Category: News

Dubai Real Estate Weekly Market Analysis 17-Feb-2025

The total real estate transactions in Dubai for Week 6 reached AED 8.58, a 16.7% decrease from last week’s AED 10.3 billion. Off-plan contributed 58.7%, while Ready properties contributed 41.3%.

Dubai’s real estate market recorded a total transaction volume of AED8.58 billion in Week 6, reflecting a notable decrease of approximately 16.7% compared to the previous week’s total of AED10.3 billion. This decline highlights a temporary slowdown in transaction volumes, potentially driven by market adjustments or seasonal fluctuations.

Off-Plan vs. Ready Transactions

The market was once again dominated by off-plan transactions, which accounted for 58.7% of the total market volume, with a total value of AED5.04 billion. Ready property transactions comprised the remaining 41.3%, amounting to AED3.54 billion.

This continued dominance of off-plan sales suggests sustained investor confidence in future developments and an appetite for new projects.

Breakdown by Property Type

Off-Plan Transactions

Off-Plan Transactions

- Flats led the segment, contributing AED3.85 billion (76.4% of off-plan sales).

- Villas followed with AED1.08 billion (21.4%).

- Hotel Apartments & Rooms recorded AED33.37 million (0.7%).

- Commercial properties accounted for AED76.09 million (1.5%).

Ready Transactions

- Flats contributed AED2.37 billion (66.9% of ready transactions).

- Villas followed with AED704.97 million (19.9%).

- Hotel Apartments & Rooms stood at AED110.63 million (3.1%).

- Commercial properties totaled AED357.27 million (10.1%).

Top Performing Areas by Transaction Value

Off-Plan Sales by Area

The highest transaction volumes in the off-plan segment were recorded in the following areas:

- Wadi Al Safa 5 led with AED390.17 million.

- Business Bay followed closely with AED333.20 million.

- Burj Khalifa saw transactions worth AED302.09 million.

- Al Yufrah 1 and Madinat Al Mataar contributed AED252.12 million and AED245.30 million, respectively.

- Other notable areas include Marsa Dubai, Palm Jumeirah, Jumeirah Village Circle, Bukadra, and Hadaeq Sheikh Mohammed Bin Rashid, each surpassing AED160 million in transactions.

Total off-plan transactions in the top ten areas amounted to AED2.48 billion, accounting for nearly 49.2% of all off-plan sales.

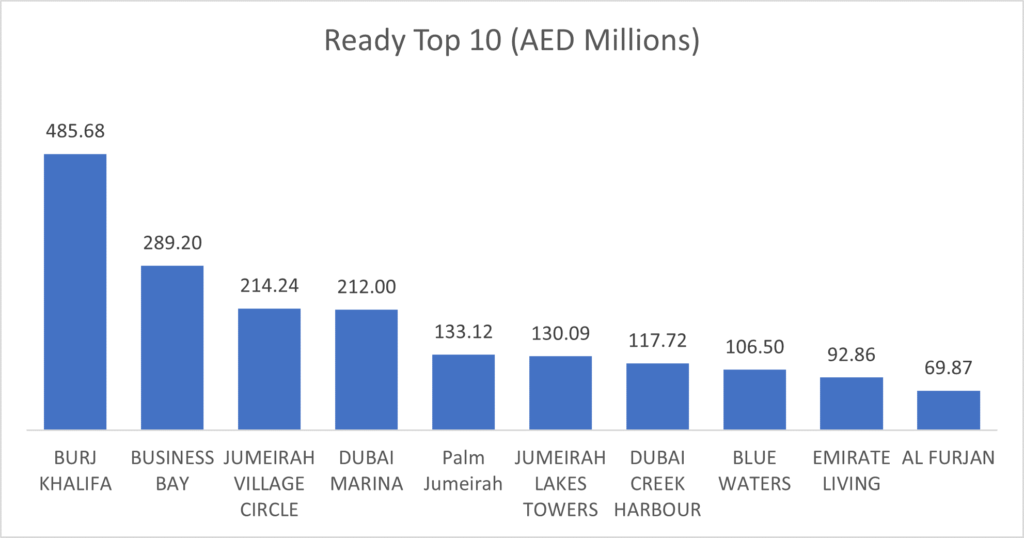

Ready Sales by Area

The ready property market was led by:

- Burj Khalifa, with an impressive AED485.68 million in transactions.

