Dubai Real Estate Transactions as Reported on the 27th of January 2025

The Dubai real estate market recorded a total transaction value of AED 1,732,646,995 on January 27, 2024, underscoring its robust activity across both off-plan and ready property segments. Here’s a detailed breakdown and analysis:

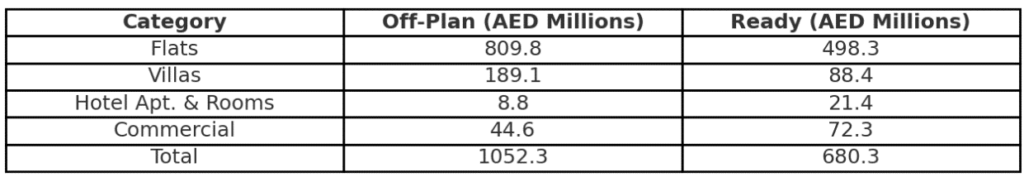

|

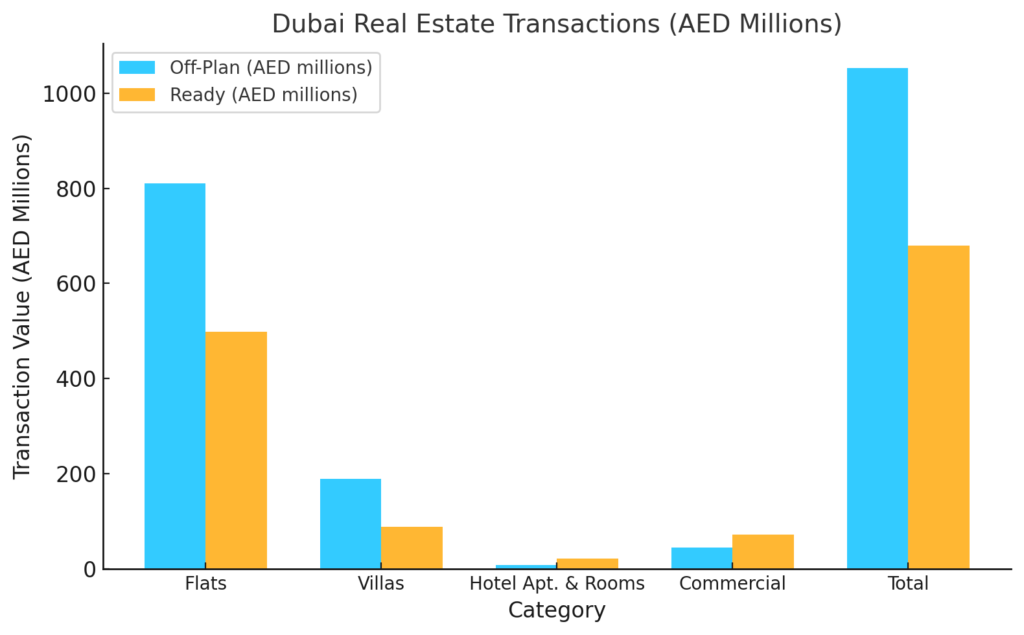

Contribution by Category

- Off-Plan Properties: AED 1,052,341,804Off-plan properties accounted for 60.7% of the total transactions, reflecting strong investor confidence in Dubai’s future developments and ongoing urban expansion.

- Ready Properties: AED 680,305,190Ready properties contributed 39.3% of the total, appealing to end-users and investors seeking immediate occupancy or income-generating assets.

|

Off-Plan Transactions Breakdown

Off-plan properties emerged as the dominant category, with flats leading the way:

- Flats: AED 809,836,211 (77.0% of off-plan transactions)

Representing the lion’s share, off-plan flats continue to attract buyers due to affordability and flexible payment plans. - Villas: AED 189,058,332 (18.0%)

Villas offer exclusivity and cater to high-net-worth individuals (HNWIs) and families seeking luxurious living spaces. - Commercial: AED 44,619,623 (4.2%)

A modest but significant contribution, driven by business expansions in the thriving commercial sector. - Hotel Apartments & Rooms: AED 8,827,638 (0.8%)

A niche segment, reflecting limited but growing demand for hospitality investments.

Ready Transactions Breakdown

Ready properties displayed strong performance across subcategories, driven by immediate usability:

- Flats: AED 498,276,352 (73.2% of ready transactions)

Flats dominate this segment, aligning with end-user preferences for move-in-ready homes. - Villas: AED 88,417,391 (13.0%)

Villas retain appeal among premium buyers and investors focused on long-term gains. - Commercial: AED 72,250,360 (10.6%)

Demonstrates healthy interest in ready-to-use business spaces amid Dubai’s economic growth. - Hotel Apartments & Rooms: AED 21,361,088 (3.1%)

Highlighting a growing trend in tourism-driven investments.

Key Insights

- Market Dynamics: Off-plan properties’ dominance reflects sustained confidence in Dubai’s ambitious real estate projects and urban development.

- Investor Preferences: Flats remain the most traded asset in both categories, showcasing their universal appeal to a wide range of buyers.

