Dubai Real Estate Transactions as Reported on the 20th of February 2025

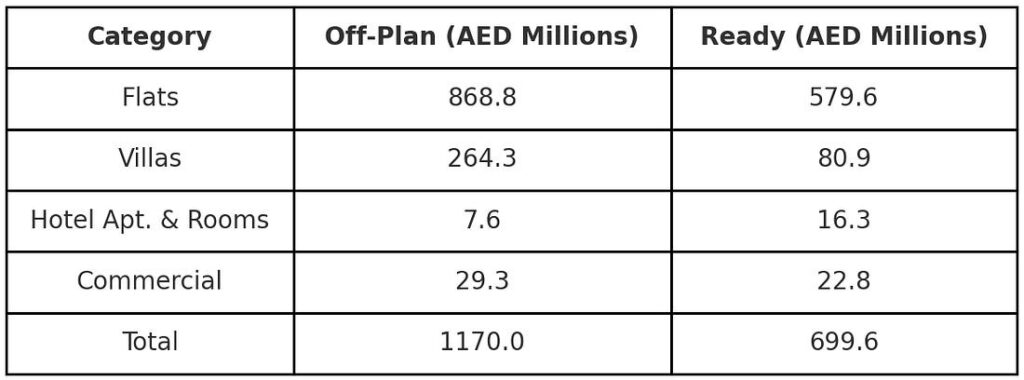

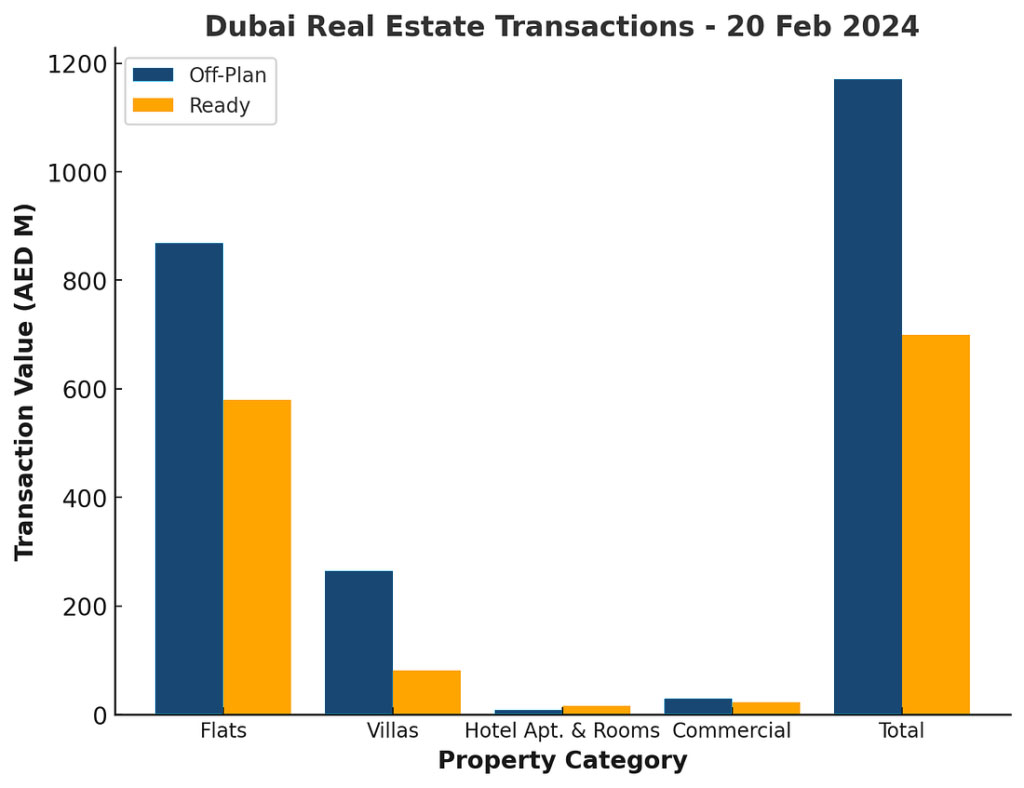

Dubai’s real estate market recorded a total transaction value of AED 1.87 billion on February 20, 2024, reflecting the strong demand for both off-plan and ready properties. The off-plan segment contributed 62.6% of the total transactions, reaching AED 1.17 billion, while ready properties accounted for 37.4%, totaling AED 699.6 million.

Off-Plan Transactions: Dominance of Flats

The off-plan sector continues to be the dominant force in Dubai’s real estate market, with flats contributing 74.2% of the segment’s total value at AED 868.77 million. Villas followed with 22.6% (AED 264.3 million), while commercial properties and hotel apartments made up 2.5% (AED 29.3 million) and 0.6% (AED 7.58 million), respectively.

