Author: noblehouse

With its glittering skyline drawing billionaires, celebrities, and investors, Dubai has solidified its position as a global symbol of luxury. The city’s real estate market is booming, with high-end residences setting new standards for luxury living. It is well-known for its lavish properties and record-breaking buildings. But what is causing this worldwide attention?

The Numbers Tell the Story

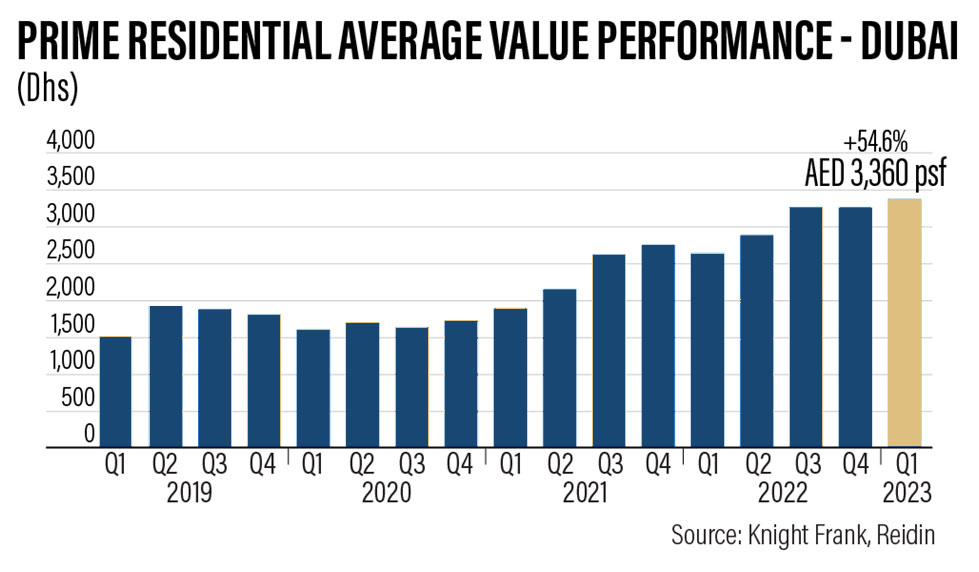

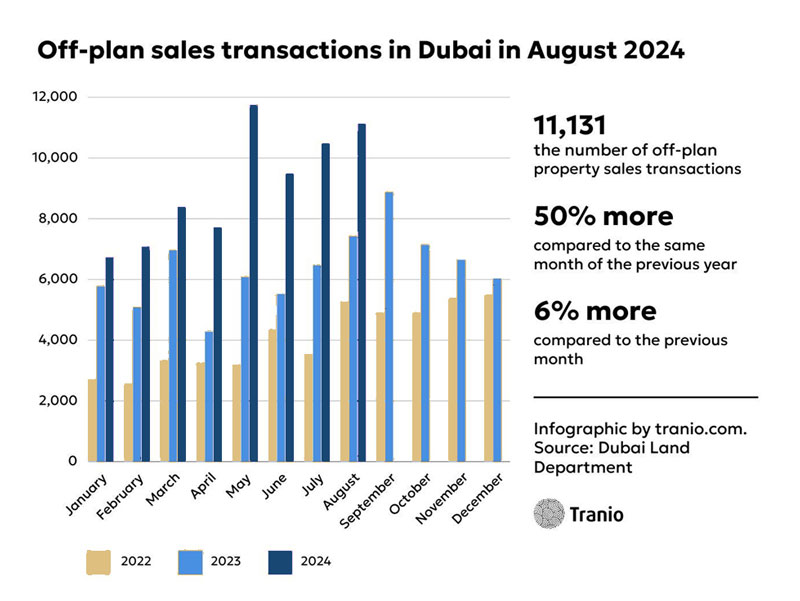

Luxury property sales in Dubai’s real estate market increased by 80% in 2023, with over $10 billion in transactions in the first half of the year alone. With the average price of high-end residences rising 44% year over year to AED 8.7 million ($2.37 million) in 2024, the city now has some of the priciest mansions in the world.

In the ultra-luxury market, demand for residences costing more than AED 100 million ($27 million) has increased, and several record-breaking penthouses and mansions will be sold in 2024. For example, the most expensive apartment ever sold in the city was the Bulgari Lighthouse penthouse, which went for an incredible AED 410 million ($111 million).

