Dubai Real Estate Market Review 17-Jun-2025

Dubai property prices rose 8% in early 2025, led by villas with 29.3% annual growth. Jumeirah Bay Island led Dubai’s waterfront surge with 24% YoY.

Living in Dubai? Here’s how much property prices could rise in 2025

Dubai property prices rose 8% in early 2025, led by villas with 29.3% annual growth. ValuStrat forecasts up to 10% more growth this year, though at a slower pace. Apartment prices also climbed but remain below 2014 peaks. Experts expect steadier, more sustainable increases ahead.

Dubai homeowners prepared to ‘play the long game’ if property values fall

Despite Fitch predicting a 15% property price drop in Dubai by late 2025, homeowners remain confident, viewing the market long-term. Buyers are cautious but optimistic, while experts highlight continued demand, rising population, and a maturing market as signs of stable, gradual growth rather than a sharp correction.

Blue Line to transform Dubai’s urban economy, turn infrastructure into ‘wealth generator’

Dubai Metro’s Blue Line will boost real estate values and economic productivity by improving connectivity across nine key districts. Experts predict rising demand, higher rental yields, and increased investor focus on areas like Dubai Creek Harbour and Academic City, positioning Dubai as a more liveable and investable global city.

Nakheel awards over $204.2mln in contracts for Palm Jebel Ali infrastructure works

Nakheel’s real estate arm awarded DBB Contracting over AED 750 million for Palm Jebel Ali’s infrastructure, utilities, roads and groundwork across Fronds A–G and the Spine District, slated for Q4 2026. Aligned with Dubai’s D33 Economic Agenda and 2040 Urban Master Plan, the 13.4 km island development aims to set a new global waterfront living benchmark.

Binghatti launches $1bn Shariah-compliant asset management arm in Dubai

Binghatti has launched Binghatti Capital in DIFC to manage up to $1 billion in Shariah-compliant real estate and private credit investments. Exclusively for professional investors, it will focus on off-plan residential projects and supply-chain financing, marking Binghatti’s expansion into alternative, non-bank funding sources in Dubai.

Jumeirah Bay Island leads surge in Dubai luxury property values

Jumeirah Bay Island led Dubai’s waterfront surge with 24%-year-on-year price growth to Dh4,122/sq. ft. Other prime locales, JBR, Palm Jumeirah and Bluewaters, saw 8–10% gains, fueled by scarcity and global demand as investors chase high-quality, low-maintenance luxury beachfront living for both lifestyle and long-term returns.

SmartCrowd launches Flip: A game-changing way to invest in Dubai’s multi-million-dirham property renovations

SmartCrowd launched Flip, a regulated real estate crowdfunding platform offering fractional investment in AED 35 M+ property renovation flips. With four completed exits generating AED 90 M from AED 63 M invested and average returns of 28% over 15 months, Flip democratizes high-end property flipping for everyday investors.

Abu Dhabi is driving ‘significant opportunity’ amid UAE real estate surge, experts say

Backed by major infrastructure, investor interest, and a strategic long-term vision, Abu Dhabi’s quiet transformation is starting to turn heads.

Dubai Startup Saga Properties Gets Early Nod from Government Innovation Wing for Blockchain-Based Real Estate Model

Saga Properties unveiled a blockchain-powered fractional property ownership model with Dubai Land Department’s preliminary backing. Founders Gaurav Raj and Sapna Bhardwaj launched a limited Founders Pass and are finalizing legal and tech partnerships ahead of a private MVP, aiming to democratize real estate investment and bolster Dubai’s digital property agenda.

AED 128B Al Maktoum Project Fuels Real Estate Boom in Dubai South

Betterhomes finds that the AED 128 billion Al Maktoum Airport expansion is driving Dubai South’s market, transactions topped AED 15 billion Jan–May 2025, rentals and inquiries are up 20%. Prices are forecast to rise 15–20%, aided by new metro and rail links. Surrounding areas remain up to 60% cheaper, echoing post-Terminal 3 growth.

Madar Developments to expand Dubai footprint with 3 new housing projects

Dubai’s Madar Developments will launch three AED 700 million residential projects, including the AED 200 million Tulip Oasis X Residences handover in Q2 2026. By managing construction in-house since land acquisition in July 2022, Madar ensures quality control and targets sustained off-plan market growth through 2026.

Emirates Properties Unveils Azha Millennium Residences in Dubai

Valued at AED350 million ($95.2 million), the project is expected to complete in the fourth quarter of 2027.

