Category: News

Dubai Real Estate Transactions as Reported on the 19th of February 2025

The Dubai real estate market recorded a total transaction value of AED 1,782,629,915 on 19 February 2024, reflecting continued investor confidence in both off-plan and ready properties. The transactions were dominated by off-plan deals, which accounted for 60.9% of the total market share, while ready properties contributed 39.1%.

Off-Plan Transactions

Off-plan properties led the market, with a total transaction value of AED 1,085,410,906, highlighting strong investor interest in future developments. This segment was primarily driven by the sale of flats, which accounted for 75.9% of off-plan sales, amounting to AED 824,845,389.

- Flats: AED 824,845,389 (75.9%)

- Villas: AED 256,443,830 (23.6%)

- Hotel Apartments & Rooms: AED 1,870,196 (0.2%)

- Commercial Properties: AED 2,251,491 (0.2%)

The significant dominance of flats within the off-plan sector suggests a continued preference for high-density, residential developments, likely in prime and upcoming locations.

Ready Property Transactions

The ready property market reported transactions worth AED 697,219,009, making up 39.1% of the day’s total sales. Within this segment, flats also emerged as the most traded asset, contributing 61.2% of total ready property transactions.

- Flats: AED 426,408,318 (61.2%)

- Villas: AED 144,134,211 (20.7%)

- Hotel Apartments & Rooms: AED 39,969,434 (5.7%)

- Commercial Properties: AED 86,707,047 (12.4%)

The strong presence of commercial properties in the ready segment, at 12.4%, indicates sustained demand for business and retail spaces, likely fueled by Dubai’s expanding economy and business-friendly environment.

Key Insights

- Off-plan properties dominated the market, with nearly 61% of all transactions, reinforcing investor confidence in Dubai’s long-term real estate growth.

- Flats accounted for the highest transaction volumes in both off-plan and ready categories, making up 75.9% of off-plan and 61.2% of ready sales.

- Villas retained a significant market share, especially in the off-plan segment, where they contributed 23.6% of sales, reflecting the growing preference for spacious living options.

- Commercial properties saw notable activity in the ready market, comprising 12.4% of ready transactions, signaling robust interest in established commercial spaces.

Market Outlook

With strong activity in both off-plan and ready property sectors, Dubai’s real estate market continues to show resilience and attract diverse investor profiles. The dominance of off-plan flats suggests that buyers remain optimistic about future developments, while the steady performance of ready properties highlights sustained demand for immediate occupancy options.

As Dubai continues to evolve as a global real estate hub, the balance between off-plan and ready transactions will be a key indicator of market sentiment and investment trends in the coming months. Investors and homebuyers should closely monitor these movements to make informed decisions in this dynamic market.

Dubai Real Estate Market Review 20-Feb-2025

Property insurance rates in the UAE increased by 10-15%. Dubai real estate leads global rankings as prices continue surge in 2025. Dubai is positioned to become the Silicon Valley of PropTech.

Dubai real estate leads global rankings as prices continue surge in 2025, outpacing London, Paris, Madrid: Report

The forecast follows Dubai’s performance in 2024, which saw prime residential capital values rise by 6.8 percent and rental values surge by 23.5 percent.

Dubai’s PropTech boom can help it become the ‘Silicon Valley of real estate innovation’

Dubai’s booming real estate market is fostering a PropTech hub, attracting global expertise and investment. The Dubai Land Department aims to position the emirate as the “Silicon Valley” of real estate innovation, leveraging AI, blockchain, and PropTech. In 2023, property deals hit Dh761 billion, growing 20% annually.

Aldar launches new luxury Dubai project featuring wildlife and bee-keeping zones

Aldar Properties has launched The Wilds in Dubai, a nature-focused residential community with 1,700 homes, wildlife habitats, and premium amenities. Prices start at Dh5.1M, with delivery expected in 2029. The launch follows Aldar’s record Dh33.6B in 2023 sales, driven by strong UAE property demand.

