Dubai Real Estate Transactions as Reported on the 24th of February 2025

Dubai’s real estate market continues its dynamic growth, with total property transactions reaching AED 1.79 billion on 24 February 2024. The breakdown of transactions highlights the ongoing strength of both off-plan and ready properties, reflecting sustained investor confidence in the market.

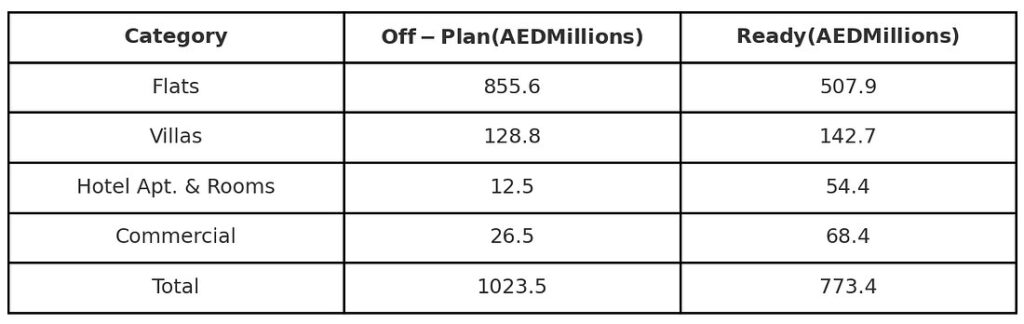

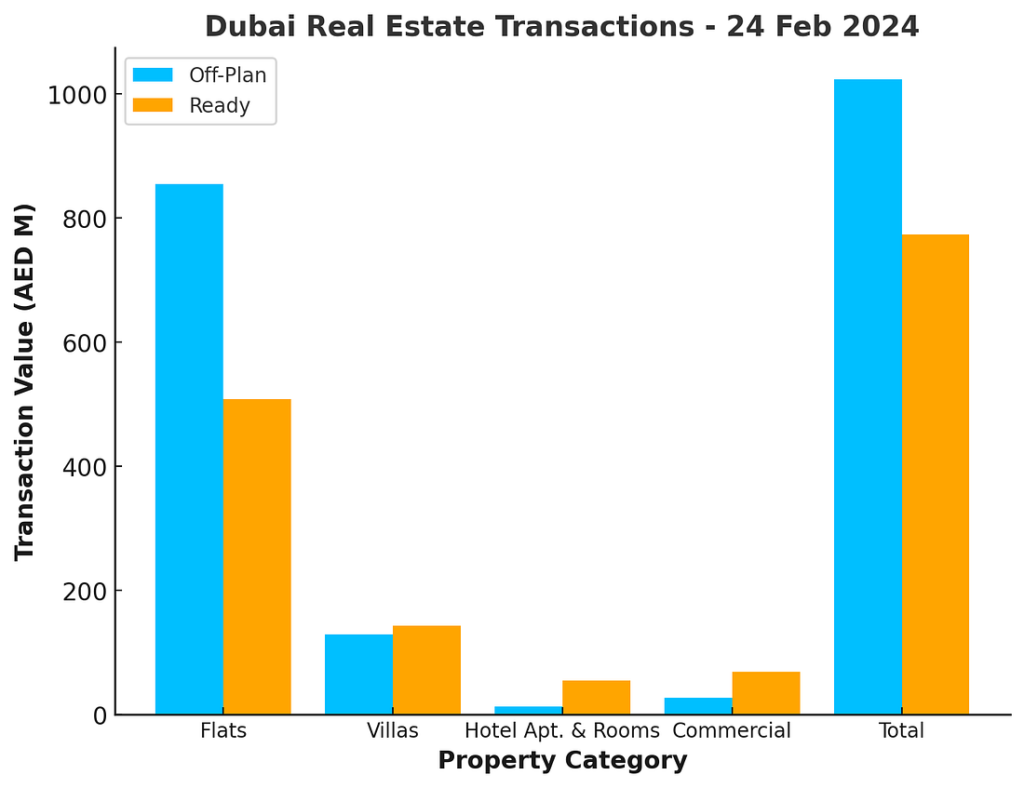

Off-Plan vs. Ready Property Performance

On this day, off-plan transactions accounted for AED 1.02 billion, contributing 57.0% of the total transactions, while ready property sales stood at AED 773.4 million, making up 43.0% of the total.