- Strategic Growth: Villas and commercial properties exhibit steady demand, driven by luxury living trends and a thriving business environment.

- Tourism Influence: Hotel apartments’ modest share suggests a niche but growing segment, benefiting from Dubai’s status as a global tourist hub.

Conclusion

Dubai’s real estate market continues to thrive, offering a diverse range of opportunities for investors and end-users. The off-plan sector’s commanding share reflects confidence in future growth, while ready properties meet the immediate needs of buyers. With its dynamic landscape and forward-looking developments, Dubai remains a top destination for real estate investment globally.

Dubai Real Estate Market Review 28-Jan-2025

Ready properties cost just got 6% more expensive, a big push for off-plan properties. Dubai’s population grew 8% in 2024, reaching 3.8M. Dubai’s real estate attracted 110,000 new investors in 2024.

Dubai Real Estate Market Report 2024: Population growth and investment opportunities

Dubai’s population grew 8% in 2024, reaching 3.8M, driven by its appeal as a global hub. Vision 2033 and 2040 plans aim to double trade, foster startups, expand green spaces, and boost public transport access. Strategic infrastructure and real estate initiatives solidify Dubai’s position as a top global destination.

DHG Properties Launches $81M Project in Dubai

DHG Properties launched its second $81.5M residential project in Meydan, Dubai, featuring 110 premium homes. Backed by Swiss craftsmanship and aligned with Dubai’s Urban Master Plan 2040, this project reinforces DHG’s expansion in a booming real estate market that saw record $142.1B in 2024 transactions.

Dubai’s real estate sector attracts 110,000 new investors in 2024

Dubai’s real estate sector attracted 110,000 new investors in 2024, achieving AED761B in transactions (+36% volume, +20% value). Supported by the D33 Agenda and Real Estate Strategy 2033, the sector emphasizes innovation, transparency, and sustainability, solidifying Dubai as a global investment hub and driving GDP growth.

How global property markets stack up against Dubai

Dubai’s real estate market offers tax-free investments, high rental yields (6-8%), and strong price growth (+20.7% in Q1 2024). Its strategic location, investor-friendly policies, and liquidity outshine markets like New York, London, and Singapore. Backed by the Dubai 2040 Urban Master Plan, it remains a global hub for sustainable, high-demand investments.

UAE: Property buyers to pay higher upfront as banks stop financing DLD, brokerage fees

Starting February 1, 2025, UAE banks will no longer finance Dubai Land Department (4%) and brokerage (2%) fees for property buyers taking mortgages. This change will increase upfront costs, making off-plan properties with flexible payment plans more attractive. Experts predict initial market adjustments but expect long-term stability and growth.

These new UAE policies are making it easier to enter the property market

The UAE introduced initiatives to boost its property market, including Dubai’s smart rental index, freehold conversion for Sheikh Zayed Road and Al Jaddaf properties, and a Central Bank directive stopping financing for DLD and broker fees. These measures aim to enhance transparency, attract investors, and ensure sustainable market growth.

Dollar-dirham peg brings its own attraction to Dubai property investments

Cross-border real estate investments are rising, with Dubai attracting 60% FDI into its property market in 2023. High returns, currency stability, and luxury offerings draw global investors, especially from India, China, and Europe. Developers are focusing on sustainability, tech-driven solutions, and exclusive projects to meet the evolving demands of international buyers.

Dubai’s luxury realty gets off to good start

Dubai’s luxury real estate sector thrives in 2025 with Condor Developers launching the Dh300M Condor Golf Links 18 in Dubai Sports City. Offering 250 premium units with diverse amenities, the project aligns with Dubai’s Real Estate Strategy 2033. Condor plans further expansion, targeting Dh2.5B investments by 2027.

Dubai: Meraas awards $272.2mln contract for Bluewaters Bay

Meraas awarded a AED1 billion ($272.2M) contract to China State Construction for Bluewaters Bay, featuring two waterfront towers with 678 apartments, retail, and F&B outlets. Located near JBR and Ain Dubai, the project offers luxury amenities and is set for completion by Q4 2027, enhancing Dubai’s waterfront appeal.

Recent Items

Dubai Real Estate Transactions as Reported on the 29th of Ja

Dubai Real Estate Transactions as Reported on the 29th of January 2025 The Dubai real... Read More

Dubai Real Estate Transactions as Reported on the 28th of Ja

Dubai Real Estate Transactions as Reported on the 28th of January 2025 Dubai’s real estate... Read More

Dubai Real Estate Weekly Market Analysis 27-Jan-2025

Dubai Real Estate Weekly Market Analysis 27-Jan-2025 The total real estate transactions in Dubai for... Read More

Dubai Real Estate Transactions as Reported on the 23rd of Ja

Dubai Real Estate Transactions as Reported on the 23rd of January 2025 The Dubai real... Read More

Dubai Real Estate Transactions as Reported on the 22nd of Ja

Dubai Real Estate Transactions as Reported on the 22nd of January 2025 On 22nd January... Read More