The Appeal of Dubai’s Luxury Real Estate

With a Tax-Free Setting and no property or capital gains taxes, Dubai’s tax-free policies continue to be a major draw for international investors. This is uncommon in major global luxury cities like New York or London.

Unrivaled Facilities World-class amenities are a hallmark of Dubai’s luxury complexes. With amenities like concierge services, Michelin-starred restaurants, private beach access, and rooftop infinity pools, these homes provide an unparalleled quality of life. This tendency is best exemplified by developments like as Palm Jumeirah’s Atlantis The Royal Residences, which offer residences valued at AED 65 million ($17.7 million).

Prime Location and Connectivity

Dubai’s advantageous location at the intersection of Europe, Asia, and Africa makes it a popular destination for international travel and commerce. With their stunning views of the Burj Khalifa and the Persian Gulf, upscale areas like Downtown Dubai, Dubai Marina, and Jumeirah Bay Island have emerged as popular investment destinations.

Incentives for Residency

The government of Dubai has launched alluring visa programs for real estate investors. Global purchasers are further encouraged by the possibility of obtaining a 10-year Golden Visa for investors who purchase real estate valued at least AED 2 million ($544,000).

Stability and Economic Growth

Investor confidence is supported by the UAE’s strong economic performance, which saw GDP growth of 3.9% in 2023. Dubai’s economy greatly benefits from the real estate industry, which is expanding by 20% annually.

Iconic Developments Making Headlines

- The World IslandsLocated off the coast of Dubai, this man-made archipelago offers ultra-exclusive villas and private islands. Prices for properties here start at AED 38 million ($10.4 million), catering to the ultra-wealthy seeking secluded luxury.

- Emaar BeachfrontCombining modern architecture with stunning waterfront views, this development has seen record-breaking sales, with units priced at AED 15 million ($4 million) and above.

- Burj Binghatti Jacob & Co ResidencesTouted as the world’s tallest residential building, this collaboration between Binghatti and Jacob & Co promises opulent penthouses with prices starting at AED 100 million ($27.2 million).

A Magnet for the Ultra-Rich

High-net-worth individuals (HNWIs) find Dubai to be unparalleled in its attraction. In 2023, the city welcomed 3,500 new millionaires, the greatest number internationally. More than 68,000 HNWIs are thought to currently reside in Dubai, which increases demand for upscale real estate.

Dubai, now ahead of international powerhouses like Paris and Hong Kong, is the fourth most desirable location for affluent people, according to Knight Frank’s Wealth Report. Its excellent standard of living, safety, and investment-friendly regulations are the reasons behind this.

Conclusion

Dubai’s surge in luxury real estate is more than an idle whim; it is evidence of the city’s standing as a global hub for luxury and innovation. The world’s elite are still drawn to Dubai because of its record-breaking sales, unparalleled amenities, and strategic growth ambition. The city’s appeal is only going to increase as the skyline changes and new construction appears, confirming its position as a symbol of opulent life.

Recent Items

Dubai’s real estate market hits a record high of $89 b

Dubai’s real estate market hits a record high of $89 billion in the first half... Read More

DIFC Real Estate vs Dubai Land (DLD) Real Estate: A Comprehe

DIFC Real Estate vs Dubai Land (DLD) Real Estate: A Comprehensive Guide A comparison between... Read More

Surging Rents & Prices: A Deep Dive into Dubai & A

Surging Rents & Prices: A Deep Dive into Dubai & Abu Dhabi’s Property Boom 1.... Read More

Dubai’s Prime Residential Market Shows No Signs of Slowing

Dubai’s Prime Residential Market Shows No Signs of Slowing Down Dubai’s luxury residential market... Read More

Bluewaters Island: Dubai’s Iconic Waterfront Destination

Bluewaters Island: Dubai’s Iconic Waterfront Destination Bluewaters Island blends luxury residences, world-class attractions like Ain... Read More

Dubai has long been known as a center of luxury, opportunity, and innovation in the world. It is a great place to invest in real estate because of its desirable location, welcoming policies for investors, and vibrant way of life. Dubai continues to be an unmatched option for investors seeking to ensure strong returns and long-term value due to its thriving real estate market and abundance of selections.

A Booming Real Estate Market

The real estate sector in Dubai continues to grow and presents investors with good returns. Over AED 300 billion was exchanged for real estate in 2024 alone, a 44% rise over the year before. Property values in prominent areas including Palm Jumeirah, Downtown Dubai, and Dubai Marina increased by 15% on average. High-net-worth individuals (HNWIs) and expats seeking upscale living quarters are driving the market for luxury villas and branded homes.

