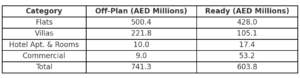

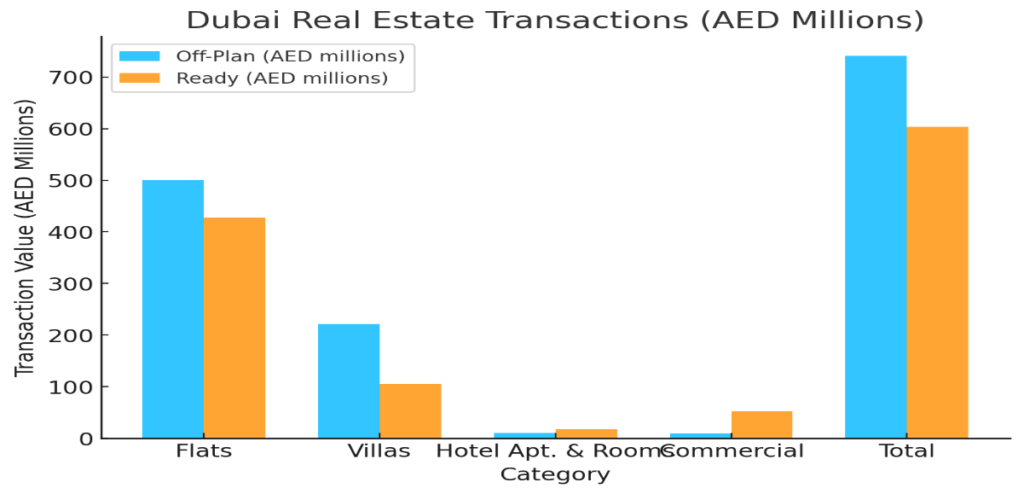

Dubai Real Estate Transactions as Reported on the 28th of January 2025

Dubai’s real estate market continues to demonstrate strong activity, with total transactions on 28 January 2024 amounting to AED 1,345,188,056. This reflects ongoing investor confidence and sustained demand across both the off-plan and ready property segments.

|

Segment Breakdown

The market was driven by both off-plan and ready property transactions, with off-plan sales contributing 55.1% (AED 741,342,158) and ready properties accounting for 44.9% (AED 603,845,898) of the total transaction value. This indicates a strong investor appetite for under-construction developments while maintaining steady interest in completed properties.

|

Off-Plan Transactions

Total: AED 741,342,158 (55.1% of total transactions)

- Flats: AED 500,433,601 (67.5% of off-plan transactions)

- Villas: AED 221,835,824 (29.9% of off-plan transactions)

- Hotel Apartments & Rooms: AED 10,030,465 (1.4% of off-plan transactions)

- Commercial Properties: AED 9,042,268 (1.2% of off-plan transactions)

The off-plan market is largely driven by flats, which made up 67.5% of the segment, signaling high investor and end-user interest in new residential units. Villas followed with a 29.9% share, reinforcing the demand for luxury and family-friendly housing. Hotel apartments & rooms, along with commercial properties, had minimal shares, suggesting that investors are currently focused on residential developments.

Ready Property Transactions

Total: AED 603,845,898 (44.9% of total transactions)

- Flats: AED 428,047,555 (70.9% of ready transactions)

- Villas: AED 105,142,575 (17.4% of ready transactions)

- Hotel Apartments & Rooms: AED 17,415,902 (2.9% of ready transactions)

- Commercial Properties: AED 53,239,866 (8.8% of ready transactions)

The ready property market continues to be dominated by flats, which represented 70.9% of total ready sales. Villas accounted for 17.4%, demonstrating solid demand in this segment. Commercial properties had a significant presence, contributing 8.8% to the total, indicating ongoing interest from businesses and investors in operational assets.

Key Insights & Market Trends

- Strong Off-Plan Activity – The off-plan segment accounted for more than half of total transactions (55.1%), reflecting confidence in Dubai’s future growth and the appeal of developer payment plans.

- Dominance of Flats – Across both categories, flats represented the highest volume of transactions, making up 67.5% of off-plan and 70.9% of ready sales, highlighting their attractiveness to both investors and end-users.

- Resilient Ready Market – Ready properties contributed nearly 45% of total sales, showing sustained demand for immediate occupancy and established communities.

