Dubai Real Estate Market Review 18-Jun-2025

Dubai’s office property market recorded $762m in Q1 2025 sales. Summer 2025 is set for peak real estate activity: over 100,000 new expats in Q1.

Dubai’s Deyaar eyes $545mln in sales from Downtown Residences project

Deyaar Development aims for nearly AED 2 billion in sales from its Downtown Residences in Business Bay, breaking ground in Q4 2025. Its AED 1.1 billion pipeline will sustain two years, with five project deliveries from July. The company holds AED 1.8 billion liquidity and AED 900 million in facilities, targeting Q4 2030 completion.

Dubai office sales hit $762m in Q1 as off-plan transactions surge 741%

Dubai’s office property market recorded $762m in Q1 2025 sales, with off-plan transactions up 741% and prices rising across all major districts.

Dubai’s summer property boom defies seasonal slowdowns

Summer 2025 is set for peak real estate activity: over 100,000 new expats in Q1, surging developer launches, rising rents steering tenants to buy, and robust foreign investment fueling record transaction volumes.

Community living in Sharjah: Inside Alef’s next-gen developments

Sharjah’s real estate surged: H1 2024 transactions +35% YoY; April 2025 saw 7,206 deals worth AED 4 billion. Affordable pricing, reforms, strategic location and family-friendly developments drive growth. Alef, led by Issa Ataya, spearheads sustainable mixed-use communities like Al Mamsha, Olfah and Hayyan.

Dubai’s office market sets new records, with AED2.8bln worth of sales across 933 transactions – Cavendish Maxwell

Dubai office sales reached AED 2.8 bn across 933 Q1 2025 transactions (+83% YoY, +24% volume). Off-plan values jumped 741% to AED 800 m. Average sales prices hit AED 1,650 psf (+24.5% YoY) and rents AED 160 psf (+24%). Business Bay led with 316 deals; total inventory is 9.3 m sqm.

Dubai: Mega Palm Jumeirah plot sells for staggering $100 million

Palm Jumeirah ultra-prime 90,036 sq ft frond-tip plot sold for Dh365 m in 2025, the island’s highest-value land deal to date. Brokered by Dubai Sotheby’s, it underscores booming ultra-luxury demand—Jan-May prices +18.9% despite 14% volume dip. Buyer developer 25 Degrees plans a bespoke waterfront mansion.

Dubai real estate: Shamal unveils 90-unit residential development at historic Dubai Zoo site

Residents will have access to amenities centred around courtyards including a club house, wellness area, children’s play area, family pool, lounge and gym.

The Middle East’s evolving role in shaping the future of real estate

Q1 2025 saw 42,000+ transactions worth AED 114 bn; apartments led sales, villas averaged AED 11 m. Rental yields hit 6.9% and prices rose 16.5% YoY. No capital gains tax, full foreign ownership, and Golden Visa incentives drive investor inflows, while Saudi Vision 2030 boosts regional mixed-use developments.

UAE real estate: Dubai, Abu Dhabi branded residences drive record $16.9bn property sales

The UAE real estate market growth stems from population growth, tourism increases, economic diversification efforts, and attraction of international corporations.

RAK Properties launches new apartment community in Ras Al Khaimah

RAK Properties unveiled Solera, a 451-unit apartment community on Raha Island’s Downtown Mina in Ras Al Khaimah, with units from 386–3,104 sq ft starting at AED 768 k. Amenities include pools, splash pad, sculptural garden, gym, skateboard park and The NOOK co-working lounge, targeting modern professionals.

Palm Jebel Ali: When will it open, planned attractions and everything you need to know

Nakheel revived Palm Jebel Ali—dormant since 2008—with ₫750 m of infrastructure contracts awarded in June 2025, due by Q4 2026. Twice the size of Palm Jumeirah, it offers 110 km of coastline, 10 villa styles, 80 hotels/resorts, with villa handovers from 2027 and full completion by 2040.

LEOS Developments unveils Weybridge Gardens 5 in Dubailand community

Inspired by nature, LEOS Developments’ Weybridge Gardens 5 blends petal geometry, curved balconies, and symbolic vertical forms.

Palazzo Versace Dubai Heads To Auction With Dramatic Price Cut

Dubai’s Palazzo Versace Hotel is auctioned online with a $163 M opening bid—less than half its prior $380 M valuation—to help Union Properties reduce debt. Swiss‐Italian investor Christopher Aleo and funds are eyeing the 215-room luxury hotel, whose operations remain robust despite the distressed sale.