Investing In Dubai’s Luxury Real Estate? Key Tips For UHNWIs From Experts

Dubai is a prime destination for ultra-high-net-worth individuals (UHNWIs) investing in luxury real estate, driven by tax benefits, strong demand, and premium locations. Key strategies include investing in prime areas, targeting luxury rentals, buying off-plan properties, prioritizing eco-friendly homes, leveraging tax incentives, diversifying income streams, and working with local experts.

Insights: Why luxury real estate in UAE draws global investors

The UAE’s luxury property market is expanding, driven by FDI, foreign buyers, and economic reforms. Dubai’s property prices are set to grow 9.9% in 2025, with high rental yields (7-8%). Institutional investors and build-to-rent portfolios are fueling demand, while new mortgage rules attract quality buyers. The market remains globally competitive.

AMWAJ Development and OCTA Properties announce a collaboration for a new luxury Meydan project

AMWAJ Development and OCTA Properties are partnering on Dubai’s first low-rise, lagoon-facing development in Meydan’s District 11. The five-floor project will feature luxury apartments, exclusive amenities, and a swimmable lagoon. Meydan’s rising demand and prime location boost investment appeal. OCTA plans 14 new branded projects worth Dh9B by June 2025.

How to use the rental index in Abu Dhabi, Dubai, and Sharjah for transparent rental prices

The rental indices in Abu Dhabi, Dubai, and Sharjah help tenants check fair rental prices and potential rent increases. In Abu Dhabi, the ADREC Rental Index (adrec.gov.ae) provides live rental data for different areas. Dubai’s DLD Smart Rent Index (dubailand.gov.ae) uses AI to assess rental values. Sharjah’s SCM Rental Map (shjmun.gov.ae) allows tenants to compare rental rates and find suitable properties. These tools ensure transparency and assist renters in making informed decisions.

IMAN Developers unveils 15 Cascade Featured By Versace Ceramics, valued at AED 700mln

IMAN Developers has launched 15 Cascade, a AED 700M luxury development in Motor City, Dubai, in collaboration with Versace Ceramics. Featuring 442 units, including penthouses and duplexes with private pools, the project blends speed-inspired architecture with nature. Offering 70+ amenities, it is set for completion in Q3 2028.

UAE property insurance rates rise 10-15%

Property insurance rates in the UAE increased by 10-15% due to flooding losses, with some premiums rising up to 30% after April 2024’s heavy rains. Meanwhile, Saudi Arabia’s property insurance rates fell by 10%. Dewa highlighted the power and water sectors’ vulnerability to climate change.

Recent Items

Brand Power and Billion-Dollar Views: Inside Dubai’s Soari

Brand Power and Billion-Dollar Views: Inside Dubai’s Soaring Branded Residences Market Dubai’s... Read More

The Billionaire Migration Fueling the UAE Property Boom

The Billionaire Migration Fueling the UAE Property Boom Due to large inflows... Read More

Dubai Real Estate Surges in Q1 2025: AED142.7 Billion in Sal

Dubai Real Estate Surges in Q1 2025: AED142.7 Billion in Sales Signals Unstoppable Growth ... Read More

Everything You Need to Know About Arabian Ranches

Everything You Need to Know About Arabian Ranches Discover everything about Arabian Ranches 1, 2... Read More

Real Estate Weekend Round-Up

Real Estate Weekend Round-Up Dubai’s real estate market grew significantly in Q1 2025. 7 out... Read More

Dubai Real Estate Transactions as Reported on the 18th of February 2025

Dubai’s real estate sector continues to demonstrate strong momentum, with total property transactions reaching AED 1.36 billion on 18 February 2024. The market was driven primarily by off-plan sales, which outpaced ready property transactions, highlighting sustained investor confidence in future developments.

Market Breakdown: Off-Plan vs. Ready Transactions

- Off-Plan Properties: AED 813.4 million (59.6% of total transactions)

- Ready Properties: AED 551.3 million (40.4% of total transactions)

The dominance of off-plan transactions (nearly 60%) underscores investor preference for new developments, driven by attractive payment plans, capital appreciation potential, and Dubai’s expanding infrastructure. Meanwhile, ready property transactions (40.4%) indicate strong end-user demand, particularly in established communities.

