Dubai Real Estate Transactions as Reported on the 25th of February 2025

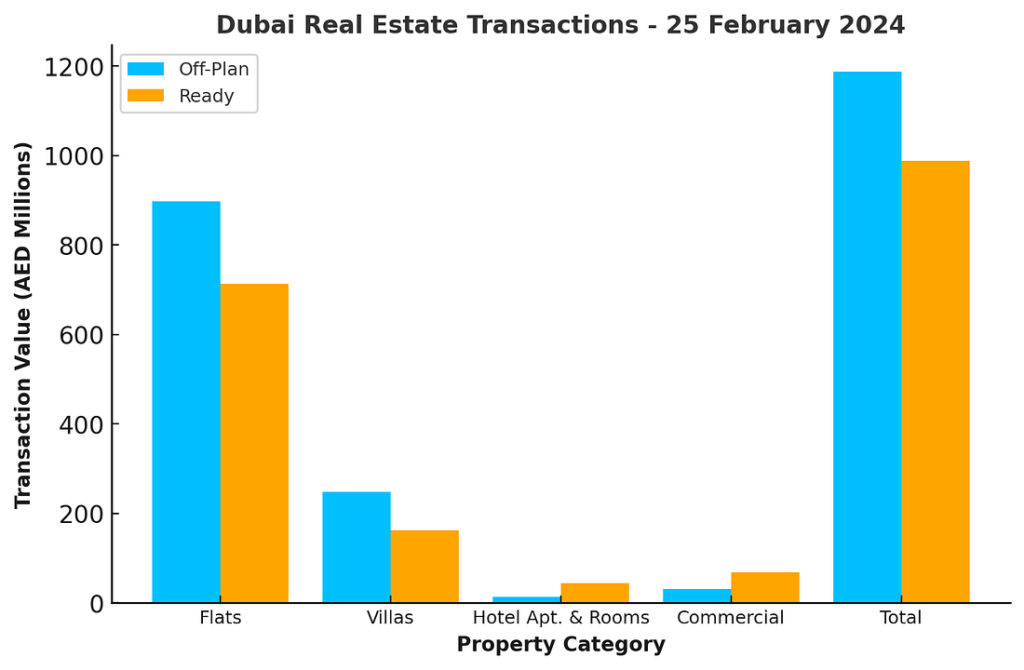

On February 25, 2024, Dubai’s real estate sector recorded a total transaction value of AED 2.18 billion, demonstrating the continued strength of the emirate’s property market. The transactions were split between Off-Plan and Ready properties, with Off-Plan contributing 54.6% (AED 1.19 billion) and Ready properties accounting for 45.4% (AED 988.27 million) of the total market activity.

Breakdown of Off-Plan Transactions

The Off-Plan segment remained dominant, indicating strong investor confidence in future developments. The category-wise distribution is as follows:

- Flats: AED 896.92 million (75.5% of Off-Plan sales)

- Villas: AED 247.28 million (20.8% of Off-Plan sales)

- Commercial Properties: AED 30.31 million (2.6% of Off-Plan sales)

- Hotel Apartments & Rooms: AED 13.00 million (1.1% of Off-Plan sales)

Key Observations

Flats led the Off-Plan market with three-quarters of total sales, indicating sustained interest from investors and end-users. Villas followed, capturing over one-fifth of Off-Plan sales, reflecting the rising appeal of spacious, family-oriented homes. Commercial properties and hotel apartments contributed modestly, but their presence highlights Dubai’s growing appeal as a business and hospitality hub.

Breakdown of Ready Transactions

Ready properties recorded AED 988.27 million, underscoring strong demand for immediate occupancy and investment opportunities. The subcategory contributions are:

- Flats: AED 712.81 million (72.1% of Ready sales)

- Villas: AED 162.20 million (16.4% of Ready sales)

- Commercial Properties: AED 68.84 million (7.0% of Ready sales)

- Hotel Apartments & Rooms: AED 44.42 million (4.5% of Ready sales)

Key Observations

Flats also led the Ready market, comprising over 70% of total transactions. Villas followed at 16.4%, indicating continued demand for luxury and family-friendly residences. Commercial properties accounted for 7%, highlighting business investments, while the hospitality sector contributed 4.5%, reflecting Dubai’s growing tourism and short-term rental market.

Market Trends & Conclusion

The near-equal distribution between Off-Plan and Ready transactions suggests a balanced market, where both investors and end-users are actively engaging. The dominance of Flats in both segments underscores Dubai’s appeal for apartment-style living, driven by urbanization, lifestyle preferences, and strong rental demand. Villas continue to attract premium buyers, while commercial and hospitality properties remain essential contributors to Dubai’s business and tourism-driven economy.