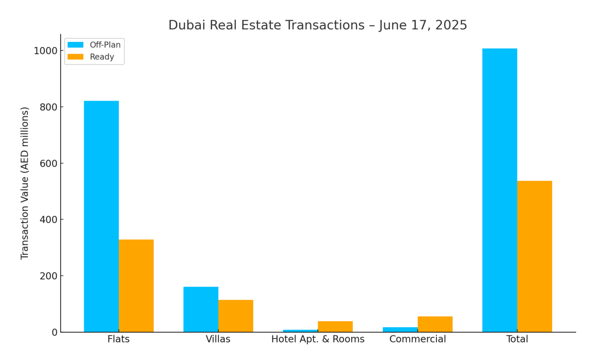

Dubai Real Estate Transactions as Reported on the 17th of June 2025

On 17 June 2025, Dubai’s total real estate transaction value reached AED 1.545 billion. Off-plan sales accounted for AED 1.007 billion (65.2%), while ready properties contributed AED 537.2 million (34.8%).

| Category | Off-Plan (AED millions) | Ready (AED millions) |

| Flats | 820.8 | 328.6 |

| Villas | 160.5 | 114.3 |

| Hotel Apartments & Rooms | 8.2 | 38.5 |

| Commercial | 17.9 | 55.9 |

| Total | 1,007.4 | 537.2 |

Off-Plan Market Performance

Total Off-Plan: AED 1.007 billion

- Flats: AED 820.8 million – 81.5% of off-plan volume

- Villas: AED 160.5 million – 15.9%

- Hotel Apartments & Rooms: AED 8.2 million – 0.8%

- Commercial: AED 17.9 million – 1.8%

Flats dominated off-plan activity, reflecting sustained investor appetite for mid-market residential units. Villa sales remain a solid secondary segment, while hospitality and commercial contributions are minimal.

Ready Market Performance

Total Ready: AED 537.2 million

- Flats: AED 328.6 million – 61.2% of ready volume

- Villas: AED 114.3 million – 21.3%

- Hotel Apartments & Rooms: AED 38.5 million – 7.2%

- Commercial: AED 55.9 million – 10.4%

The ready-market mix similarly favors flats, with villas capturing just over one-fifth of activity. Commercial transactions show healthy participation, and hotel apartment sales remain modest.

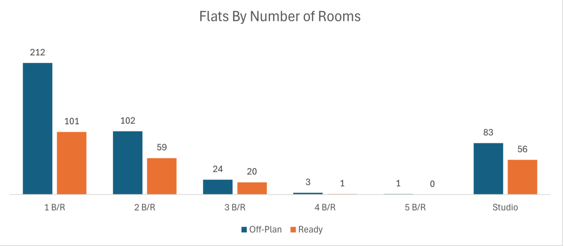

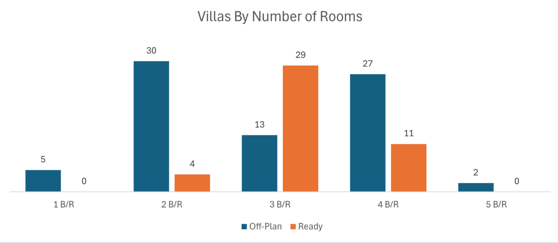

On The Micro Level

Market Insights

Dubai’s market remains driven by off-plan launches, with flats leading both segments. The strong off-plan share (65% of total value) underscores developers’ ability to attract pre-completion capital. Villa demand, while smaller, continues steadily across both segments. Commercial and hospitality volumes remain niche but offer selective opportunities as new projects come online. Looking ahead, sustained demand for residential flats and upscale villas, coupled with upcoming project handovers, should support steady growth. As supply pipelines expand, a more balanced market is expected, rewarding targeted developments and underpinning sustainable price trends.

Recent Items

Dubai International City: Affordable Multicultural Living

Dubai International City: Affordable Multicultural Living International City offers affordable, multicultural living and high rental... Read More

Will Trump’s Tariffs Impact UAE Real Estate?

Will Trump’s Tariffs Impact UAE Real Estate? Executive Summary Dubai’s strategic position as a resilient... Read More

Dubai Harbour: Dubai’s Premier Waterfront Lifestyle Destin

Dubai Harbour: Dubai’s Premier Waterfront Lifestyle Destination Dubai Harbour is a luxury waterfront community offering... Read More

A Prestige Address for Luxury Living: Emirates Hills

A Prestige Address for Luxury Living: Emirates Hills Emirates Hills is Dubai’s premier luxury community,... Read More

Dubai Real Estate Weekly Market Analysis 2nd June 2025

Dubai Real Estate Weekly Market Analysis 2nd June 2025 The total real estate transactions in... Read More