Month: November 2024

Real estate investing in the UAE, often perceived as a venture for the wealthy, can be accessible to a wider range of investors through the strategic use of leverage. By understanding and effectively utilizing leverage, individuals can significantly amplify their returns while minimizing initial capital outlay.

Understanding Leverage: A Powerful Tool for Real Estate Investors

Leverage, in essence, is the employment of borrowed funds to magnify the potential return of an investment. In the realm of real estate, this typically involves utilizing a mortgage to acquire a property. By leveraging other people’s money, investors can gain control of assets that would otherwise be unattainable with their own capital.

How Leverage Amplifies Returns

1. Enhanced Purchasing Power: A mortgage empowers investors to acquire properties that might be beyond their immediate financial reach.

2. Potential for Significant Returns: As property values appreciate, the equity in the investment grows. Given that the initial investment is only a fraction of the property’s value, the potential return on investment (ROI) can be substantial.

3. Tax Advantages: In certain circumstances, mortgage interest payments and property taxes may be tax-deductible, further bolstering returns.

Strategies to Minimize Initial Investment

1. House Hacking:

– Residing in a portion of the property (e.g., a multi-unit building or a home with a separate rental unit).

– Renting out the remaining space to generate income that can cover mortgage payments and other expenses.

– This strategy allows investors to build equity while reducing housing costs.

2. BRRR (Buy, Renovate, Rent, Refinance):

– Acquiring a property below market value.

– Renovating it to enhance its value.

– Renting out the property to generate income.

– Refinancing the property to extract some of the equity, which can be used for a down payment on a new property or to invest in other ventures.

3. Partnerships:

– Collaborating with other investors to pool resources and reduce the initial investment required for a property.

– This can be achieved through joint ventures, limited partnerships, or real estate investment groups.

Practical Tips for Finding the Right Property and Securing Financing

1. Thorough Market Research: Analyzing local market trends, rental demand, and property values.

2. Due Diligence: Conducting a comprehensive property inspection to identify potential issues.

3. Cultivating a Strong Relationship with a Lender: A strong relationship with a lender can facilitate securing favorable loan terms.

4. Considering Government-Backed Programs: Exploring government-backed programs that offer low-down-payment options and other benefits for first-time homebuyers.

By leveraging these strategies and staying informed about the UAE real estate market, investors can position themselves for long-term financial success. It is crucial to remember that while leverage can amplify returns, it also amplifies risk. Therefore, conducting thorough research and consulting with financial advisors is essential for making informed investment decisions.

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More

On November 21, 2024, the Dubai real estate market recorded an impressive

total transaction value of AED 1.49 billion, reflecting a dynamic mix of both

off-plan and ready properties. This insightful breakdown offers a closer look at

the composition of these transactions, shedding light on the performance of

different property types.

Total Transactions Summary

Total Transaction Value: AED 1,491,958,554

Off-Plan Properties: AED 720,791,119 (48.3% of total)

Ready Properties: AED 771,167,434 (51.7% of total)

The ready property segment contributed slightly more to the overall market

activity, accounting for 51.7% of the total transaction value, while off-plan

properties made up 48.3%. This near-equal distribution highlights sustained

investor interest across both segments.

Off-Plan Property Transactions

Total Value: AED 720,791,119

Contribution to Total Transactions: 48.3%

Sub-Category Breakdown:

Flats: AED 393,322,980 (54.6% of off-plan total)

Villas: AED 141,851,339 (19.7%)

Hotel Apartments & Rooms: AED 6,340,619 (0.9%)

Commercial Properties: AED 179,276,181 (24.9%)

Off-plan flats dominated the segment, contributing 54.6% to the total value of

off-plan transactions, followed by commercial properties at 24.9%. The

substantial interest in flats reflects a preference for smaller residential units,

potentially driven by affordability and demand from first-time investors. Villas

and hotel apartments played a smaller but notable role.

Ready Property Transactions

Total Value: AED 771,167,434

Contribution to Total Transactions: 51.7%

Sub-Category Breakdown:

Flats: AED 549,340,698 (71.2% of ready total)

Villas: AED 140,061,405 (18.2%)

Hotel Apartments & Rooms: AED 8,577,160 (1.1%)

Commercial Properties: AED 73,188,172 (9.5%)

Within the ready property segment, flats were also the most prominent,

comprising 71.2% of the total value. Villas contributed 18.2%, while

commercial properties and hotel apartments together represented a smaller

share. The dominance of ready flats indicates ongoing demand for

established, hassle-free residential units that can be immediately occupied or

rented out.

Key Insights

The ready properties segment showed slightly higher traction

compared to off-plan properties, which might be indicative of a

preference for immediate possession amid market conditions.

Flats remained the most favored asset class across both off-plan and

ready transactions, collectively representing the majority of the day's

total property deals.

Commercial property transactions showed a significant share in

both segments, underscoring investor interest in commercial assets as

the economy continues to grow.

This balanced activity between off-plan and ready properties is a testament to

the resilience and attractiveness of Dubai's real estate market, which

continues to offer diverse investment opportunities for both investors and

end-users.

Dubai Real Estate Market Review 22-Nov-2024

Dubai's residential real estate sales exceeded Dh50 billion for the first time. New

mortgage fee, 60-day registration period for off-plan. Sharjah's residential rents have

surged by up to 50%.

Dubai real estate: $48m ‘sunken balcony’ project sold out in one day

Reef Luxury Developments innovative ‘sunken balcony’ project sold out on first day

on sale.