- Business Bay, at AED289.20 million.

- Jumeirah Village Circle and Dubai Marina, with AED214.24 million and AED212.00 million, respectively.

- Other significant contributors included Palm Jumeirah, Jumeirah Lakes Towers, Dubai Creek Harbour, Blue Waters, Emirates Living, and Al Furjan.

Total transactions in the top ten areas for ready properties stood at AED1.85 billion, representing 52.3% of all ready property transactions.

Market Insights and Trends

- Off-Plan Sales Maintain Dominance: With 58.7% of transactions, off-plan sales continue to attract investors, reflecting confidence in future developments and long-term returns.

- Ready Properties Hold Strong in Key Areas: While off-plan transactions led the market, ready properties in prime locations such as Burj Khalifa and Business Bay demonstrated robust activity, indicating sustained demand for immediate occupancy assets.

- Significant Weekly Decline: The overall transaction volume dropped from AED10.3 billion to AED8.58 billion, highlighting potential market fluctuations or investor hesitancy.

- Luxury and Prime Locations Drive Sales: Areas like Burj Khalifa, Business Bay, and Palm Jumeirah remained hotspots, reinforcing Dubai’s position as a high-value real estate hub.

Conclusion

Despite the decline in total transaction value compared to the previous week, Dubai’s real estate market remains resilient. The strong performance of off-plan sales signals continued investor interest in upcoming projects, while the ready property segment thrives in prime locations. Moving forward, monitoring investor sentiment and market conditions will be key to assessing future trends in transaction volumes and property values.

Recent Items

Brand Power and Billion-Dollar Views: Inside Dubai’s Soari

Brand Power and Billion-Dollar Views: Inside Dubai’s Soaring Branded Residences Market Dubai’s... Read More

The Billionaire Migration Fueling the UAE Property Boom

The Billionaire Migration Fueling the UAE Property Boom Due to large inflows... Read More

Dubai Real Estate Surges in Q1 2025: AED142.7 Billion in Sal

Dubai Real Estate Surges in Q1 2025: AED142.7 Billion in Sales Signals Unstoppable Growth ... Read More

Everything You Need to Know About Arabian Ranches

Everything You Need to Know About Arabian Ranches Discover everything about Arabian Ranches 1, 2... Read More

Real Estate Weekend Round-Up

Real Estate Weekend Round-Up Dubai’s real estate market grew significantly in Q1 2025. 7 out... Read More

Dubai Real Estate Transactions as Reported on the 13th of February 2025

Transaction Value Exceeds AED 1.76 Billion, With Strong Off-Plan Market Activity

The Dubai real estate market continues to demonstrate resilience and investor confidence, with total property transactions reaching AED 1.76 billion on 13 February 2024. This surge in activity underscores the city’s growing appeal for both off-plan and ready property investments.

Off-Plan Market Performance

The off-plan segment contributed AED 1.03 billion, accounting for 58.7% of the total transactions, reflecting a strong preference for new developments and future-ready investments. Within this category:

- Flats emerged as the dominant segment, with transactions worth AED 734.7 million, representing 71.1% of the off-plan market.

- Villas followed with AED 271 million, making up 26.2% of off-plan sales, showcasing sustained demand for luxury and family-oriented living spaces.

- Hotel Apartments & Rooms recorded a modest AED 5.6 million (0.5%), suggesting niche but steady investment interest in hospitality real estate.

- Commercial properties contributed AED 22.2 million, representing 2.1% of off-plan sales, indicating a selective approach to commercial investments in upcoming developments.

