Dubai Real Estate Transactions as Reported on the 03rd of March 2025

Dubai’s real estate market continues to demonstrate robust activity, with total transactions reaching AED 2.54 billion on March 3, 2024. This includes both off-plan and ready property transactions, reflecting strong investor confidence in both new developments and completed properties.

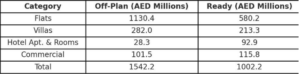

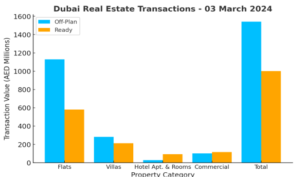

Off-Plan vs. Ready Market Performance

- Off-Plan Transactions: AED 1.54 billion (60.6% of total transactions)

- Ready Transactions: AED 1.00 billion (39.4% of total transactions)

- The off-plan market dominated the day’s transactions, accounting for 60.6% of the total value, signaling continued interest in new developments. The ready market, comprising completed properties, contributed 39.4%, showcasing demand for move-in-ready investments.

Breakdown of Off-Plan Transactions

The off-plan segment recorded AED 1.54 billion in transactions, with the following distribution across asset types:

- Flats: AED 1.13 billion (73.3% of off-plan transactions)

- Villas: AED 281.95 million (18.3%)

- Hotel Apartments & Rooms: AED 28.34 million (1.8%)

- Commercial Properties: AED 101.50 million (6.6%)

Flats continued to drive off-plan sales, contributing a dominant 73.3% of this segment, highlighting investor preference for residential apartments in under-construction projects. Villas made up 18.3%, while commercial properties contributed 6.6%, showing sustained demand for business spaces.

Breakdown of Ready Transactions

Ready properties recorded AED 1.00 billion in sales, distributed as follows:

- Flats: AED 580.16 million (57.9% of ready transactions)

- Villas: AED 213.35 million (21.3%)

- Hotel Apartments & Rooms: AED 92.92 million (9.3%)

- Commercial Properties: AED 115.80 million (11.6%)

In the ready market, flats accounted for 57.9%, indicating a strong preference for immediate occupancy in residential units. Villas represented 21.3%, while commercial properties contributed 11.6%, reinforcing the appeal of fully developed business spaces.

Market Insights

- Off-Plan Dominance: The significant 60.6% share of off-plan properties highlights strong investor confidence in Dubai’s future growth, infrastructure development, and real estate value appreciation.

- Ready Market Strength: Despite the off-plan segment leading the day’s transactions, the 39.4% share of ready properties underscores sustained demand for immediate occupancy and rental investments.

- Residential Preference: Across both segments, flats emerged as the top-performing asset, capturing 73.3% of off-plan sales and 57.9% of ready transactions, making them the preferred choice for investors and homebuyers.

- Commercial Stability: Commercial transactions in both categories contributed a combined AED 217.3 million, reflecting steady demand for business spaces.

Conclusion

Dubai’s real estate market remains highly dynamic, with off-plan properties leading investor interest due to attractive payment plans and future capital appreciation. Meanwhile, the ready property market continues to attract end-users and rental investors, ensuring a balanced growth trajectory.

As new developments continue to shape the skyline, the interplay between off-plan and ready properties will be critical in defining the city’s real estate landscape in the months ahead.

Dubai Real Estate Market Review 04-Mar-2025

The Dubai real estate sector recorded AED19bn ($5.2bn) of transactions last week. Saudi Arabia’s real estate market is booming, residential transactions rose 50%, office demand surged.

Why do so many millionaires want to live in Dubai?

Dubai is attracting billionaires and millionaires, driving luxury real estate growth. Prime property values rose 6.8% in 2024, with rents surging 23.5%. Dubai leads in $10M+ home sales, offering lower prices than global cities. High-net-worth individuals favor its safety, amenities, and connectivity, fueling continued investment and innovation in luxury living.

Dubai real estate sector recorded $5.2bn of transactions last week, including $23m office

The Dubai real estate sector recorded AED19bn ($5.2bn) of transactions last week, according to data from the Land Department.