This significant share of off-plan properties indicates strong investor interest in Dubai’s future developments, driven by attractive payment plans, high return potential, and confidence in the city’s long-term growth. Meanwhile, ready properties maintain a solid presence, appealing to end-users and investors looking for immediate returns.

Breakdown of Off-Plan Transactions

The off-plan market witnessed AED 1.02 billion in transactions, with different property types contributing as follows:

- Flats: AED 855.6 million (83.6% of off-plan sales)

- Villas: AED 128.8 million (12.6% of off-plan sales)

- Hotel Apartments & Rooms: AED 12.5 million (1.2% of off-plan sales)

- Commercial: AED 26.5 million (2.6% of off-plan sales)

Flats dominated the off-plan market, making up over four-fifths (83.6%) of all off-plan transactions, reinforcing the continued demand for high-rise living and investment properties in key locations. Villas followed, contributing a significant 12.6%, reflecting ongoing interest in family-friendly communities and spacious residences.

Hotel apartments and commercial properties made up only 1.2% and 2.6%, respectively, indicating that while investors remain interested in alternative asset classes, residential properties continue to drive the majority of off-plan sales.

Breakdown of Ready Transactions

The ready property segment recorded AED 773.4 million in transactions, with contributions from different property types as follows:

- Flats: AED 507.9 million (65.7% of ready sales)

- Villas: AED 142.7 million (18.4% of ready sales)

- Hotel Apartments & Rooms: AED 54.4 million (7.0% of ready sales)

- Commercial: AED 68.4 million (8.8% of ready sales)

The ready property segment was led by flats, making up 65.7% of total transactions, demonstrating the high liquidity and appeal of completed residential units for both homebuyers and investors seeking rental income. Villas accounted for 18.4%, reinforcing their desirability among long-term residents and end-users.

Hotel apartments and commercial spaces contributed 7.0% and 8.8%, respectively, showing stable demand for hospitality-related and business-centric investments.

Market Insights and Takeaways

- Off-plan dominates the market – With 57% of all transactions, off-plan properties remain the preferred choice for investors, driven by flexible payment plans and strong capital appreciation prospects.

- Flats continue to be the most sought-after asset class, leading both off-plan and ready transactions, showcasing the high demand for urban living and rental yield potential.

- Villas maintain strong demand, particularly in the ready segment, as families and end-users look for spacious homes.

- Commercial and hotel apartments remain niche but relevant, catering to a select group of investors in business and hospitality sectors.

Dubai’s real estate market remains resilient and dynamic, with strong demand across multiple property categories, highlighting its position as a global investment hub.

Dubai Real Estate Market Review 25-Feb-2025

Dubai recognizes USDC, EURC. Dubai developer introduces flexible unit designs. Dubai to host PropTech Connect 2026. Deloitte unveils Dubai’s Real Estate Predictions report for 2025.

Dubai’s Blueprint For Real Estate Future: Digitalization And Crypto In The World’s Most Luxurious Market

Dubai’s luxury real estate market is embracing digitalization and cryptocurrency, attracting high-net-worth investors. Developers increasingly accept Bitcoin and Ethereum, leveraging blockchain for secure, borderless transactions. Innovations like tokenization and AI-driven PropTech enhance investment opportunities. Unique Properties helps global buyers navigate crypto-based real estate investments, reinforcing Dubai’s position as a leader in next-gen property transactions.

Dubai to host PropTech Connect 2026

Dubai will host PropTech Connect 2026, the world’s largest real estate technology conference, to drive digital transformation in the sector. The event will showcase AI, blockchain, and data analytics, attracting global investors and industry leaders. It aligns with Dubai’s vision to enhance market transparency, efficiency, and innovation in real estate.

Dubai real estate: Freehold rule changes cause spike in buyers, developments, prices, experts say

Prime areas in Dubai are set to see a new wave of developments with the property market seeing hectic parleys between property owners and real estate companies for joint development of properties, industry players said.

Dubai property: Are developer discounts making JVC, JLT more affordable?

Dubai’s property market remains strong, but JVC and JLT offer value opportunities due to developer discounts. JVC’s off-plan prices dropped from AED 1,272 to AED 1,170/sqf, while JLT saw a decline in both off-plan and ready property prices. With rising listings and new launches, buyers can find deals in Dubai’s evolving market.

