Dubai Real Estate Transactions as Reported on the 22nd of January 2025

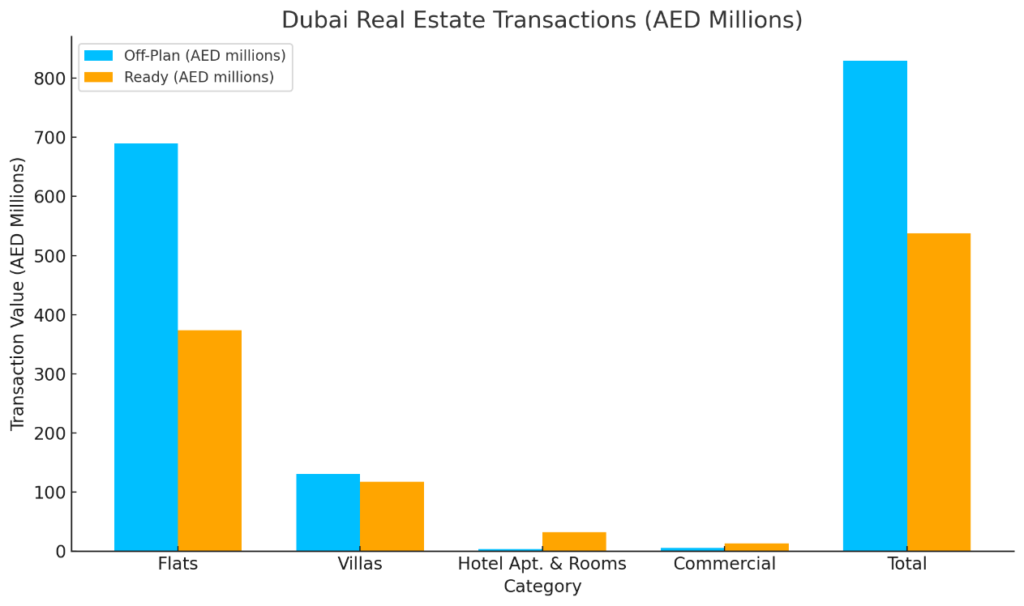

On 22nd January 2024, Dubai recorded total real estate transactions amounting to AED 1.37 billion, reflecting the city’s dynamic and thriving property market. This commentary provides a detailed breakdown of these transactions across off-plan and ready property categories, highlighting their respective contributions to the total value and the performance of subcategories within each segment.

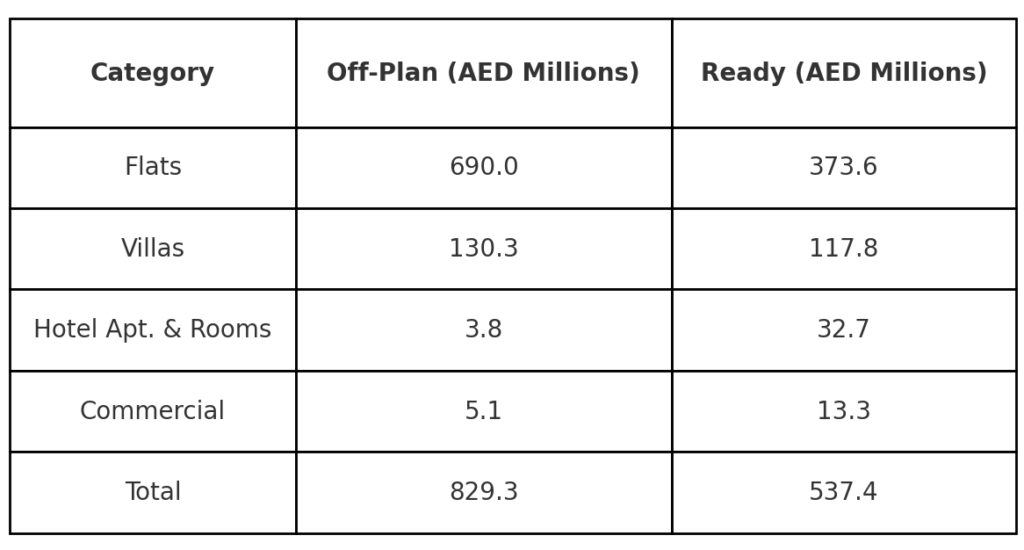

|

Category Contribution

- Off-Plan Properties:

Off-plan transactions accounted for 60.7% of the total value, contributing AED 829.35 million. - Ready Properties:

Ready property transactions contributed 39.3% of the total, amounting to AED 537.38 million.

|

This indicates a stronger investor inclination toward off-plan properties, a trend often driven by attractive payment plans and potential for capital appreciation.

Off-Plan Transactions Breakdown

The total value of off-plan transactions, AED 829.35 million, is distributed as follows:

- Flats: AED 690.04 million (83.2% of off-plan total).

- Flats dominate the off-plan market, reflecting their appeal among both investors and end-users seeking modern living spaces.

- Villas: AED 130.34 million (15.7%).

- Villas attract buyers looking for spacious, premium living in emerging communities.

- Hotel Apartments & Rooms: AED 3.82 million (0.5%).

- This niche market highlights interest in hospitality-related investments.

- Commercial Properties: AED 5.14 million (0.6%).

- A smaller yet steady segment, often appealing to businesses and investors seeking high returns.

Ready Transactions Breakdown

The total value of ready transactions, AED 537.38 million, is distributed as follows:

- Flats: AED 373.60 million (69.5% of ready total).

