Sobha Realty issues $750m green sukuk. UAE GDP grows 3.9 percent to $123.9 billion in Q1 2025

GFS Developments Launches New Office in Frankfurt and Showcases Dubai Real Estate Opportunities in Dubai

GFS Developments opened a Frankfurt office on Aug 30, 2025, to connect European investors with Dubai. The launch showcased Coventry Living and record H1 2025 metrics. AED 431bn transactions (+25%), 1.3m investors, 61% off-plan share, 7–10% apartment yields, underpinned by population growth and strong 2025 outlook.

Read the full article on Globe Newswire

Major Developments to Watch in Dubai’s Property Market 2025

Dubai targets 6m residents by 2040, spurring mega projects, Creek Harbour, Dubai Islands, Palm Jebel Ali, Dubai South, MBR City and Emaar Beachfront. These integrated districts expand housing, infrastructure and coastline; brisk sales, mid-to-luxury pricing, policy safeguards, airport growth and waterfront scarcity underpin strong investor demand.

Read the full article on Business News This Week

Sobha Realty issues $750m green sukuk, largest by real estate developer

Sobha Realty issued a $750m five-year Green Sukuk, the largest by a developer globally, dual-listed on LSE and Nasdaq Dubai. Order book hit $2.1b (2.8x); priced at 7.125% profit rate (7.375% yield). Proceeds follow its Green Financing Framework; expected Ba2/BB ratings; 56% allocated to regional investors.

Read the full article on Gulf News

New developer AVIAAN enters UAE real estate market with AED 1.7bln project pipeline

AVIAAN, founded by veteran broker Gaurav Aidasani, debuts in Dubai with a customer-centric approach and an AED 1.7bn project pipeline. First launches, a branded residence in Meydan and a Dubailand villa community. Leveraging Union Square House credibility, it targets strong investor returns via design-led, transparent developments.

Read the full article on Zawya

Abu Dhabi Real Estate Market 2025: Top Areas to Watch

Abu Dhabi’s property market is maturing via culture, tourism and infrastructure. Five hotspots, Saadiyat, Yas, Al Reem, Al Maryah and Masdar, offer distinct drivers and yields (~5–8%). From museums and ADGM to theme parks and green design, each targets specific buyers; watch 2025 handovers, Saadiyat museum openings, Reem retail, Yas events.

Read the full article on BBN Times

Ora Developers launches new residential projects in UAE, Iraq

Ora Developers unveiled two mega-projects. Bayn in Ghantoot, UAE, a 4.8m sqm coastal community with 7 km waterfront, 55% open space and major amenities, and Madinat Al Ward in Baghdad, a 62m sqm city delivering 120,000 homes over 24 years. Combined first-phase investment exceeds $16bn.

Read the full article on Trade Arabia

MAIR Group and Al Jazira Club Partner on New Commercial Project

MAIR Group PJSC and Al Jazira Sports Club signed an MoU to develop an 80,000 sqm site beside MBZ Stadium via Makani Real Estate, creating an integrated commercial, entertainment, and health-focused center to enhance community engagement and support Abu Dhabi’s urban and economic growth.

Read the full article on Emirates 24/7

Abu Dhabi housing prices surge amid supply crunch, demand for ready homes

Abu Dhabi’s 2025 market is dominated by ready homes, transaction value more than Dh67bn, villa/townhouse sales up 72% YoY, prices and rents rising. Off-plan volumes plunged amid limited launches; only 2,400 units delivered H1. With strong demand and policy support, outlook is bullish—but supply shortfalls risk affordability.

Read the full article on Khaleej Times

Taraf and Masdar City form strategic joint venture to deliver new sustainable residential community

Taraf and Masdar City formed a JV to build a 1.4m sqm sustainable community in Masdar City, featuring 1,000+ 2–6BR villas and townhouses, freehold ownership, clubs and parks, shaded walkways and cycling routes linked to Al Masar Park, advancing Abu Dhabi’s design-led, low-carbon living vision.

Read the full article on Zawya

UAE GDP grows 3.9 percent to $123.9 billion in Q1 2025 with non-oil sector at record 77.3 percent

UAE Q1 2025 GDP grew 3.9% to AED 455bn, with non-oil up 5.3% to AED 352bn (77.3% of GDP), underscoring diversification. Manufacturing led growth (+7.7%), then finance/insurance and construction (+7.0), real estate (+6.6), trade (+3.0). Biggest non-oil contributors: trade 15.6%, finance 14.6%, manufacturing 13.4%, construction 12%, real estate 7.4%.

Read the full article on Economy Middle East

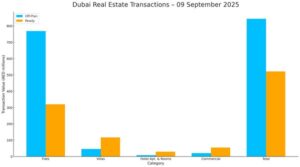

Dubai Real Estate Transactions as Reported on the 9th of September 2025

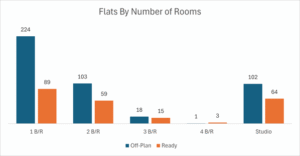

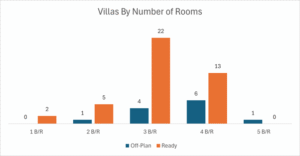

On the 9th of September, the total transacted value reached AED 1,364,975,135. Off-plan dominated with AED 843,918,652 (61.8%), while Ready accounted for AED 521,056,483 (38.2%).

| Category | Off-Plan (AED millions) | Ready (AED millions) |

| Flats | 768.5 | 319.8 |

| Villas | 46.1 | 116.9 |

| Hotel Apt. & Rooms | 8.3 | 29.6 |

| Commercial | 21.0 | 54.7 |

| Total | 843.9 | 521.1 |

Off-Plan Market Performance

Total Value: AED 843,918,652

- Flats: AED 768,496,197 (91.1%)

- Villas: AED 46,111,367 (5.5%)

- Hotel Apts & Rooms: AED 8,327,652 (1.0%)

- Commercial: AED 20,983,436 (2.5%)

Off-plan activity was overwhelmingly led by flats, with modest contributions from villas and limited hospitality/commercial trades.

Ready Market Performance

Total Value: AED 521,056,483

- Flats: AED 319,841,497 (61.4%)

- Villas: AED 116,882,792 (22.4%)

- Hotel Apts & Rooms: AED 29,628,410 (5.7%)

- Commercial: AED 54,703,784 (10.5%)

Ready transactions were anchored by apartments, with villas providing a sizable secondary share and a notable commercial slice.

Market Insights & Outlook

Off-plan’s lead was driven by apartment-heavy launches, while the ready market shows balanced end-user and investor demand, especially in apartments and villas. Expect steady momentum with apartments setting the pace; watch commercial readiness and villa appetite as key swing factors.

Data Source: Dubai Land Department