over $20,000 per night, has a private gym, a spa, and a large balcony with breathtaking views of the sea. The suite’s sophisticated design offers a tranquil haven by fusing Middle Eastern accents with contemporary aesthetics.

The Presidential Suite at Al Maha, a Luxury Collection Desert Resort & Spa

The Presidential Suite, which costs about $15,000 per night, provides a private desert experience. With three bedrooms, a private infinity pool, and designated wildlife watching balconies, this 5,700-square-foot home transports guests to the peace and quiet of the Arabian Desert.

The Penthouse Suite at JW Marriott Marquis Hotel Dubai

The Penthouse Suite at the JW Marriott Marquis, one of the tallest hotels in the world, costs about $10,000 per night. With expansive views of the city and the Arabian Gulf, this duplex apartment has a dining room and a large living area.

These suites exemplify Dubai’s commitment to luxury, providing guests with unparalleled experiences that blend exceptional design, exclusive amenities, and impeccable service.

Sources:

https://edition.cnn.com/travel/gallery/dubai-atlantis-royal-mansion-hnk-spc-intl/index.html

https://housiey.com/blogs/top-20-most-expensive-hotels-in-the-world-2025-26

https://www.architecturaldigest.com/story/see-inside-dubais-most-expensive-hotel-suites

https://www.marriott.com/en-us/hotels/dxbjw-jw-marriott-marquis-hotel-dubai/rooms

https://guide.michelin.com/th/en/article/travel/8-luxury-michelin-hotels-dubai

Recent Items

Dubai’s real estate market hits a record high of $89 b

Dubai’s real estate market hits a record high of $89 billion in the first half... Read More

DIFC Real Estate vs Dubai Land (DLD) Real Estate: A Comprehe

DIFC Real Estate vs Dubai Land (DLD) Real Estate: A Comprehensive Guide A comparison between... Read More

Surging Rents & Prices: A Deep Dive into Dubai & A

Surging Rents & Prices: A Deep Dive into Dubai & Abu Dhabi’s Property Boom 1.... Read More

Dubai’s Prime Residential Market Shows No Signs of Slowing

Dubai’s Prime Residential Market Shows No Signs of Slowing Down Dubai’s luxury residential market... Read More

Bluewaters Island: Dubai’s Iconic Waterfront Destination

Bluewaters Island: Dubai’s Iconic Waterfront Destination Bluewaters Island blends luxury residences, world-class attractions like Ain... Read More