Off-Plan Transactions: Category Contribution

Total Off-Plan Transactions: AED 813.4 million

- Flats: AED 495.1 million (60.9% of off-plan transactions)

- Villas: AED 296.4 million (36.4% of off-plan transactions)

- Hotel Apartments & Rooms: AED 11.7 million (1.4% of off-plan transactions)

- Commercial: AED 10.3 million (1.3% of off-plan transactions)

Flats remained the most traded off-plan asset, capturing nearly 61% of total off-plan transactions, followed by villas at 36.4%. The relatively lower share of hotel apartments and commercial units suggests a primary focus on residential investments.

Ready Transactions: Category Contribution

Total Ready Transactions: AED 551.3 million

- Flats: AED 348.6 million (63.2% of ready transactions)

- Villas: AED 114.8 million (20.8% of ready transactions)

- Hotel Apartments & Rooms: AED 4.5 million (0.8% of ready transactions)

- Commercial: AED 83.4 million (15.1% of ready transactions)

Flats also dominated ready property sales, accounting for 63.2% of transactions. Villas (20.8%) and commercial units (15.1%) followed, reflecting continued interest in high-end residential properties and commercial investments.

Market Insights & Outlook

- Off-Plan Dominance: Nearly 60% of total transactions were off-plan, showing strong investor trust in Dubai’s property market.

- Flats Lead in Both Segments: Flats accounted for over 60% of both off-plan and ready sales, reinforcing demand for residential properties.

- Commercial Growth in Ready Market: The 15.1% share of commercial property in ready transactions highlights growing business activity in Dubai.

With sustained demand across both off-plan and ready properties, Dubai’s real estate market remains a lucrative space for investors and homebuyers, supported by high rental yields, long-term capital appreciation, and a resilient economic outlook.

Dubai Real Estate Market Review 19-Feb-2025

Dubai’s industrial and logistics sector saw a 225% surge in demand in 2024. Burj Azizi, the world’s second-tallest tower units starting at Dh7.5M and reaching Dh156M. DIFC workforce swells to 46,000.

Dubai real estate: What are the top five changes driving the property market in 2025?

Managing affordability, quality, accessibility and investor demand is a delicate balancing act, but these five measures are a positive move for the rapidly growing real estate market.

Dubai’s emerging off-plan hotspots lure buyers in droves

Dubai’s real estate market is thriving, with off-plan sales driving record transactions of Dh151 billion in 2024. Affordable areas like JVC and Dubai South attract investors with high rental yields and flexible payment plans. Luxury hotspots continue to rise, while off-plan incentives fuel demand into 2025.

Property Finder reveals a surge in demand for holistic community living

Dubai’s real estate market is seeing a surge in demand for community-centric living, driven by the UAE’s 2025 Year of Community initiative. Buyers prioritize integrated developments with amenities, social engagement, and family-friendly environments. Popular areas like JVC, Dubai Hills Estate, and Marina offer connectivity, lifestyle convenience, and a strong sense of belonging.

Demand for industrial & logistics space in Dubai increased by 225% in 2024

Dubai’s industrial and logistics sector saw a 225% surge in demand in 2024, driven by economic growth, trade expansion, and infrastructure projects like Etihad Rail. Tight supply pushed rents up by 33%, with further increases expected in 2025. The UAE’s logistics sector aims to hit $54B by 2030.

Dubai’s Burj Azizi: Prices revealed as sales launch announced for world’s second-tallest tower

Azizi Developments unveiled pricing for Burj Azizi, the world’s second-tallest tower, with units starting at Dh7.5M and reaching Dh156M. The 725m skyscraper on Sheikh Zayed Road will feature luxury residences, a 7-star hotel, and record-breaking amenities, set for completion in 2028. Sales begin February 19, 2025.

