Dubai Real Estate Weekly Market Analysis 16th-Jun-2025

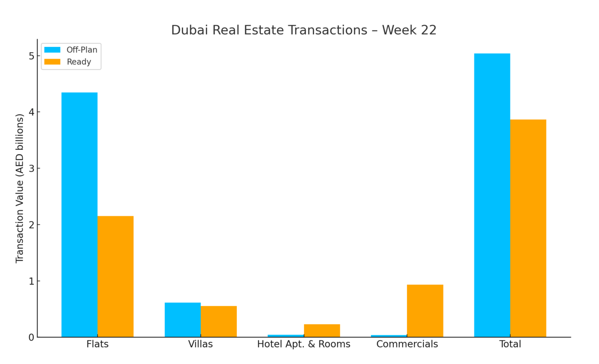

The total real estate transactions in Dubai for Week 22 was AED 8.90 billion and 40,60 transactions. Off-plan contributed 56.6% or 5.04 billion, while Ready properties contributed 43.4% or 3.86 billion.

Dubai’s real estate market experienced a sharp surge in Week 22 of 2025, with total transactions reaching AED 8.90 billion, a 45.1% increase compared to AED 6.13 billion recorded in Week 21. The number of transactions also rose to 4,060 deals, up from 3,906 the week before, marking a steady increase in market activity across both off-plan and ready segments.

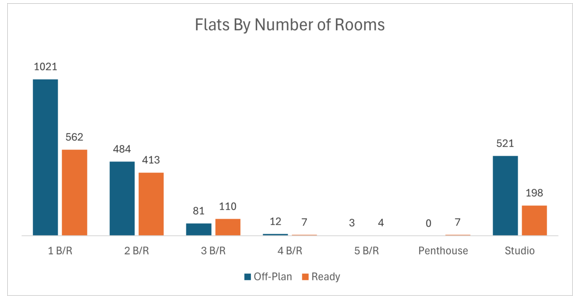

- One-bedroom Flats were the most traded, with 1,853

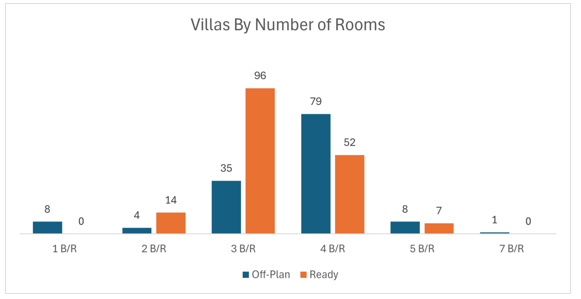

- 3-Bedroom & 4-Bedroom villas dominated the villas with 262 transactions combined.

- The total number of flats traded reached 3,423, while the villas accounted for 304

| Category | Off‑Plan (AED millions) | Ready (AED millions) |

| Flat | 4,345.5 | 2,153.1 |

| Villa | 615.6 | 551.1 |

| Hotel Apt. & Rooms | 41.2 | 229.7 |

| Commercials | 38.8 | 930.1 |

| Total | 5,041.1 | 3,863.9 |

Off-Plan Market Performance

Total Value: AED 5.04 billion

Share of Total Transactions: 56.6%

The off-plan segment led the market this week, contributing 56.6% to the overall weekly transaction value. Among subcategories:

| Subcategory | Value (AED) | % of Off-Plan |

| Flats | 4,345,505,183.07 | 86.2% |

| Villas | 615,573,152.09 | 12.2% |

| Hotel Apartments/Rooms | 41,169,603.10 | 0.8% |

| Commercial | 38,804,442.65 | 0.8% |

| Total | 5,041,052,380.91 | 100% |

Apartments remained the dominant off-plan asset class, accounting for over 86% of the off-plan value. Villas followed at 12.2%, while commercial units and hotel inventory together made up just 1.6%.