Deloitte unveils Dubai’s Real Estate Predictions report for 2025, with 2024 figures showing 20% rise in residential sales prices, 19% in rentals

Dubai’s real estate market remains strong in 2025, with 20% sales price growth, 19% rental hikes, and record transaction volumes. The office sector thrives with 17% rent increases, while retail and hospitality expand. Demand for industrial and logistics space grows, reinforcing Dubai’s status as a global investment hub amid ongoing urban development.

Dubai properties: Developers dismiss concerns around market slowdown in 2025

Dubai developers remain confident in 2025, expecting strong sales despite analysts predicting market stabilization. With record demand, projects are selling rapidly, driven by new residents, government initiatives, and major infrastructure projects. Over 72,000 new units may balance supply, but investor appetite and off-plan sales continue to fuel Dubai’s real estate growth.

Damac unveils prime luxury waterfront projects in Dubai

Damac Properties is showcasing its luxury waterfront projects—Couture by Cavalli, Damac Bay, and Damac Bay 2—at the Dubai International Boat Show. These developments offer high-end seafront living with private beaches, sky pools, and Cavalli-inspired interiors, reflecting Dubai’s growing demand for premium waterfront residences.

Prestige One Developments to launch 11 new real estate projects in 2025

Prestige One Developments plans to nearly double its portfolio in 2025, launching 11 new luxury projects across Palm Jumeirah, Business Bay, JVC, and Dubai Islands. The company is expanding regionally and internationally while completing two flagship projects. With record growth in 2024, it aims for 25 total developments by 2025’s end.

SAAS Properties reveals SAAS Heights: A benchmark of luxury living on Al Reem Island

SAAS Properties has launched SAAS Heights on Al Reem Island, featuring luxury sea-view residences across two iconic towers. With fully furnished apartments, smart home technology, private elevators, and penthouses with exclusive amenities, the development sets a new benchmark for coastal living in Abu Dhabi’s luxury real estate market.

GCC real estate transactions hit $383bn; apartment yields in Saudi, UAE, Kuwait, Qatar, Bahrain, and Oman revealed

GCC real estate investments see healthy yields for apartments in Saudi Arabia, UAE, Kuwait, Qatar, Bahrain, and Oman.

Dubai recognizes USDC, EURC as first stablecoins under token regime

Dubai’s DFSA has approved USDC and EURC as the first stablecoins under its crypto regime, allowing firms in DIFC to integrate them for payments and treasury management. This move enhances regulatory clarity in the UAE’s growing crypto sector, aligning with recent stablecoin oversight and updated digital asset regulations.

‘Convert studio into 1BHK’: Dubai developer introduces flexible unit designs

Danube Properties is introducing convertible unit designs in Timez by Danube, allowing studios to be converted into one-bedrooms and 1BHKs into 2BHKs. With cheaper land prices in Dubai Silicon Oasis, Danube is expanding along the E11 corridor. Demand is rising due to Dubai Metro’s Blue Line and airport relocation, attracting global investors.

Skyloov unveils the UAE’s most in-demand property hotspots of 2025

Skyloov’s 2025 insights reveal International City, Al Reem Island, and Muwaileh as the UAE’s most-searched communities, reflecting demand for affordable and premium properties. JVC, Business Bay, and Yas Island attract investors for high rental yields. With AI-driven analytics, Skyloov is transforming data-driven real estate decisions in a competitive market.

Recent Items

Why Dubai? The Global Obsession with Ultra-Luxe Living

With its glittering skyline drawing billionaires, celebrities, and investors, Dubai has solidified its position as... Read More

The Ultimate Guide to Profitable Property Investment in Duba

Dubai has long been known as a center of luxury, opportunity, and innovation in the... Read More

The Role of Art in Luxury Homes: How High-Net-Worth Buyers C

Art has evolved beyond its historical use as adornment in the context of luxury living... Read More

The Price of Exclusivity: Exotic Materials that Define High

High fashion has long been associated with exclusivity, luxury, and incomparable artistry. The use of... Read More

The Pinnacle of Pampering: Exploring Dubai’s Top 3 Most Ex

Dubai is synonymous with luxury, providing experiences that are unmatched in all aspects of extravagance. The... Read More