Dubai set to lead world’s prime residential market in 2025: Savills

Dubai is set to lead global prime residential price growth in 2025, with values expected to rise by up to 9.9%, the highest among 30 cities in Savills’ index. Rental prices are also projected to grow over 10%, driven by strong demand from high-net-worth individuals and limited supply in prime areas.

Dubai jobs: DIFC workforce swells to 46,000 as centre attracts 1,800 new companies in 2024

Dubai International Financial Centre (DIFC) saw record growth in 2024, with new company registrations rising 25% to 1,823, bringing the total to 6,920. Operating profit surged 55% to Dh1.33B. DIFC plans major expansions, including new commercial spaces and real estate projects, aligning with Dubai’s economic growth strategy.

International Property Show opens nominations for IPS Awards 2025

The International Property Show (IPS) Awards 2025 is now accepting nominations, recognizing excellence in real estate. Set for April 14-16, 2025, at Dubai World Trade Centre, the awards promote innovation, sustainability, and industry collaboration. Developers and stakeholders can apply now to showcase groundbreaking projects.

Dubai Industrial City attracts over $95.3mln F&B investments in 2024

Dubai Industrial City attracted AED 350M in F&B investments in 2024, securing 1.7M sq.ft. in leases from over 25 companies. Major projects include SLG Group’s dairy hub and Pure Ice Cream’s factory, set for 2026. The district, home to 1,100 manufacturers, continues advancing sustainability and industrial growth.

Recent Items

Brand Power and Billion-Dollar Views: Inside Dubai’s Soari

Brand Power and Billion-Dollar Views: Inside Dubai’s Soaring Branded Residences Market Dubai’s... Read More

The Billionaire Migration Fueling the UAE Property Boom

The Billionaire Migration Fueling the UAE Property Boom Due to large inflows... Read More

Dubai Real Estate Surges in Q1 2025: AED142.7 Billion in Sal

Dubai Real Estate Surges in Q1 2025: AED142.7 Billion in Sales Signals Unstoppable Growth ... Read More

Everything You Need to Know About Arabian Ranches

Everything You Need to Know About Arabian Ranches Discover everything about Arabian Ranches 1, 2... Read More

Real Estate Weekend Round-Up

Real Estate Weekend Round-Up Dubai’s real estate market grew significantly in Q1 2025. 7 out... Read More

