Dubai Real Estate Market Review 24-Jun-2025

GCC commercial real estate is set to reach $82.1 billion by 2033 (8.2% CAGR). European family offices are relocating en masse to the UAE

Dubai becoming the top legacy hub for African super-rich

African high-net-worth individuals are increasingly viewing Dubai as a hub for long-term wealth preservation and multigenerational legacy planning. With zero capital-gains tax, residency incentives, policy stability and world-class infrastructure, the emirate offers certainty, safety and lifestyle benefits—while fostering a two-way investment corridor with African markets.

‘Middle-class Indians win in Dubai, lose in India’: CA breaks down the brutal real estate truth

Middle-class Indians in Dubai buy multiple rental properties at low interest (5%) with 6–7% yields, building sustainable retirement assets. In India, similar couples face 10% loans, 3% yields, and burdensome EMIs, turning homeownership into a financial liability rather than an income-generating investment.

Dubai real estate sector recorded $5bn of transactions last week, including $46m Jumeirah apartment

The Dubai real estate sector recorded AED18.51bn ($5bn) of transactions last week, according to data from the Land Department.

How European family offices are reallocating capital towards the UAE

European family offices are relocating en masse to the UAE, around 800 in DIFC and rising in ADGM, lured by tax-free income, strong legal structures (foundations, trusts) and 140+ double-tax treaties, driving assets toward $500 billion by 2025.

World’s first MANSORY Residences launched with Amaal in Dubai

Emirati developer Amaal partners with automotive designer MANSORY to launch the AED 1.8 billion MANSORY Residences in Mohammed bin Rashid City. This 48-floor tower features bespoke auto-inspired interiors, ultra-luxury amenities—including pools, spa, gyms, cinema, car showroom parking—and smart-home tech. Completion slated for Q4 2028.

Dubai real estate: Property market attracts international investors as FDI surges 48% to $45 billion

Data from the Dubai FDI Monitor shows that real estate contributed 14 per cent of total estimated FDI capital flows into Dubai in 2024.

Dubai to expand Burj Khalifa/Dubai Mall Metro Station; here’s what it involves

RTA and Emaar are expanding Burj Khalifa/Dubai Mall Metro Station from 6,700 to 8,500 sqm, boosting capacity by 65% to 12,320 passengers per hour (220,000 daily). Upgrades include expanded entrances, pedestrian bridges, concourse enhancements, more escalators and gates, plus full accessibility to meet rising ridership through 2040.

Amirah awards main contract for Dubai Islands residential project

Emirati developer Amirah Developments has engaged Shine Square Building Contracting and Al Gafry Consulting for Bonds Avenue Residences on Dubai Islands. The waterfront project features sustainable, smart‐home apartments with leisure amenities, pedestrian‐friendly design, and flexible payment plans. Construction starts late 2025, with completion targeted for Q1 2027.

Al Tareq Star officially launches Norah Residence in the heart of Jumeirah Village Circle

Al Tareq Star is debuting in Dubai with Norah Residence in Jumeirah Village Circle: 183 smart-home units (studios to three-bed duplexes), priced from AED 650,000 on a 40/60 plan. Amenities include cinema, gym, yoga hall and pool views. Handover is scheduled for Q2 2027.

Where to invest in UAE real estate now: 6 booming areas with high returns, lifestyle appeal

Dubai’s summer 2025 property market is projected to exceed $40 billion, with six hotspots, Dubai Creek Harbour, Al Marjan Island, Business Bay, Yas Island, Dubai South and JVC, offering 6–9% yields, accessible prices and buyer-friendly incentives in a narrow entry window before Q4.

UAE construction market set to surpass $52.7 billion by 2030: Report

UAE’s construction market is set to grow at a 4.26% CAGR to AED 193.38 billion by 2030, driven by government investment, infrastructure projects and proptech innovation. Proptech is shifting from a luxury to a necessity, enhancing design, quality and investor confidence as real estate supply expands.

GCC Commercial Real Estate Market Size to Surpass USD 82.14 Billion by 2033, at a CAGR of 8.20%

GCC commercial real estate grew to $38.8 billion in 2024 and is set to reach $82.1 billion by 2033 (8.2% CAGR), driven by economic diversification, urbanization and foreign investment reforms. Key trends include flexible workspaces, green building and mixed‐use projects, with a robust outlook amid supportive policies.