Investor-Friendly Policies

One of the primary factors drawing in foreign real estate buyers is Dubai’s pro-investment climate. Investors who buy property worth AED 2 million or more can obtain long-term residency through the UAE’s Golden Visa program, which offers security and lifestyle advantages. In addition, unlike markets in London or New York, investors can optimize returns due to the lack of income and property taxes. Dubai is now more accessible and desirable to foreign purchasers thanks to recent changes to ownership legislation that permit 100% foreign ownership.

High ROI and Rental Yields

In desirable neighborhoods, Dubai offers some of the highest rental yields in the world, averaging between 6% and 8%. Important Investment Areas:

Due to the strong demand for upscale flats, downtown Dubai offers yields ranging from 6 to 7%.

Average rental yields in Dubai Marina, which is well-known for its lively lifestyle, range from 7-8%.

With returns of up to 9%, Jumeirah Village Circle (JVC) is a well-liked option for reasonably priced apartments.

Palm Jumeirah: Branded homes and upscale villas provide a 5-6% income and significant capital growth.

Because these numbers are significantly higher than the global average, Dubai is a dependable market for buy-to-let investors.

World-Class Infrastructure and Developments

Modern infrastructure and innovative projects in Dubai continue to draw in international investors. Dubai’s aspirations are symbolized by iconic projects like the Palm Jumeirah, Expo City, and the Burj Khalifa. The Dubai 2040 Urban Master Plan calls for future construction to promote sustainable living, expand urban connectedness, and improve green areas. Future eco-friendly and high-tech communities like Mohammed Bin Rashid City and Dubai South are also open to investors.

Diversified Property Options

From ultra-luxury purchasers to those looking for more economical options, Dubai serves a diverse spectrum of investors. Among the examples are:

Palm Jumeirah and Emirates Hills are examples of luxury markets, with average costs per square foot of AED 3,500.

Property prices in the mid-tier market, which includes Business Bay and JVC, average AED 1,200 per square foot.

Off-Plan Properties: Investors can find reasonable pricing and substantial potential value in developing neighborhoods like Dubai Creek Harbour and Dubai Hills Estate.

Resilience Amid Global Challenge

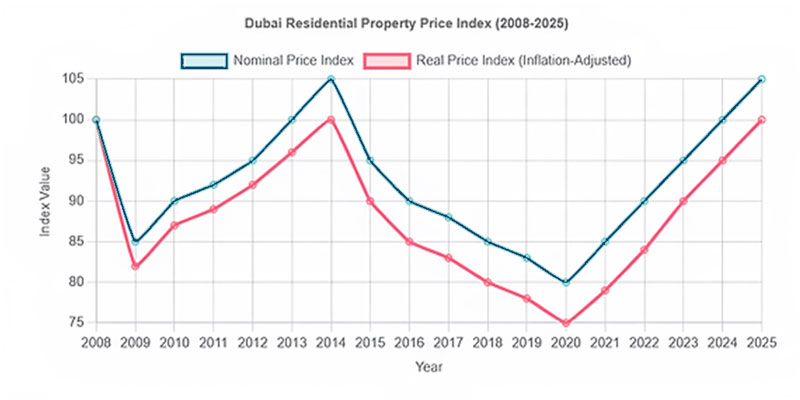

Dubai stands apart from other markets due to its capacity to evolve and prosper in the face of global economic difficulties. Dubai saw a V-shaped rebound following the epidemic, with real estate values increasing by 12% a year since 2021. This resilience creates a safe and predictable investment environment when combined with an open regulatory framework.

Vision for the Future

Dubai’s dedication to sustainability and innovation maintains its allure to investors. The city’s real estate market is changing as a result of initiatives like renewable energy projects, AI-powered smart homes, and sustainable urban planning. The government’s emphasis on eco-friendly projects and green certifications will raise the value of real estate in strategic locations.

Dubai is a top real estate investment location in 2025 because of its strong rental yields, investor-friendly regulations, and progressive outlook. Dubai provides unparalleled opportunities whether you’re looking for a luxury lifestyle, long-term appreciation, or consistent rental income.

Invest in the booming real estate market in Dubai now to start along your journey to a bright future!