- Continued Demand for Villas – Villas held a significant 29.9% share in off-plan and 17.4% in ready transactions, reinforcing the premium market’s growth, especially among families and long-term investors.

- Commercial Property Stability – While not the largest category, commercial properties maintained a notable 8.8% share in ready transactions, reflecting business expansion and investment opportunities.

Conclusion

Dubai’s real estate sector remains robust, with a well-balanced distribution between off-plan and ready properties. The preference for flats highlights the city’s appeal to both investors and residents, while villas continue to show resilience in both segments. With continued government support, infrastructure development, and increasing investor confidence, Dubai’s real estate market is well-positioned for sustained growth in the coming months.

Dubai Real Estate Market Review 29-Jan-2025

Dubai rent hikes to slow down in 2025. Over 72,000 new units are expected to be delivered in 2025. Ajman’s real estate transactions rose 21% in 2024, reaching AED20.5 billion.

Dubai Land Department Recognises Over 120 Leading Entities For Excellence In The Real Estate Sector

Dubai Land Department hosted the 2024 Stakeholders Forum, honoring 120+ partners for their role in Dubai’s real estate growth. The event emphasized collaboration, supporting the 2033 strategy, and sustaining Dubai as a top investment hub. Director General Marwan Bin Ghalita highlighted partnerships as key to the sector’s continued success.

Dubai residential real estate volume up 47% last year with one zone accounting for over half of transactions

Dubai real estate saw massive increase last year on back of a surge in off-plan property sales.

Dubai rent hikes to slow down in 2025 as property market set for record supply

Dubai’s real estate market is set to stabilize in 2025 as rental price increases slow due to a surge in supply and a smart rental index. Over 72,000 new units are expected, balancing demand. Key areas like JVC and MBR City lead completions, reinforcing Dubai’s status as a global property hub.

Dubai real estate market set for major growth as population nears 4m and major investments pave way for positive future

Dubai’s population at the end of 2024 reached 3,826,130, reflecting an 8 per cent growth compared to the fourth quarter of 2023.

Dubai’s Union Properties gets boost after Dh1b plus in plot sales

Union Properties raised over Dh1.3 billion from plot sales since launching its 5-year turnaround strategy in April 2023, strengthening its cash position. CEO Amer Khansaheb highlighted improved financial performance and debt reduction. The company’s Motor City project marks its return to off-plan launches, signaling continued growth and liquidity enhancement.

Ajman real estate deals rise 21% to $5.6bn in 2024

Ajman’s real estate transactions rose 21% in 2024, reaching AED20.5 billion ($5.6 billion) across 15,125 deals, driven by increased investment and incentives. The highest sale was AED300 million in Al Jurf 1. Hay Al Helio 2 led in trades. Dubai also saw a 20% surge, hitting AED761 billion ($207 billion).

Prestige One Developments To Unveil 11 New Real Estate Projects In 2025

Prestige One Developments plans to double its portfolio in 2025, launching 11 new projects across Dubai and expanding into the GCC and West Africa. It will also complete Vista (Dubai Sports City) and The Residence (JVC). The developer, following a record year in 2024, remains confident in Dubai’s premium property demand.

Dubai’s growth continues, but affordability concerns rise

Dubai’s rapid growth has led to record real estate transactions and population surges, but it also brings challenges like worsening traffic congestion and rising housing costs. Analysts warn of affordability concerns as the city aims to expand to 5.8 million residents by 2040, driven by its booming economy and real estate sector.

Recent Items

Dubai Real Estate Transactions as Reported on the 29th of Ja

Dubai Real Estate Transactions as Reported on the 29th of January 2025 The Dubai real... Read More

Dubai Real Estate Transactions as Reported on the 27th of Ja

Dubai Real Estate Transactions as Reported on the 27th of January 2025 The Dubai real... Read More

Dubai Real Estate Weekly Market Analysis 27-Jan-2025

Dubai Real Estate Weekly Market Analysis 27-Jan-2025 The total real estate transactions in Dubai for... Read More

Dubai Real Estate Transactions as Reported on the 23rd of Ja

Dubai Real Estate Transactions as Reported on the 23rd of January 2025 The Dubai real... Read More

Dubai Real Estate Transactions as Reported on the 22nd of Ja

Dubai Real Estate Transactions as Reported on the 22nd of January 2025 On 22nd January... Read More