Ready Property Transactions

The ready property segment reached AED 727 million, constituting 41.3% of the total transactions, reflecting sustained investor interest in completed, move-in-ready properties. The breakdown of this category is as follows:

- Flats led the segment with AED 472.7 million, accounting for 65.0% of total ready property transactions, reinforcing the strong demand for urban residential units.

- Villas secured AED 162.3 million in transactions, contributing 22.3%, confirming steady interest in premium housing.

- Hotel Apartments & Rooms recorded AED 25.1 million (3.5%), indicating investor confidence in Dubai’s thriving hospitality market.

- Commercial properties saw transactions worth AED 67.0 million, making up 9.2% of the ready property segment, highlighting ongoing business expansion and demand for commercial spaces.

Market Insights and Trends

- The off-plan market continues to dominate, signaling investor confidence in Dubai’s long-term growth and the appeal of new developments.

- Flats led both the off-plan and ready property segments, emphasizing strong demand for residential units, particularly in prime locations.

- The higher share of ready commercial transactions (9.2%) compared to off-plan (2.1%) suggests an immediate need for operational spaces in Dubai’s thriving business landscape.

- The hotel and hospitality sector saw limited activity, but consistent investment suggests long-term interest in tourism-driven assets.

Conclusion

Dubai’s real estate market remains a magnet for investors, with off-plan properties leading the way and ready units maintaining solid traction. With the total transaction volume exceeding AED 1.76 billion, the city’s real estate sector continues to thrive, bolstered by strategic developments and increasing investor confidence.

As Dubai continues to evolve as a global investment hub, the balance between off-plan and ready properties indicates a diverse market catering to both speculative and immediate demand.

Dubai Real Estate Market Review 14-Feb-2025

Dubai launches digital real estate analytics platform. Ras Al Khaimah’s real estate market surged 118% in 2024. Transaction Value Exceeds AED 1.76 Billion, With Strong Off-Plan Market Activity.

Union Properties achieves exceptional financial results in fiscal year 2024

Union Properties reported a strong 2024, with a 59% rise in operating profit to AED 161.8M and total income of AED 395M. It repaid AED 723M in debt, improved liquidity, and plans AED 6B in new projects. The company aligns with Dubai’s real estate strategy for sustainable growth.

OMNIYAT launches ultra-luxury division with Luna Sky Palace debut

OMNIYAT launched OMNIYAT Bespoke, an ultra-luxury division creating one-of-a-kind residences for UHNWIs. It debuted with Luna Sky Palace at ORLA, a 58,476 sq. ft. home with a rooftop sky garden and infinity pool. The division plans more exclusive projects, including Sky Palaces and a bespoke mansion.

Dubai-listed Emaar Properties’ sales hit record high of $19bln in 2024

Emaar Properties reported record-high property sales of AED 70B in 2024, a 72% YoY increase. Revenue rose 33% to AED 35.5B, with a net profit of AED 13.51B. The company acquired 141M sq. ft. of prime land and proposed its highest-ever AED 8.8B dividend.

MAK Developers’ Island Tower Breaks Ground in Dubai – The Future of Luxury Living Begin

MAK Developers broke ground on I’sola Bella in JVC, Dubai’s first tower with a private island. Inspired by Italy’s Isola Bella, it offers 45 luxury amenities, including an infinity sky pool and sand beach. Nearly sold out, the project redefines upscale living and investment potential in Dubai’s real estate market.

Dubai launches digital real estate analytics platform with detailed building information on rent, apartment sizes, investments and more

Dubai Municipality launches Building Intelligence Platform with data to support investors, planners and property stakeholders.

RAK’s real estate market witnesses remarkable growth amid luxury appeal

Ras Al Khaimah’s real estate market surged 118% in 2024, reaching AED 15.08B in transactions. Driven by luxury yet affordable developments, infrastructure projects, and the upcoming Wynn Resort, RAK is attracting global investors. Strong rental yields, limited supply, and high ROI position it as a prime investment destination in the UAE.

