Dubai Real Estate Market Review 06-Jan-2026

Dubai real estate in 2026 is shifting from hype to “perception engineering.”

Dubai property market caps record-shattering 2025 with powerful December finish

Dubai’s real estate hit a record in 2025. 215,700 sales worth Dh686.8bn (+18.7% volume, +30.9% value). December surged to Dh63.1bn across 18,587 deals. Growth was broad-based (primary/resale), prices rose, supply expanded, and demand stayed strong across apartments, villas, and commercial assets.

Read the full article on Khaleej Times

PR for Dubai Real Estate in 2026: Winning the Global Investor’s Trust

Dubai real estate in 2026 is shifting from hype to “perception engineering”: buyers demand transparency, data, delivery track records, and infrastructure-backed value. Strategy 2033 targets higher GDP contribution and homeownership. ESG/smart communities rise, while PR must emphasize regulation, proven outcomes, and residency-led narratives to build trust.

Read the full article on MENA FN

Dhs4m rentals and rising: Why some Dubai landlords aren’t blinking

Dubai’s ultra-luxury rental market is booming despite oversupply concerns. Exclusive Links closed a Dh4.25m/year lease for a Dubai Hills mansion in a week, with other Dubai Hills leases reportedly reaching Dh22m–25m over two years. Brokers say wealthy tenants rent for flexibility and “trial” living before buying, even as Fitch warns prices could fall amid heavy 2026 supply.

Read the full article on Gulf Business

Dubai to host PropTech Connect Middle East in February 2026

Dubai will host the Middle East debut of PropTech Connect on Feb 4–5, 2026 at Grand Hyatt Dubai, in partnership with the Dubai Land Department. Expect 3,000+ attendees and 1,500+ companies, with panels, case studies and workshops focused on AI, blockchain and data to boost market efficiency and transparency under D33 and the Real Estate Strategy 2033.

Read the full article on Gulf News

Dubai real estate: Robust demand, population growth and influx of HNWIs fuel price growth in 2025

Dubai real estate surged in 2025: 214,912 sales worth AED682.5bn (+18.9% volume, +30.7% value). Off-plan led with 62.6% share and 134,623 deals (~AED293bn). Apartments dominated volumes, while commercial grew fastest (~40%). Top areas by volume: JVC, Business Bay. Ultra-luxury peaked with a AED550m Bugatti Residences sale and AED425m Emirates Hills villa.

Read the full article on Economy Middle East

Dubai Design District, D3, residential masterplan revealed: Water-front homes, work-live communities

Meraas unveiled a major Dubai Design District (d3) residential expansion: an 18m sq ft masterplan adding a canal-front, live-work neighbourhood with homes, retail, culture and hospitality. It features a pedestrian “Design Line,” targets LEED Silver, and is split into five zones. Recent launches (Atélis, The Edit) show strong demand; indicative pricing ranges from ~Dh1.9m apartments to Dh30m+ penthouses.

Read the full article on Gulf News

BEYOND Developments launches HADO, the first residential project at SIORA on Dubai Islands

BEYOND Developments launched HADO, the first project in the SIORA masterplan on Dubai Islands: three 21-storey beachfront towers with 678 one- to four-bed homes (including duplexes and penthouses), plus retail and wellness amenities. The pedestrian-first coastal district spans 6km of shoreline, with handover planned for Q3 2029.

Read the full article on Zawya

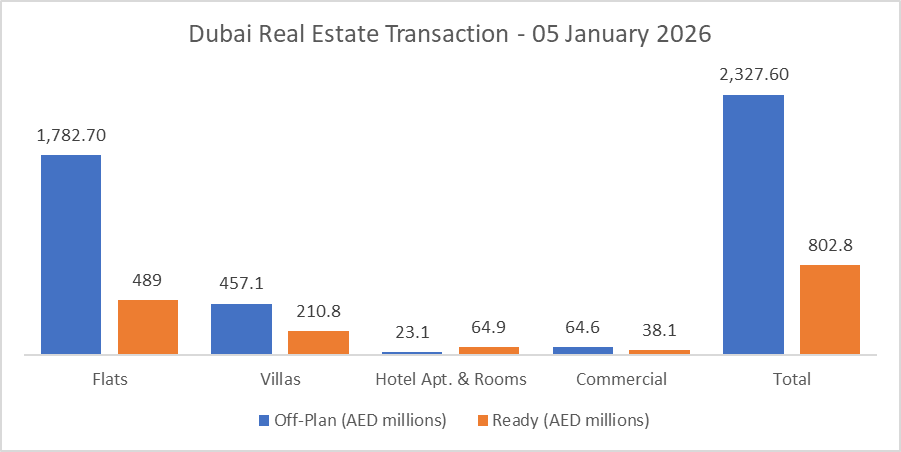

Dubai Real Estate Transactions as Reported on the 5th of January 2026

On the 05-Jan-2026 (1-5 Jan), the total transacted value reached AED 3.13bn. Off-plan dominated with AED 2.33bn (74.4%), while Ready accounted for AED 802.8m (25.6%).