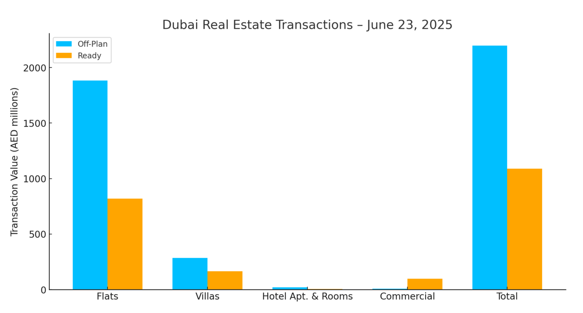

Dubai Real Estate Transactions as Reported on the 23rd of June 2025

On 23 June 2025, Dubai’s total real estate transactions reached AED 3.286 billion. Off-plan sales dominated with AED 2.197 billion (66.9%), while ready properties contributed AED 1.090 billion (33.1%).

| Category | Off-Plan (AED millions) | Ready (AED millions) |

| Flats | 1,882.8 | 819.1 |

| Villas | 284.2 | 165.5 |

| Hotel Apt. & Rooms | 21.7 | 6.2 |

| Commercial | 8.0 | 98.8 |

| Total | 2,196.8 | 1,089.5 |

Off-Plan Market Performance

Total Off-Plan: AED 2,197 million (66.9% of total)

- Flats: AED 1,883 million (85.7% of off-plan)

- Villas: AED 284 million (12.9%)

- Hotel Apartments & Rooms: AED 22 million (1.0%)

- Commercial: AED 8 million (0.4%)

Flats remain the cornerstone of off-plan activity, reflecting strong pre-launch interest, while villas capture a modest one-eighth of the segment.

Ready Market Performance

Total Ready: AED 819 million (33.1% of total)

- Flats: AED 819 million (75.2% of ready)

- Villas: AED 165 million (15.2%)

- Commercial: AED 99 million (9.1%)

- Hotel Apartments & Rooms: AED 6 million (0.6%)

Ready flats again lead the segment, supported by immediate rental demand; commercial assets also play a notable role, accounting for roughly one-tenth.

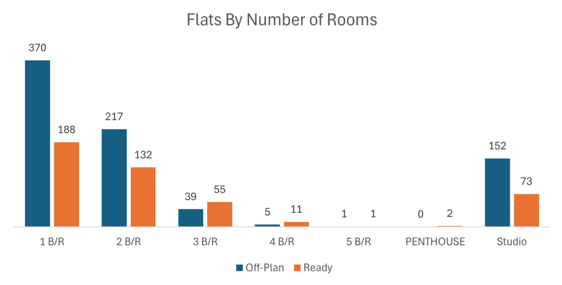

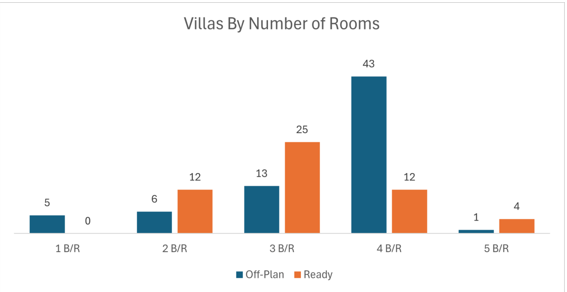

On The Micro Level

Market Insights

Dubai’s market remains firmly driven by flat sales, both off-plan and ready, underscoring the enduring appeal of high-yield residential assets. The two-thirds off-plan share points to robust developer pipelines and buyer confidence in future deliveries. Meanwhile, the ready-segment’s one-third share, buoyed by commercial interest, offers investors immediate income streams.

Recent Items

Dubai’s real estate market hits a record high of $89 b

Dubai’s real estate market hits a record high of $89 billion in the first half... Read More

DIFC Real Estate vs Dubai Land (DLD) Real Estate: A Comprehe

DIFC Real Estate vs Dubai Land (DLD) Real Estate: A Comprehensive Guide A comparison between... Read More

Surging Rents & Prices: A Deep Dive into Dubai & A

Surging Rents & Prices: A Deep Dive into Dubai & Abu Dhabi’s Property Boom 1.... Read More

Dubai’s Prime Residential Market Shows No Signs of Slowing

Dubai’s Prime Residential Market Shows No Signs of Slowing Down Dubai’s luxury residential market... Read More

Bluewaters Island: Dubai’s Iconic Waterfront Destination

Bluewaters Island: Dubai’s Iconic Waterfront Destination Bluewaters Island blends luxury residences, world-class attractions like Ain... Read More