- Ready flats see high demand from tenants transitioning to ownership amid rising rental prices.

- Villas: AED 117.78 million (21.9%).

- Villas maintain a significant share, favored by families and long-term investors.

- Hotel Apartments & Rooms: AED 32.74 million (6.1%).

- Reflects a growing trend in ready-to-use hospitality investments.

- Commercial Properties: AED 13.25 million (2.5%).

- Indicates steady demand for operational spaces in the ready property segment.

Insights and Market Trends

- Off-Plan Dominance: The larger share of off-plan transactions demonstrates the market’s strong investor confidence in future developments and Dubai’s robust growth prospects.

- Flats as the Preferred Asset: Across both off-plan and ready categories, flats consistently dominate, highlighting their attractiveness due to affordability, accessibility, and higher rental yields.

- Demand for Villas: Villas show notable contributions in both categories, driven by the desire for larger living spaces and the appeal of luxury living.

Conclusion

The real estate transactions on 22nd January 2024 underscore Dubai’s position as a global hub for property investment. With off-plan properties leading the market at 60.7% of total transactions, the city continues to attract both local and international investors seeking diverse opportunities in a competitive and mature market. The robust performance of ready properties further reflects a thriving demand for immediate ownership and rental opportunities.

Dubai’s real estate market remains a beacon of growth and resilience, offering a wide array of investment opportunities to cater to varied preferences and financial objectives.

Dubai Real Estate Market Review 23-Jan-2025

Dubai’s property market nears its peak with price stabilization expected in 2025. Sharjah’s real estate sector grew 48% in 2024 to Dh40b. The UAE’s GDP projected to grow 3.9% in 2024 and 4.1% in 2025.

Sharjah real estate developer shows off $953m District 11 project ahead of Q2 launch

District 11 in Sharjah will feature 11 buildings with 200 commercial units.

Sharjah’s real estate transactions hit Dh40 billion in 2024

Sharjah’s real estate sector grew 48% in 2024, reaching Dh40 billion, its highest since 2008. Investments from 120 nationalities highlighted global demand, with Emiratis leading at Dh19.2 billion. Mortgage deals totaled Dh10 billion, and 14 new projects were launched, further boosting Sharjah’s appeal for housing and investment.

RAK Properties plans to launch 12 projects worth Dh5bn in 2025

RAK Properties plans 12 projects worth Dh5 billion in 2025, including high-end villas and branded apartments in the Mina master development. Strong demand, boosted by Wynn Resorts’ $3.9 billion project, fuels growth. RAK expects sales to double to Dh3 billion, with plans to deliver 2,500-3,000 units.

REEF Luxury Developments launches its AED 300mln project in Al Furjan – REEF 999

REEF Luxury Developments launches REEF 999 in Al Furjan, Dubai, featuring 142 luxury units with climate-controlled balconies and winter gardens. Spanning 60,000 sq. ft., amenities include sports courts, pools, and co-working spaces. Priced from AED 1.15M, the sustainable project targets high ROI and completes in Q1 2027.

UAE continues to be on investors’ radar

The UAE’s economy is thriving, with GDP projected to grow 3.9% in 2024 and 4.1% in 2025, driven by strong momentum. Dubai’s real estate gains global appeal, boosted by new freehold policies and strategic investments like the $5 billion Gulf Data Hub expansion. Oil prices may reach $117/barrel by 2025.

Sobha Realty eyes Dh30b portfolio size this year

Sobha Realty achieved record-breaking sales of Dh23 billion in 2024, a 50% year-on-year growth, and targets Dh30 billion in 2025. Key projects include the $5 billion Sobha Siniya Island, housing 25,000 residents. With 10% of Dubai’s market share, Sobha continues expanding globally while enhancing customer trust and experience.

Azizi Developments unveils luxury residences on Dubai Islands

Azizi Developments launches Azizi Wasel, a luxury seafront project on Dubai Islands, featuring penthouses, apartments, and premium amenities like a marina, yacht club, and beaches. Strategically located near major attractions, prices start at AED 1M with a 50/50 payment plan, blending waterfront living with urban convenience.

Dubai property market to peak in 2025? Prices for high-end villas to stabilise

Dubai’s property market nears its peak with price stabilization expected in 2025, especially for high-end villas. Growth is projected at 5-10%, supported by economic momentum and strong demand. Off-plan sales surged 76.4% in 2024, while affordable units gained popularity as tenants turned to ownership amid lower mortgage rates and rising rents.

Recent Items

Dubai Real Estate Transactions as Reported on the 29th of Ja

Dubai Real Estate Transactions as Reported on the 29th of January 2025 The Dubai real... Read More

Dubai Real Estate Transactions as Reported on the 28th of Ja

Dubai Real Estate Transactions as Reported on the 28th of January 2025 Dubai’s real estate... Read More

Dubai Real Estate Transactions as Reported on the 27th of Ja

Dubai Real Estate Transactions as Reported on the 27th of January 2025 The Dubai real... Read More

Dubai Real Estate Weekly Market Analysis 27-Jan-2025

Dubai Real Estate Weekly Market Analysis 27-Jan-2025 The total real estate transactions in Dubai for... Read More

Dubai Real Estate Transactions as Reported on the 23rd of Ja

Dubai Real Estate Transactions as Reported on the 23rd of January 2025 The Dubai real... Read More