Sobha One: First In The Middle East With Green Mark Platinum SLE

Sobha Realty’s Sobha One became the first building outside Singapore to earn the Green Mark Platinum Super Low Energy (SLE) certification from BCA. It also received the Whole Life Carbon badge, highlighting its eco-conscious design. The project aligns with the UAE’s Net Zero 2050 vision, emphasizing sustainability and energy efficiency.

Recent Items

Brand Power and Billion-Dollar Views: Inside Dubai’s Soari

Brand Power and Billion-Dollar Views: Inside Dubai’s Soaring Branded Residences Market Dubai’s... Read More

The Billionaire Migration Fueling the UAE Property Boom

The Billionaire Migration Fueling the UAE Property Boom Due to large inflows... Read More

Dubai Real Estate Surges in Q1 2025: AED142.7 Billion in Sal

Dubai Real Estate Surges in Q1 2025: AED142.7 Billion in Sales Signals Unstoppable Growth ... Read More

Everything You Need to Know About Arabian Ranches

Everything You Need to Know About Arabian Ranches Discover everything about Arabian Ranches 1, 2... Read More

Real Estate Weekend Round-Up

Real Estate Weekend Round-Up Dubai’s real estate market grew significantly in Q1 2025. 7 out... Read More

Dubai Real Estate Transactions as Reported on the 12th of February 2025

The Dubai real estate market recorded a total transaction volume of AED 1.57 billion on February 12, 2024. The market activity was driven by both off-plan and ready property transactions, reflecting continued investor confidence in Dubai’s property sector.

- Off-plan transactions accounted for 57.9% of the total, reaching AED 910.09 million.

- Ready property transactions contributed 42.1%, amounting to AED 662.05 million.

Breakdown of Off-Plan Transactions

The off-plan segment dominated the day’s transactions, showcasing strong demand for new developments. The distribution of transactions within the category was as follows:

- Flats: AED 742.23 million (81.6% of off-plan transactions)

- Villas: AED 128.11 million (14.1% of off-plan transactions)

- Hotel Apartments & Rooms: AED 28.42 million (3.1% of off-plan transactions)

- Commercial Properties: AED 11.34 million (1.2% of off-plan transactions)

The significant share of flats highlights the continued preference for apartments in upcoming developments, particularly in high-demand locations. Villas also attracted notable investment, reflecting a parallel trend of interest in larger residential spaces.

Breakdown of Ready Property Transactions

The ready property market recorded transactions totaling AED 662.05 million, indicating continued interest in immediate property acquisitions. The category breakdown was:

- Flats: AED 461.57 million (69.7% of ready transactions)

- Villas: AED 148.21 million (22.4% of ready transactions)

- Hotel Apartments & Rooms: AED 4.15 million (0.6% of ready transactions)

- Commercial Properties: AED 48.13 million (7.3% of ready transactions)

The high demand for ready flats suggests strong interest in move-in-ready residential units, likely driven by end-user buyers and investors looking for rental income. Villas continue to be a substantial segment, reflecting sustained demand for spacious family homes. The commercial sector, while smaller in comparison, still attracted investment, particularly in office and retail spaces.

Market Insights and Trends

- Off-Plan Dominance: The higher transaction value in off-plan properties (57.9%) suggests that investors and buyers are keen on future gains and flexible payment plans, leveraging Dubai’s expanding real estate landscape.

- Apartment Demand: Across both off-plan and ready markets, flats represented the largest share of transactions (76.6% of the total market), reinforcing their popularity among investors and end-users.

- Sustained Villa Interest: With a combined transaction value of AED 276.32 million, villas remain a key segment, attracting buyers seeking luxury and family-oriented living.

- Commercial Investment Activity: The commercial sector contributed AED 59.47 million in total transactions, highlighting ongoing interest in business-related real estate assets.

Conclusion

Dubai’s real estate market continues to demonstrate resilience and robust demand, with off-plan properties leading transaction volumes. The preference for apartments, both in under-construction and ready-to-move-in categories, indicates investor confidence in Dubai’s long-term urban development. As the market evolves, trends in property preferences and investment behaviors will remain critical to watch for future growth opportunities.