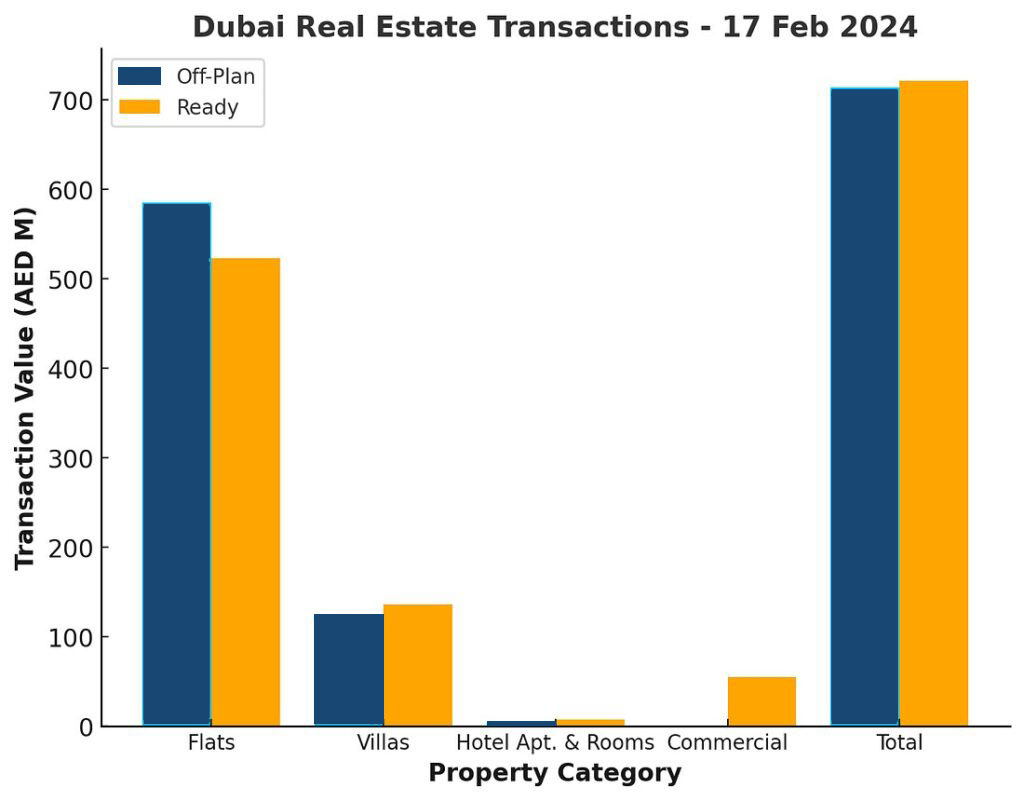

Dubai Real Estate Transactions as Reported on the 17th of February 2025

Dubai’s real estate market recorded a total transaction volume of AED 1.43 billion on February 17, 2024, reflecting sustained investor interest across both off-plan and ready properties. The market remains balanced, with off-plan sales contributing AED 713.96 million (49.7%) and ready properties accounting for AED 721.27 million (50.3%) of the total transaction value.

Off-Plan Transactions: A Strong Investor Focus

Off-plan properties continued to be a major driver of investment activity, contributing 49.7% of the day’s total transactions. Within this segment:

- Flats dominated the category, accounting for AED 585.40 million (82%) of off-plan sales. This suggests a continued preference for apartments in new developments, likely driven by attractive payment plans and competitive pricing.

- Villas made up AED 124.04 million (17.4%), indicating demand for larger residential spaces among buyers looking for long-term investments.

- Hotel Apartments & Rooms recorded a modest AED 4.52 million (0.6%), highlighting niche investor interest in hospitality assets.

Ready Property Transactions: Stability and Demand for Completed Units

Ready properties accounted for 50.3% of total sales, slightly surpassing off-plan deals, signaling strong interest in move-in-ready assets. Breaking down this category:

- Flats led the segment, with AED 522.79 million (72.5%) of the ready transactions. The strong performance reflects high demand for completed apartments, particularly in prime and well-established communities.

- Villas contributed AED 136.34 million (18.9%), demonstrating continued buyer interest in spacious homes.

- Hotel Apartments & Rooms saw AED 7.18 million (1%), suggesting moderate activity in the short-term rental and hospitality sector.

- Commercial properties recorded AED 54.96 million (7.6%), indicating a healthy demand for office and retail spaces in Dubai’s dynamic business environment.

Market Insights & Outlook

Dubai’s real estate market continues to showcase resilience, with a balanced performance between off-plan and ready properties. The sustained demand for flats across both segments indicates a strong investor and end-user appetite for well-located, high-quality residential units.

Additionally, the higher share of villa transactions in both categories suggests an ongoing preference for larger living spaces, in line with global post-pandemic lifestyle trends. The relatively low contribution from hospitality and commercial properties could reflect selective investment behavior in these sectors.

Looking ahead, the market is expected to maintain its momentum, driven by a mix of off-plan launches and stable demand for ready properties. Investor confidence remains high, supported by Dubai’s business-friendly environment and robust infrastructure development.

Dubai Real Estate Market Review 18-Feb-2025

Sales of AED 15M+ homes hit AED 71B in 2024, a 688% rise since 2015. Dubai commercial real estate boom, Prime office spaces set for 12% value rise. Why Dubai’s real estate market is thriving?

EXCLUSIVE: Dubai’s highest office space draws global fund interest at $12.2 million

The world’s highest office space, located in Dubai’s Burj Khalifa, is attracting interest from Gulf family offices and investment funds from the US and Europe as it hits the market for $12.2 million amid a record year for the emirate’s commercial property sector.