Dubai Real Estate Transactions as Reported on the 16th of June 2025

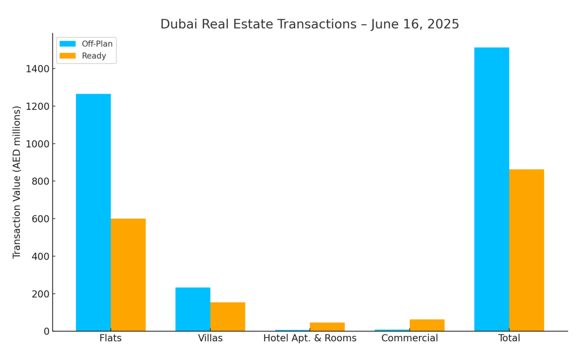

On 16 June 2025, Dubai’s total real estate transaction value reached AED 2.376 billion. Off-plan sales accounted for AED 1.514 billion (63.7%), while ready properties contributed AED 862 million (36.3%).

| Category | Off-Plan (AED m) | Ready (AED m) |

| Flats | 1,265.8 | 599.7 |

| Villas | 233.2 | 153.5 |

| Hotel Apt. & Rooms | 7.0 | 46.2 |

| Commercial | 7.5 | 63.0 |

| Total | 1,513.5 | 862.4 |

Off-Plan Market Performance

- Total Off-Plan: AED 1.514 billion

- Flats: AED 1.266 billion – 83.6% of off-plan volume

- Villas: AED 233.2 million – 15.4%

- Hotel Apartments & Rooms: AED 7.0 million – 0.5%

- Commercial: AED 7.5 million – 0.5%

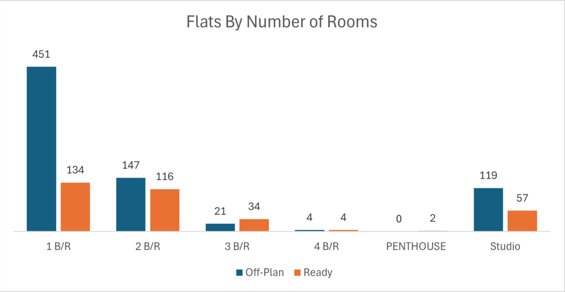

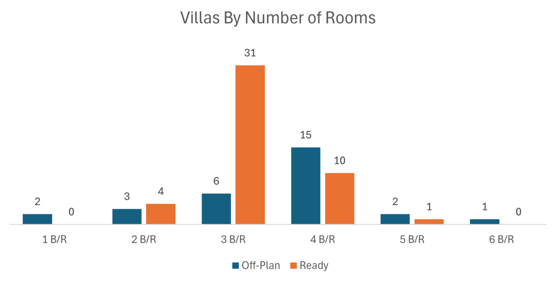

Flats dominated off-plan activity, reflecting continued investor appetite for mid-market residential units. Villa sales remain a solid secondary segment, while hospitality and commercial contributions are minimal.

Ready Market Performance

- Total Ready: AED 862.4 million

- Flats: AED 599.7 million – 69.5% of ready volume

- Villas: AED 153.5 million – 17.8%

- Hotel Apartments & Rooms: AED 46.2 million – 5.4%

- Commercial: AED 63.0 million – 7.3%

The ready market mix similarly Favors flats, with villas and commercial properties each capturing under 20% of activity. Hotel apartment sales showed modest gains.

On The Micro Level

Market Insights

Dubai’s market remains driven by off-plan launches, with flats leading both segments. The strong off-plan share (nearly two-thirds of total value) underscores developers’ ability to attract pre-completion capital. Villa demand, while smaller, continues steadily. Lower commercial and hospitality volumes point to selective investor focus. Looking ahead, sustained demand for flats and high-end villas, alongside upcoming project handovers, should support steady growth. As supply pipelines mature, we expect a balanced market that rewards targeted developments and keeps price growth on a sustainable trajectory.

Recent Items

Dubai International City: Affordable Multicultural Living

Dubai International City: Affordable Multicultural Living International City offers affordable, multicultural living and high rental... Read More

Will Trump’s Tariffs Impact UAE Real Estate?

Will Trump’s Tariffs Impact UAE Real Estate? Executive Summary Dubai’s strategic position as a resilient... Read More

Dubai Harbour: Dubai’s Premier Waterfront Lifestyle Destin

Dubai Harbour: Dubai’s Premier Waterfront Lifestyle Destination Dubai Harbour is a luxury waterfront community offering... Read More

A Prestige Address for Luxury Living: Emirates Hills

A Prestige Address for Luxury Living: Emirates Hills Emirates Hills is Dubai’s premier luxury community,... Read More

Dubai Real Estate Weekly Market Analysis 2nd June 2025

Dubai Real Estate Weekly Market Analysis 2nd June 2025 The total real estate transactions in... Read More