With real estate transactions surpassing AED 2 billion in a single day, Dubai’s property market continues to exhibit resilience, investor confidence, and growth potential, solidifying its position as a global real estate hub.

Dubai Real Estate Market Review 26-Feb-2025

A luxury tower inspired by Messi? Service charges in Dubai are expected to rise by up to 10% in 2025. Dubai’s property market may stabilize or see slight price declines over the next 12-18 months.

Startups and PropTech at the heart of IPS 2025 in Dubai next April

Dubai will host IPS 2025 from April 14-16, spotlighting PropTech and real estate innovation. The event will showcase AI, smart city solutions, and digital transformation, alongside a startup competition. Dubai’s real estate market remains strong, with rising property values. IPS 2025 aims to foster collaboration and technological advancements in the sector.

Dubai real estate’s next phase sees end-users outpace investors, bringing stability in mid-to-high-end market: Experts

Mid-to-high-income professionals in the 30–45 age group are making up a larger share of buyers in the end-user demand.

Dubai’s Property Market Faces Stabilisation Amid Rising Construction Costs

Dubai’s property market may stabilize or see slight price declines over the next 12-18 months, per Moody’s, due to rising construction costs and project delays. Despite strong demand, developers face supply chain issues and labor shortages. Rapid luxury development raises concerns of oversupply, requiring careful project management to mitigate risks.

Richmind to enter UAE real estate market with 1,000 new units

Luxury developer Richmind is entering the UAE market with plans to launch over 1,000 units in 2024. Its first project, a high-end waterfront development on Al Marjan Island, is in partnership with Zaha Hadid Architects. The project will feature premium residences, a beach club, and Ras Al Khaimah’s first 360° infinity pool.

UAE megaprojects 2025: 50 massive developments set to transform the nation

The UAE is undergoing significant change with a series of large-scale projects set to alter the nation’s landscape.

Elemental launches new residential project in Jumeirah Garden City

Elemental, a new UAE real estate venture, has launched its debut project, Elemental 22, in Jumeirah Garden City. Focused on nature, wellness, and community, the low-rise residential development features green spaces, curated amenities, coworking areas, and The Mill Café. It offers a balanced, all-in-one living experience with seamless indoor-outdoor integration.

AFA Set to Build Luxury Tower in Dubai

The Argentine Football Association (AFA) is launching the AFA Tower in Dubai with Prestige One Developments. Inspired by Argentine football and Lionel Messi, the luxury residential project enhances AFA’s Middle East presence. This partnership strengthens AFA’s brand in the region, aligning with Dubai’s high-end real estate market and ongoing expansion efforts.

Oravel opens first Sunday hotel in Dubai, eyes 15 properties

Oravel Stays is expanding its Sunday Hotels brand in Dubai, launching the Sunday Emirates Grand Hotel near the Financial Center metro. With over 400 rooms and premium amenities, it caters to business and leisure travelers. Oravel plans 15 Sunday Hotels in 2025, targeting key locations like Downtown, Marina, and Palm Jumeirah.

Dubai property: Up to 10% rise in service charges this year

Service charges in Dubai are expected to rise by up to 10% in 2025 due to higher maintenance, utility, and district cooling costs. Older buildings face steeper increases, while landlords may raise rents to offset costs. Despite the impact, location and ROI remain key property-buying factors over service fees.

Dubai real estate: Palma Development launches $1.3bn Serenia District in Jumeirah Islands

The development spans 600,000 sq. ft. with a built-up area of 3.5 million sq. ft. and features six integrated towers.

Recent Items

Why Dubai? The Global Obsession with Ultra-Luxe Living

With its glittering skyline drawing billionaires, celebrities, and investors, Dubai has solidified its position as... Read More

The Ultimate Guide to Profitable Property Investment in Duba

Dubai has long been known as a center of luxury, opportunity, and innovation in the... Read More

The Role of Art in Luxury Homes: How High-Net-Worth Buyers C

Art has evolved beyond its historical use as adornment in the context of luxury living... Read More

The Price of Exclusivity: Exotic Materials that Define High

High fashion has long been associated with exclusivity, luxury, and incomparable artistry. The use of... Read More

The Pinnacle of Pampering: Exploring Dubai’s Top 3 Most Ex

Dubai is synonymous with luxury, providing experiences that are unmatched in all aspects of extravagance. The... Read More