| Category | Off-Plan (AED millions) | Ready (AED millions) |

| Flats | 1,782.7 | 489.0 |

| Villas | 457.1 | 210.8 |

| Hotel Apt. & Rooms | 23.1 | 64.9 |

| Commercial | 64.6 | 38.1 |

| Total | 2,327.6 | 802.8 |

Off-Plan Market Performance

Total Value: AED 2.33bn

- Flats: AED 1.78bn (76.6%)

- Villas: AED 457.1m (19.6%)

- Hotel Apts & Rooms: AED 23.1m (1.0%)

- Commercial: AED 64.6m (2.8%)

Off-plan activity was overwhelmingly apartment-led, with villas providing the only meaningful secondary contribution.

Ready Market Performance

Total Value: AED 802.8m

- Flats: AED 489.0m (60.9%)

- Villas: AED 210.8m (26.3%)

- Hotel Apts & Rooms: AED 64.9m (8.1%)

- Commercial: AED 38.1m (4.7%)

Ready transactions were more diversified than off plan, with villas and hotel units taking a larger share of value.

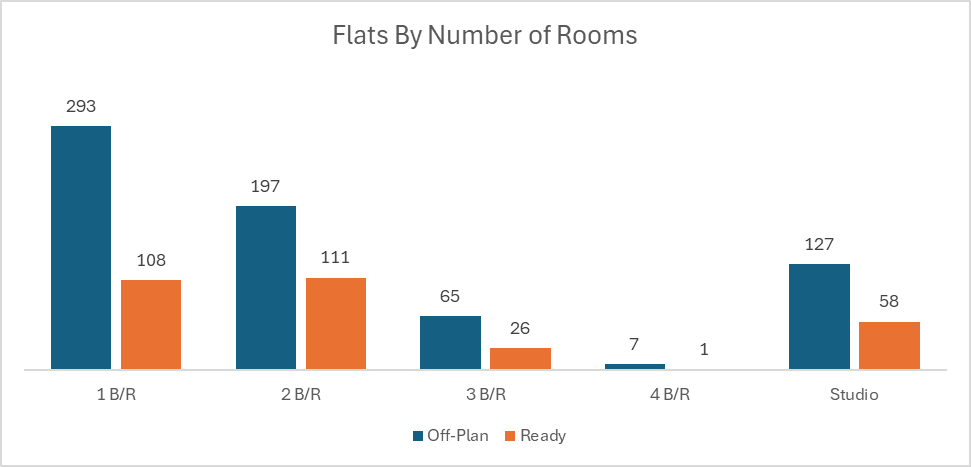

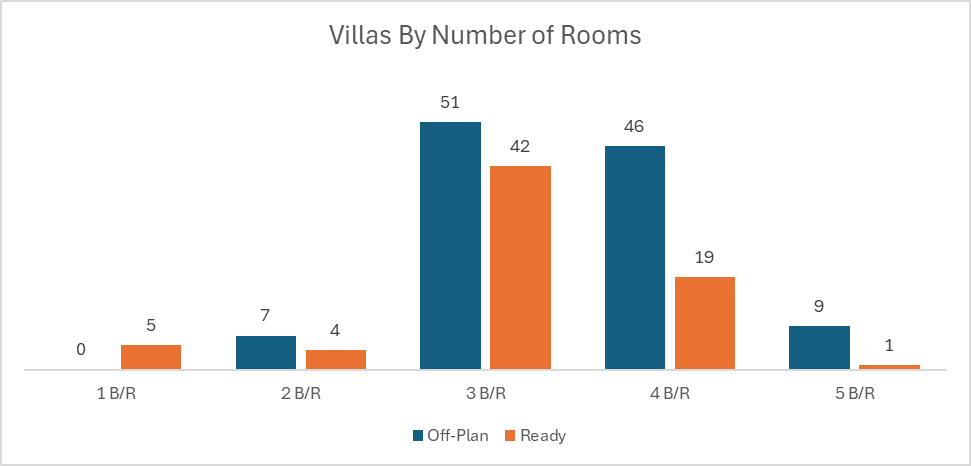

On The Micro Level

Market Insights & Outlook

The market opened the year with a clear off-plan tilt, driven by strong apartment absorption and comparatively limited reliance on commercial value. Ready activity contributed a smaller share overall, but showed a healthier mix, particularly villas and hotel units, suggesting end-user and lifestyle-driven demand remains active alongside investor-led off-plan momentum.

Data Source: Dubai Land Department