Top Performing Off-Plan Areas (by Value Traded)

| Area | Value (AED) |

| Madinat Al Mataar | 361,946,901.00 |

| Al Wasl | 334,249,190.28 |

| Hadaeq Sheikh MBR | 312,124,823.46 |

| Jumeirah Village Circle | 307,052,145.37 |

| Madinat Dubai Al Mela | 277,358,276.00 |

The top 10 areas alone accounted for over AED 2.65 billion, or 52% of all tracked off-plan community value this week. JVC continues to draw substantial investor interest in the mid-market off-plan segment.

Ready Market Performance

Total Value: AED 3.86 billion

Share of Total Transactions: 43.4%

The ready property market accounted for 43.4% of the total transaction value this week, with apartments again leading the way:

| Subcategory | Value (AED) | % of Ready |

| Flats | 2,153,091,715.73 | 55.7% |

| Villas | 551,076,260.41 | 14.3% |

| Hotel Apartments/Rooms | 229,670,638.05 | 5.9% |

| Commercial | 930,063,120.16 | 24.1% |

| Total | 3,863,901,734.35 | 100% |

The commercial segment had an unusually strong showing at 24.1% of ready transactions, driven by large-value deals — a possible indicator of rising institutional activity or bulk portfolio sales.

Top Performing Ready Areas (by Value Traded)

| Area | Value (AED) |

| Business Bay | 707,172,239.29 |

| Dubai Marina | 367,381,650.09 |

| Burj Khalifa | 269,236,901.20 |

| Barsha Heights | 213,778,541.98 |

| Jumeirah Lakes Towers | 204,402,465.32 |

Business Bay dominated the ready market with over AED 707 million, followed by Dubai Marina and Burj Khalifa, indicating a strong concentration of high-value transactions in central urban districts.

Weekly Comparison

| Metric | Week 21 | Week 22 | Change |

| Total Volume | AED 6.13 billion | AED 8.90 billion | +45.1% |

| Total Transactions | 3,906 | 4,060 | +3.9% |

| Off-Plan Volume | AED 3.45 billion | AED 5.04 billion | +46.1% |

| Ready Volume | AED 2.68 billion | AED 3.86 billion | +43.9% |

Both off-plan and ready segments recorded double-digit growth, with the off-plan market slightly outpacing ready in terms of momentum. The increase in both value and number of transactions suggests broader market confidence.

On the micro level, below is the sales distribution based on the number of bedrooms

Market Insights & Outlook

- The surge in off-plan sales, particularly in emerging communities like Madinat Al Mataar and Al Wasl, reflects robust developer activity and ongoing buyer demand for under-construction projects.

- The commercial sector’s strong performance in the ready market is notable and could be driven by strategic institutional purchases, especially in prime business hubs like Business Bay.

- Ready apartment sales, especially in Business Bay and Dubai Marina, remain strong, indicating sustained end-user demand and investor confidence in mature districts.

- With both the volume and transaction count rising, the market may be entering a new growth phase, especially ahead of seasonal interest in Q3.

Recent Items

Dubai International City: Affordable Multicultural Living

Dubai International City: Affordable Multicultural Living International City offers affordable, multicultural living and high rental... Read More

Will Trump’s Tariffs Impact UAE Real Estate?

Will Trump’s Tariffs Impact UAE Real Estate? Executive Summary Dubai’s strategic position as a resilient... Read More

Dubai Harbour: Dubai’s Premier Waterfront Lifestyle Destin

Dubai Harbour: Dubai’s Premier Waterfront Lifestyle Destination Dubai Harbour is a luxury waterfront community offering... Read More

A Prestige Address for Luxury Living: Emirates Hills

A Prestige Address for Luxury Living: Emirates Hills Emirates Hills is Dubai’s premier luxury community,... Read More

Dubai Real Estate Weekly Market Analysis 2nd June 2025

Dubai Real Estate Weekly Market Analysis 2nd June 2025 The total real estate transactions in... Read More