Abu Dhabi real estate transactions hit $4.69bln in first two months of 2025

Abu Dhabi’s real estate sector saw AED 17.24 billion in transactions in early 2025, with AED 9.8 billion in sales and AED 7.2 billion in mortgages. Strong activity, transparency, and infrastructure reinforce its status as a prime investment hub, attracting investors and supporting market growth.

Chinese and Russian investors dazzled by Dubai real estate market

Chinese and Russian nationals’ investments in Dubai’s luxury real estate market increased by 15 and 20 per cent in 2024, respectively, highlighting the BRICS (Brazil, Russia, India, China, and South Africa) Factor that is driving the growth of foreign capital inflows into the emirate.

Residential sales in Saudi Arabia reach SAR 118bln in 2024, signalling robust real estate growth

Saudi Arabia’s real estate market is booming, driven by Vision 2030, mega-events like Expo 2030 and FIFA 2034, and giga-projects. Residential transactions rose 50%, office demand surged, and hospitality outperformed global cities. Retail and logistics sectors are expanding, positioning the Kingdom as a dynamic, investment-friendly market with strong growth prospects.

Dubai vs. Abu Dhabi: Which City Offers the Best Off-Plan Investment for Indian Buyers?

Dubai and Abu Dhabi offer attractive off-plan investment opportunities for Indian buyers. Dubai provides high rental yields (5%-11%), strong capital appreciation, and diverse properties, while Abu Dhabi offers market stability, luxury homes, and long-term growth. Investment choice depends on goals, risk appetite, and lifestyle preferences.

Dubai rents: Rates in Discovery Gardens, Deira see stability – less so in JVC

Dubai’s rental market is stabilizing in affordable areas like Discovery Gardens and Sports City, with minimal rent increases due to the new Rental Index and star rating system. Deira rents remain steady, while JVC continues to see sharp hikes. New supply in 2025 may slow rental growth further.

GJ Properties unveils $108bln development investment in 2025-26

Ajman’s GJ Properties is investing AED 4 billion in projects for 2025-2026, planning to launch 10 developments with 4,500 units. The company sold 800 units last month. Its Biltmore Residences Sufouh in Dubai, 65% sold and 61% complete, is set for Q4 2025 completion.

Quiet luxury in Dubai: a new standard

Dubai is embracing quiet luxury, a shift from spectacle to understated elegance. Lamar Development’s Park Lamar, designed by Sir David Chipperfield, embodies this trend with sustainable, human-centric design. Featuring 200 apartments, cultural spaces, and green areas, it redefines luxury by prioritizing balance, authenticity, and environmental harmony over extravagance.

Sharjah, Ajman and RAK residential rental markets witness sustained growth

The Northern Emirates’ rental market grew steadily in 2024, with Ras Al Khaimah, Sharjah, and Ajman attracting tenants from Dubai. Abu Dhabi saw rising demand, especially in luxury residences and villas, while Dubai maintained high project launches. Al Ain’s market remained stable, with modest rental increases and upcoming retail expansions in 2025.

Dubai communities to undergo $1.6bn road upgrade

Dubai’s RTA and Dubai Holding are investing AED 6 billion ($1.6 billion) in major road upgrades across Palm Jumeirah, JVC, Dubai Production City, Business Bay, and International City (Phase 3) to cut travel times by over 50%. The project includes new bridges, lanes, and access points to ease congestion.

Recent Items

Why Dubai? The Global Obsession with Ultra-Luxe Living

With its glittering skyline drawing billionaires, celebrities, and investors, Dubai has solidified its position as... Read More

The Ultimate Guide to Profitable Property Investment in Duba

Dubai has long been known as a center of luxury, opportunity, and innovation in the... Read More

The Role of Art in Luxury Homes: How High-Net-Worth Buyers C

Art has evolved beyond its historical use as adornment in the context of luxury living... Read More

The Price of Exclusivity: Exotic Materials that Define High

High fashion has long been associated with exclusivity, luxury, and incomparable artistry. The use of... Read More

The Pinnacle of Pampering: Exploring Dubai’s Top 3 Most Ex

Dubai is synonymous with luxury, providing experiences that are unmatched in all aspects of extravagance. The... Read More