Dubai rentals are tilting toward tenants as new supply surges and absorption softens. Property transactions surge nearly fourfold as market hits record highs.

Dubai tenants get 1 month’s free rent, better deals as landlords adjust to rising supply

Dubai rentals are tilting toward tenants as new supply surges and absorption softens. Landlords offer incentives, multiple cheques, free month, waived fees, utilities, amid 93,000 units launched YTD. Price growth is cooling; rents edge up (apartments +1% m/m, villas +2%) as upgraded units command premiums and relocations persist.

Read the full article on Khaleej Times

Dubai tenants get 1 month’s free rent, better deals as landlords adjust to rising supply

Dubai rentals are tilting toward tenants as new supply surges and absorption softens. Landlords offer incentives, multiple cheques, free month, waived fees, utilities, amid 93,000 units launched YTD. Price growth is cooling; rents edge up (apartments +1% m/m, villas +2%) as upgraded units command premiums and relocations persist.

Read the full article on Khaleej Times

Dubai real estate: Villas outperform apartments with 27.1 percent annual growth in August

Dubai’s VPI hit 227.3 in Aug-2025 (+1.4% m/m, +22.1% y/y). Villas led (+1.8% m/m, +27.1% y/y), apartments +1.1%/+17%. Off-plan made 77.8% of sales; Binghatti, Damac, Emaar led. 19 deals >AED30m (six >AED50m). Growth moderating but momentum intact; prices seen +10% by end-2025.

Read the full article on Economy Middle East

Dubai real estate: Property transactions surge nearly fourfold as market hits record highs

Dubai ‘s residential property market has achieved record transaction volumes in the first half of 2025, with 99,146 deals completed compared to just 26,891 in H1 2021, according to the latest Driven Properties market report.

Read the full article on Arabian Business

Dubai real estate: Shift from renting to buying emerges as property transactions hit $11.55 billion

Dubai’s market is pivoting to ownership: secondary sales up 22% YTD as families buy larger homes. August logged 17,879 deals (AED42.4bn); off-plan 75%. Prices hit AED1,664/sq ft (+16.3% YoY). Yields average 6.76% (flats 7.12%). Leasing slips, while 3.9% mortgages sustain dual off-plan and resale momentum into Q4.

Read the full article on Economy Middle East

Dubai’s Landmark First-Time Buyer Initiative Set to Spark Youth-Driven Growth in Real Estate Sector

Dubai Land Department launched a first-homebuyer program with preferential pricing, flexible mortgages and phased DLD fees for properties under AED 5m. Framed as a catalyst for youth ownership and long-term growth, it aligns with D33/Real Estate Strategy 2033 and mirrors global best-practice incentives.

Read the full article on Business News This Week

Arada Masaar 3 first two phases sell out hours after launch in Sharjah

Arada has sold all 1,051 homes in the first two phases of Masaar 3 within hours of their release at 9am on Sunday morning.

Read the full article on Arabian Business

Inside Jumeirah Bay Island: Dubai’s most expensive neighbourhood

Jumeirah Bay Island, “Billionaire’s Island”, is Dubai’s priciest address at AED 13,068/sq ft. Ultra-private and bridge-linked, with the Bvlgari resort, marina, and turnkey waterfront villas, it attracts HNW buyers. Limited supply, Downtown/DIFC proximity, and elite amenities keep demand, and prices, surging.

Read the full article on What’s On

Inside Jumeirah Bay Island: Dubai’s most expensive neighbourhood

Jumeirah Bay Island, “Billionaire’s Island”, is Dubai’s priciest address at AED 13,068/sq ft. Ultra-private and bridge-linked, with the Bvlgari resort, marina, and turnkey waterfront villas, it attracts HNW buyers. Limited supply, Downtown/DIFC proximity, and elite amenities keep demand, and prices, surging.

Read the full article on What’s On

Dubai builder Alec Holdings to sell 20% in listing

Alec Holdings will sell 20 percent of its shares on the Dubai Financial Market, with subscriptions starting next week, the Dubai contractor has announced. The Investment Corporation of Dubai (ICD), the principal investment arm of the Dubai government and the sole shareholder of Alec, will offer 1 billion shares.

Read the full article on Arabian Gulf Business Insight

Sharjah property market surges 75.8% with $1.33bn transactions in August 2025

Sharjah’s real estate sector continued its strong momentum in August 2025, recording property transactions worth AED4.9bn ($1.33bn), a 75.8% increase compared to August 2024, according to the latest Real Estate Transactions Report issued by the Sharjah Real Estate Registration Department.

Read the full article on Arabian Business

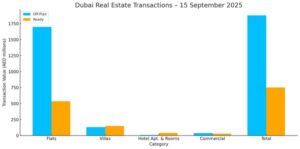

Dubai Real Estate Transactions as Reported on the 15th of September 2025

On the 15th of September 2025, the total transacted value reached AED 2,628,085,674. Off-plan dominated with AED 1,877,769,912 (71.5%), while Ready accounted for AED 750,315,762 (28.5%).

| Category | Off-Plan (AED millions) | Ready (AED millions) |

| Flats | 1,698.3 | 534.6 |

| Villas | 131.6 | 147.9 |

| Hotel Apts & Rooms | 9.1 | 40.5 |

| Commercial | 38.7 | 27.3 |

| Total | 1,877.8 | 750.3 |

Off-Plan Market Performance

Total Value: AED 1,877,769,912

- Flats: AED 1,698,319,290 (90.4%)

- Villas: AED 131,648,268 (7.0%)

- Hotel Apts & Rooms: AED 9,107,607 (0.5%)

- Commercial: AED 38,694,747 (2.1%)

Off-plan activity was overwhelmingly flat-led, with apartments comprising over nine-tenths of value; villas provided a modest secondary lift.

Ready Market Performance

Total Value: AED 750,315,762

- Flats: AED 534,585,137 (71.2%)

- Villas: AED 147,913,792 (19.7%)

- Hotel Apts & Rooms: AED 40,468,000 (5.4%)

- Commercial: AED 27,348,833 (3.6%)

Ready transactions were anchored by flats, while villas contributed one-fifth, indicating sustained end-user demand for larger homes.

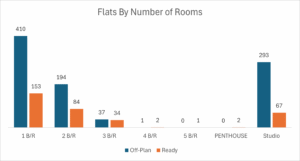

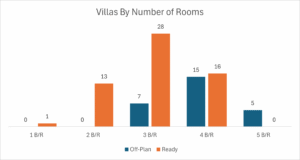

On The Micro Level

Market Insights & Outlook

A firmly off-plan–driven day (71.5% share) underscores developer momentum, while a healthy ready segment, with villas at nearly 20%, signals stable owner-occupier interest. Barring external shocks, the breadth across segments points to continued liquidity and depth into late Q3–Q4 2025.

Data Source: Dubai Land Department