Dubai Real Estate Market Review: February 2025Land transactions in Feb. 2025 was 45% of the total transactions. The market saw a jump of approximately AED 12 billion from Jan 2025, a massive 24% increase in market activity MoM. 50% increase YoY. Dubai’s real estate market witnessed an impressive surge in February 2025, with total transaction values reaching AED 65.59 billion. This marks a 23.7% increase from January 2025 (AED 53 billion) and an extraordinary 50.5% jump from February 2024 (AED 43.6 billion). This growth reflects sustained investor confidence, strong off-plan sales, and robust land transactions, which accounted for nearly 45% of total transaction value. The momentum highlights Dubai’s increasing appeal as a global investment hub.

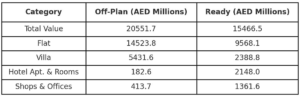

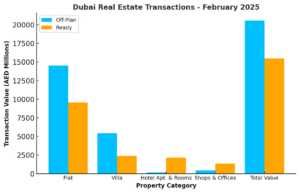

Segment Breakdown· Off-Plan Market: AED 20.55 billion · Ready Market: AED 15.47 billion · Land Transactions: AED 29.57 billion

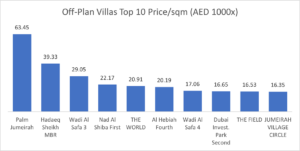

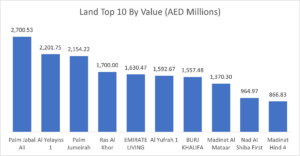

The largest contributor to the total transaction volume was land sales, accounting for nearly 45% of the total market activity. 1. Off-Plan Market The off-plan segment accounted for AED 20.55 billion, showing strong demand, particularly for flats (AED 14.52 billion) and villas (AED 5.43 billion). · Flats dominate the off-plan market, making up 70.7% of total off-plan value. · Hotel apartments & commercial spaces remain minor segments but indicate potential growth. · The strong off-plan activity signals confidence in future developments and high investor interest in new projects.

Top Areas by Value – Off-Plan: · Wadi Al Safa 5 – AED 1.76 billion · Al Yufrah 1 – AED 1.42 billion · Business Bay – AED 1.21 billion · Madinat Al Mataar – AED 1.17 billion · Hadaeq Sheikh MBR – AED 1.00 billion

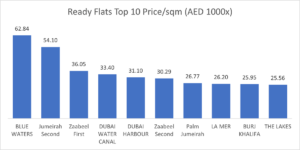

The average price per square meter for off-plan flats stood at AED 46,307, while off-plan villas averaged AED 26,168. 2. Ready Property Market The ready property market recorded AED 15.47 billion in transactions, with flats leading at AED 9.57 billion, followed by villas at AED 2.39 billion. · Ready flats represent 61.9% of this segment, signaling strong demand for immediate occupancy units. · Hotel apartments & rooms saw AED 2.15 billion, indicating a growing interest in short-term rental investments.

Top Areas by Value – Ready: · Burj Khalifa – AED 2.02 billion · Jumeirah Beach Residence – AED 1.86 billion · Business Bay – AED 1.32 billion · Dubai Marina – AED 946 million · Palm Jumeirah – AED 801 million

The average price per square meter for ready flats stood at AED 35,227, while ready villas averaged AED 25,072. 3. Land Transactions Land sales contributed AED 29.57 billion, making it the largest segment (45% of total transactions). · Sustained appetite for large-scale developments and commercial investments. · Potential for high-end villa communities and new commercial hubs.

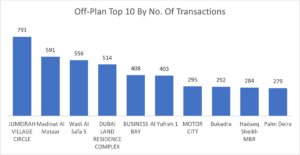

Market Insights· The record-breaking total of AED 65.59 billion suggests strong investor confidence and heightened activity in both the off-plan and ready property segments. · Land transactions played a crucial role, comprising nearly half of the market activity. · Jumeirah Village Circle continues to dominate transactions, while Burj Khalifa leads in transaction value, reinforcing demand for luxury and prime-location real estate. · The growth in off-plan transactions in emerging areas such as Wadi Al Safa 5, Madinat Al Mataar, and Hadaeq Sheikh Mohammed Bin Rashid highlights increasing interest in newly developed zones. ConclusionDubai’s real estate market has demonstrated robust momentum, with both month-on-month and year-on-year gains. The combination of strong demand for off-plan properties, steady ready property sales, and high-value land transactions signals continued investor interest and long-term growth potential for the sector. |

Recent Items

Why Dubai? The Global Obsession with Ultra-Luxe Living

With its glittering skyline drawing billionaires, celebrities, and investors, Dubai has solidified its position as... Read More

The Ultimate Guide to Profitable Property Investment in Duba

Dubai has long been known as a center of luxury, opportunity, and innovation in the... Read More

The Role of Art in Luxury Homes: How High-Net-Worth Buyers C

Art has evolved beyond its historical use as adornment in the context of luxury living... Read More

The Price of Exclusivity: Exotic Materials that Define High

High fashion has long been associated with exclusivity, luxury, and incomparable artistry. The use of... Read More

The Pinnacle of Pampering: Exploring Dubai’s Top 3 Most Ex

Dubai is synonymous with luxury, providing experiences that are unmatched in all aspects of extravagance. The... Read More