Recent Items

Dubai’s real estate market hits a record high of $89 b

Dubai’s real estate market hits a record high of $89 billion in the first half... Read More

DIFC Real Estate vs Dubai Land (DLD) Real Estate: A Comprehe

DIFC Real Estate vs Dubai Land (DLD) Real Estate: A Comprehensive Guide A comparison between... Read More

Surging Rents & Prices: A Deep Dive into Dubai & A

Surging Rents & Prices: A Deep Dive into Dubai & Abu Dhabi’s Property Boom 1.... Read More

Dubai’s Prime Residential Market Shows No Signs of Slowing

Dubai’s Prime Residential Market Shows No Signs of Slowing Down Dubai’s luxury residential market... Read More

Bluewaters Island: Dubai’s Iconic Waterfront Destination

Bluewaters Island: Dubai’s Iconic Waterfront Destination Bluewaters Island blends luxury residences, world-class attractions like Ain... Read More

Art has evolved beyond its historical use as adornment in the context of luxury living to play a crucial part in the design of elegant and unique environments. A growing number of high-net-worth individuals (HNWIs) are spending money on art collections that not only express their unique preferences but also raise the aesthetic and cultural significance of their homes. By 2025, this style has really taken off, with art playing a major role in the atmosphere and decor of opulent residences.

The Rising Investment in Art

According to recent data, HNWIs are increasingly inclined to spend large sums of money on art purchases. The Art Basel and UBS Survey of Global Collecting 2024 found that 52% of HNWIs’ art spending went toward new and emerging artists, an 8% rise over prior years. This change reflects a growing desire in the art industry to find and nurture new talent.

Art as a Defining Feature in Luxury Homes

Beyond just being visually appealing, adding art to a luxury property is a way for the homeowner to express themselves and shows off their cultural awareness. Living areas can be transformed with original artwork that gives them personality and a story that appeals to the residents. The home’s atmosphere is enhanced by this individualized curation, which makes it a genuine representation of the owner’s character and principles.

Curating Art Collections: A Personalized Approach

The process of curating art for luxury homes is highly individualized, often involving collaboration with art advisors and interior designers to select pieces that harmonize with the home’s architecture and the owner’s preferences. This bespoke approach ensures that each artwork complements the overall design scheme, creating a cohesive and immersive environment.

The Impact on Market Dynamics

The heightened demand for art among HNWIs has notable implications for the art market. The Art Basel and UBS report highlights that 97% of collectors planned to purchase works of art over the next 12 months, reflecting a robust and sustained interest in art acquisitions.

By thoughtfully integrating art into their living spaces, high-net-worth individuals are not only enhancing the visual appeal of their homes but also making a profound statement about their personal journeys and cultural engagements. This trend underscores the evolving role of art in luxury residences, where each piece contributes to a curated narrative that defines the essence of sophisticated living.

Sources:

https://www.fratantonidesign.com/2025-luxury-architectural-trends-redefining-elegance-and-innovation

https://www.artsy.net/article/artsy-editorial-5-themes-will-define-art-market-2025

https://thesmythhouse.com/2025/01/10/2025-luxury-interior-design-trends/

https://www.spherelife.com/culture/culture-and-design-trends-2025

https://www.vogue.com/article/interior-design-trends-2025

https://stephnash.com/blog/luxury-home-design-trends-for-2025

https://choosewiselygroup.com/blog/luxury-home-design-trends-for-2025

https://www.fladgate.com/insights/art-market-trends-and-industry-insights-post-budget

https://www.veranda.com/luxury-lifestyle/artwork/a63008901/how-rich-people-are-buying-art/

https://luxurylakeoconee.com/blog/luxury-home-design-trends-for-2025

https://levyrealestategroup.com/blog/luxury-home-design-trends-for-2025

Recent Items

Dubai’s real estate market hits a record high of $89 b

Dubai’s real estate market hits a record high of $89 billion in the first half... Read More

DIFC Real Estate vs Dubai Land (DLD) Real Estate: A Comprehe

DIFC Real Estate vs Dubai Land (DLD) Real Estate: A Comprehensive Guide A comparison between... Read More

Surging Rents & Prices: A Deep Dive into Dubai & A

Surging Rents & Prices: A Deep Dive into Dubai & Abu Dhabi’s Property Boom 1.... Read More

Dubai’s Prime Residential Market Shows No Signs of Slowing

Dubai’s Prime Residential Market Shows No Signs of Slowing Down Dubai’s luxury residential market... Read More

Bluewaters Island: Dubai’s Iconic Waterfront Destination

Bluewaters Island: Dubai’s Iconic Waterfront Destination Bluewaters Island blends luxury residences, world-class attractions like Ain... Read More