Breakdown of Off-Plan Transactions

- Flats: AED 868.77 million (74.2%)

- Villas: AED 264.3 million (22.6%)

- Commercial: AED 29.3 million (2.5%)

- Hotel Apartments & Rooms: AED 7.58 million (0.6%)

Ready Property Transactions: Strong Demand for Flats

In the ready property sector, flats led the way, accounting for 82.9% of the segment’s total with AED 579.6 million in transactions. Villas represented 11.6% (AED 80.85 million), while hotel apartments and commercial properties made up 2.3% (AED 16.3 million) and 3.3% (AED 22.8 million), respectively.

Breakdown of Ready Transactions

- Flats: AED 579.6 million (82.9%)

- Villas: AED 80.85 million (11.6%)

- Commercial: AED 22.8 million (3.3%)

- Hotel Apartments & Rooms: AED 16.3 million (2.3%)

Market Insights & Trends

- The off-plan market continues to outperform ready properties, attracting a higher share of investments, driven by competitive payment plans, developer incentives, and investor confidence in Dubai’s long-term growth.

- Flats dominated both segments, reflecting strong demand for residential units, particularly in prime and emerging locations.

- Villas maintained a significant presence, though their share was notably higher in off-plan transactions, indicating continued interest in larger living spaces with flexible payment options.

- Commercial transactions remained steady across both sectors, while hotel apartments showed relatively lower demand, likely due to seasonal market dynamics.

Conclusion

The February 20, 2024 real estate transactions highlight Dubai’s sustained market strength, with off-plan properties leading the way. The continued dominance of flats and villas suggests robust demand for both investment and end-use properties, reaffirming Dubai’s position as a global real estate hub. With ongoing infrastructure developments and investor-friendly regulations, the market is poised for further expansion in the coming months.

Dubai Real Estate Market Review 21-Feb-2025

Dubai real estate sector sees 27 percent surge in prices in January 2025. Emaar Led the ranking by online reputation. Rental market surges in Ras Al Khaimah. World’s highest outdoor pool is coming.

Giant 500m Dubai hotel and branded real estate project to have ‘world’s highest outdoor pool’

Corinthia Dubai will tower more than 500m and include branded real estate and the “world’s highest outdoor pool”.

Dubai’s Top Real Estate Developers Of 2024 Ranked By Online Reputation

Reputation House analyzed the digital reputation of 27 major Dubai developers, scoring them across eight key metrics. EMAAR led overall (61.46), followed by Nakheel (57.48) and DAMAC (57.11). Standouts included Reportage for website quality, Select Group for search reputation, and Nakheel for global recognition. Full results are online.

UAE real estate: Rental market surges as investors flock to Ras Al Khaimah amid luxury property boom, tourism wave

Ras Al Khaimah is rapidly emerging as a top choice for real estate investments, as investors increasingly seek alternative destinations that offer luxury and high returns amid soaring property prices in Dubai.

Dubai real estate sector sees 27 percent surge in prices in January 2025: Report

Dubai’s real estate market maintained strong momentum in early 2025, with a 27% annual price increase. Villas rose 31.2%, while apartments grew 23.1%. Off-plan sales surged 37.9% annually, making up 69.1% of transactions. Popular areas included Palm Jumeirah, Dubai Marina, and JVC. Rental demand favored furnished apartments and larger villas.

IMAN Developers unveils 15 Cascade featured By Versace Ceramics, valued at Dh700 million

IMAN Developers launched 15 Cascade, a Dh700M luxury development in Motor City, featuring Versace Ceramics. Inspired by speed and water, it offers 442 high-end units, including studios to four-bedroom penthouses with private pools. With 70+ premium amenities, it promises modern luxury and completes in Q3 2028.

IMKAN launches Naseem AlJurf in Abu Dhabi: A luxury and serene living concept in the Emirates riviera

IMKAN has launched Naseem AlJurf, a luxury community in Abu Dhabi’s Ghantoot region, featuring 111 villas, 8 apartment towers, and 60 townhouses. With 1.6 km of coastline and 9 km of canal front, it offers upscale living, sustainability, and connectivity to key UAE destinations, blending heritage with modern design.

Recent Items

Why Dubai? The Global Obsession with Ultra-Luxe Living

With its glittering skyline drawing billionaires, celebrities, and investors, Dubai has solidified its position as... Read More

The Ultimate Guide to Profitable Property Investment in Duba

Dubai has long been known as a center of luxury, opportunity, and innovation in the... Read More

The Role of Art in Luxury Homes: How High-Net-Worth Buyers C

Art has evolved beyond its historical use as adornment in the context of luxury living... Read More

The Price of Exclusivity: Exotic Materials that Define High

High fashion has long been associated with exclusivity, luxury, and incomparable artistry. The use of... Read More

The Pinnacle of Pampering: Exploring Dubai’s Top 3 Most Ex

Dubai is synonymous with luxury, providing experiences that are unmatched in all aspects of extravagance. The... Read More