Dubai’s ultra-luxury real estate booming amid limited supply

Dubai’s ultra-luxury real estate market will continue growing in 2025, driven by high demand and limited supply. Sales of AED 15M+ homes hit AED 71B in 2024, a 688% rise since 2015. With only 16,500 luxury units under construction, scarcity will sustain price growth, especially as HNWIs keep arriving.

Dubai developers score red-hot profits from global homebuyers

Dubai’s property market continues to boom, with developers reporting record profits. Emaar Development’s earnings doubled to AED 7.6B in 2024, while Binghatti and Aldar saw major gains. Driven by expats, wealthy investors, and liberal visa policies, home prices are expected to keep rising in 2025, albeit at a slower pace.

Dubai South launches ‘Beachfront Gates’

Dubai South Properties has launched Beachfront Gates, a new apartment project in Dubai South’s Residential District. Featuring two towers, only Tower 2 is currently for sale, offering 157 units. With strong investor demand, family-friendly amenities, and proximity to Al Maktoum Airport, the project saw over 100 units sold on launch day.

Dubai commercial real estate boom: Prime office spaces set for 12% value appreciation in 2025

Dubai International Financial Centre and Business Bay areas expected to see up to a 20% rise in rentals this year upon renewals in Grade A and B buildings.

Dubai landlords required to give 90 days notice for rent increases under new index

Dubai landlords must provide 90 days’ notice for rent increases under the new Smart Rental Index. The index, updated in real time, determines eligibility based on market value. Rent hikes range from 5% to 20%, depending on price gaps. Authorities expect it to reduce disputes and stabilize rental inflation in 2025.

Why Dubai’s real estate market is thriving – Bayut’s Fibha Ahmed explains

Dubai’s property market saw historic growth in 2024. In an exclusive interview, Bayut’s Vice President of Property Sales, Fibha Ahmed explains what’s fuelling demand and where investors are looking next.

Dubai’s Burj Azizi: Sales launch announced for world’s second-tallest tower

Dubai’s Burj Azizi, the world’s second-tallest tower at 725m, will be sold in seven cities on February 19. Set for completion in 2028, it features residences, a 7-star hotel, retail, and entertainment. The tower will house record-breaking amenities, reinforcing Dubai’s dominance in the global skyscraper market.

ENBD REIT announces Q3 NAV as at 31 December 2024

ENBD REIT’s NAV rose to $216M in Q3 2024, up 6.9% QoQ and 13.1% YoY, driven by strong leasing and cost management. FFO surged 51% YoY to $8.4M, supporting dividends. Portfolio value increased 3.9% QoQ to $394M, with record 95% occupancy. Burj Daman led with a 27% valuation rise.

Buyback option, no service charges: Dubai developers woo buyers with attractive deals

Dubai developers are offering incentives like guaranteed returns, zero service charges, and full buyback options to attract buyers amid rising competition. Dugasta Properties promises 10% annual returns for ten years. With new developers entering the market, unique selling points are key. Despite market maturity, demand remains strong due to Dubai’s investor-friendly policies.

Recent Items

Brand Power and Billion-Dollar Views: Inside Dubai’s Soari

Brand Power and Billion-Dollar Views: Inside Dubai’s Soaring Branded Residences Market Dubai’s... Read More

The Billionaire Migration Fueling the UAE Property Boom

The Billionaire Migration Fueling the UAE Property Boom Due to large inflows... Read More

Dubai Real Estate Surges in Q1 2025: AED142.7 Billion in Sal

Dubai Real Estate Surges in Q1 2025: AED142.7 Billion in Sales Signals Unstoppable Growth ... Read More

Everything You Need to Know About Arabian Ranches

Everything You Need to Know About Arabian Ranches Discover everything about Arabian Ranches 1, 2... Read More

Real Estate Weekend Round-Up

Real Estate Weekend Round-Up Dubai’s real estate market grew significantly in Q1 2025. 7 out... Read More