Dubai Real Estate Market Review 13-Feb-2025

UAE in top 10 countries with most AI companies. DIFC has launched a PropTech API allowing third parties to access real estate data. UAE’s next real estate frontier: AI-driven ‘longevity communities’.

OMNIYAT Bespoke: Where Ultra-Luxury Meets Personalized Elegance

OMNIYAT is redefining Dubai’s ultra-luxury real estate with its Bespoke concept, offering UHNWIs fully customizable living spaces. The latest, Luna Sky Palace at ORLA, spans 58,476 sq. ft. and features a sky garden, infinity pool, and private amenities. This initiative cements Dubai’s position as a hub for exclusive, tailor-made luxury homes.

DIFC introduces new PropTech solution, boosting Dubai’s appeal as a leading property investment destination

DIFC has launched a PropTech API allowing third parties to access real estate data, enhancing market transparency and supporting Dubai’s Real Estate Strategy 2033. Keyper is the first user, offering real-time property insights on values, transactions, and rental yields, reinforcing Dubai’s status as a global, tech-driven investment hub.

UAE’s next real estate frontier: AI-driven ‘longevity communities’

Dubai’s real estate is evolving beyond luxury to longevity-focused communities, integrating AI, biotech, and wellness to enhance lifespan and well-being. These health-centric developments feature smart homes, green spaces, and AI-driven urban planning. Demand is rising among health-conscious buyers and investors, marking a shift toward wellness-driven urban living.

How will real estate perform in the UAE, Saudi Arabia and Kuwait in 2025?

Real estate markets in the UAE, Saudi Arabia and Kuwait are expected to thrive in 2025, according to Kuwait Financial Centre “Markaz”.

Comparing Off-Plan Projects in Dubai’s Key Districts: A UK Investor’s Guide

Dubai’s off-plan property market is booming, attracting UK investors with capital growth, flexible payment plans, and customization. Key areas include Downtown, Marina, Business Bay, Dubailand, and DAMAC Hills 2, offering luxury and affordable options. Investors should assess risks, government protections, and fees before buying in this dynamic market.

Dubai’s new architectural benchmark – world’s largest 3D printed lounge interior

London-based DA BUREAU has unveiled Dubai’s MYATA Platinum Lounge, featuring the world’s largest 3D-printed restaurant interior with 27 canyon-like structures made from recycled plastic. The project aligns with Dubai’s sustainability goals and highlights the city’s growing adoption of 3D printing in construction, real estate, and interior design.

Cheval Maison – Expo City Dubai set to open in March

Cheval Maison – Expo City Dubai opens in March 2025, featuring 151 luxury serviced apartments in the refurbished Leadership Pavilion from Expo 2020 and COP28. Located near Al Wasl Plaza, it offers high-end amenities, dining, a rooftop pool, and meeting spaces, marking Cheval Collection’s Middle East expansion into UAE and Saudi Arabia.

UAE in top 10 countries with most AI companies; how Golden Visas and investment will unlock $91bn GDP boost

UAE is fast-becoming a global hub for AI as Golden Visa incentives and investment attract top talent.

Recent Items

Brand Power and Billion-Dollar Views: Inside Dubai’s Soari

Brand Power and Billion-Dollar Views: Inside Dubai’s Soaring Branded Residences Market Dubai’s... Read More

The Billionaire Migration Fueling the UAE Property Boom

The Billionaire Migration Fueling the UAE Property Boom Due to large inflows... Read More

Dubai Real Estate Surges in Q1 2025: AED142.7 Billion in Sal

Dubai Real Estate Surges in Q1 2025: AED142.7 Billion in Sales Signals Unstoppable Growth ... Read More

Everything You Need to Know About Arabian Ranches

Everything You Need to Know About Arabian Ranches Discover everything about Arabian Ranches 1, 2... Read More

Real Estate Weekend Round-Up

Real Estate Weekend Round-Up Dubai’s real estate market grew significantly in Q1 2025. 7 out... Read More