Dubai real estate sales tops Dh50 billion for the first time

Dubai's residential real estate sales exceeded Dh50 billion for the first time, driven by

an 80% surge in transactions, mainly from off-plan properties. Despite rising prices,

Dubai remains attractive with a 6.9% rental yield. Top exclusive areas include Palm

Jumeirah, Dubai Marina, and Downtown Dubai.

Dubai Real Estate Boom: Top Locations Driving 50,000 Property Transactions

In Q3 2024

Dubai's real estate market reached a record AED 141.9 billion in Q3 2024, a 14.4%

increase from the previous quarter. Sales volumes rose 37.9% year-over-year, led by

apartments and villas. Jumeirah Village Circle topped sales locations. Strong

demand persists, driven by relaxed ownership laws and investor-friendly conditions.

Dubai: New mortgage fee, 60-day registration period for off-plan property in

amended laws

DIFC amended its Application Law and Real Property Law, introducing a 0.25%

mortgage registration fee and extending off-plan sales registration from 30 to 60

days. New Article 8A clarifies that DIFC Law references DIFC statute, common law,

and international model laws, reinforcing DIFC's connection to common law

principles.

Sharjah rents rise as former Dubai residents add to surging demand

Sharjah's residential rents have surged by up to 50%, driven by rising demand,

economic growth, and inflow of residents from Dubai and other countries. Tenants

face steep increases, with calls for a rental cap similar to Dubai’s, while landlords

cite market-driven pricing and pandemic recovery challenges.

Dubai's new 'islands' out to create another offplan property wave

Dubai's property market sees a rise in island-themed projects, with Damac launching

"Damac Islands" featuring townhouses from Dh2.25 million. Waterfront options are

expanding, including Dubai Islands by Nakheel and islands at Tilal Al Ghaf. The UAE

is experiencing a full-scale "island" renaissance, boosting investment opportunities.

Arada kicks off construction at Armani Beach Residences at Palm Jumeirah

Arada has begun work on Armani Beach Residences at Palm Jumeirah, featuring 52

bespoke homes designed by Armani/Casa and Tadao Ando. The luxury project

offers panoramic views, extensive amenities, and exclusive penthouses.

Construction enabling works are underway, with completion expected by March

2025.

Pearlshire Development celebrates full sale of 555 Park Views; announces new

flagship project in Dubai

Pearlshire Development's 555 Park Views in Jumeirah Village Triangle sold out

quickly, highlighting strong demand for premium residential spaces in Dubai. With

completion near, Pearlshire is now launching a new flagship project focused on

luxury, innovation, and sustainability, continuing its commitment to redefining quality

living in Dubai.

RAK Properties launches coliving, coworking project in Ras Al Khaimah

RAK Properties, in collaboration with ARM Holding and HIVE, launched a coliving

and coworking development in Mina Al Arab, Ras Al Khaimah. The 233-unit project

features 117 HIVE units, 116 residential units, 300 sqm of retail, and 2,000 sqm of

coworking space. Project cost details were not disclosed.

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More

The total real estate transactions in Dubai for Week 47reached AED 7.07

billion, down 5.7% . Off-plan contributed 56.8% or AED 4.02 billion and

Ready properties contributed 43.2% or AED 3.06 billion.

In Week 47, Dubai's real estate market recorded transactions totaling AED

7.07 billion, reflecting a slight decline from the previous week's total of AED

7.5 billion. This report provides a breakdown of the contributions from off-plan

and ready properties, as well as an analysis of the most active areas for both

categories.

Market Breakdown: Off-Plan vs. Ready Properties

The total transactions of AED 7.07 billion were comprised of both off-plan and

ready properties. Off-plan properties contributed AED 4.02 billion, which

represents 56.8% of the total value. Ready properties made up AED 3.06

billion, accounting for 43.2% of the total transactions. This composition shows

a stronger leaning towards off-plan properties in this week’s real estate

activity, which aligns with the continued demand for new developments in

Dubai.

Off-Plan Properties Breakdown

Off-plan properties saw a significant contribution from flats, totaling AED 2.98

billion, which accounts for 74.2% of all off-plan transactions. Villas added

AED 721.6 million, contributing 18% to the off-plan total, while hotel

apartments and rooms contributed AED 61 million (1.5%), and commercial

properties added AED 256.5 million (6.4%).

The most active areas for off-plan property transactions by value were:

Business Bay: AED 594.6 million (15% of off-plan transactions)

Marsa Dubai: AED 316.2 million (8%)

Bukadra: AED 244.8 million (6%)

Al Yufrah 1: AED 241.8 million (6%)

Jumeirah Village Circle: AED 194.9 million (5%)

These areas represent key growth spots in Dubai, showing high investor

interest in both residential and mixed-use developments.

Ready Properties Breakdown

Ready properties amounted to AED 3.06 billion, with flats contributing AED

2.18 billion (71.3%) and villas adding AED 548.8 million (17.9%). Hotel

apartments and rooms accounted for AED 135.7 million (4.4%), while

commercial properties contributed AED 194.5 million (6.4%).

The top-performing areas for ready property transactions by value were:

Burj Khalifa: AED 390 million (13% of ready transactions)

Business Bay: AED 290 million (9%)

Dubai Marina: AED 224 million (7%)

JVC: AED 184 million (6%)

Palm Jumeirah: AED 180 million (6%)

Dubai Hills led the ready property market, indicating strong demand for well-

established luxury residential communities.

Market Comparison with Previous Week

The total market transactions of AED 7.07 billion for Week 47 represent a

decrease of 5.7% compared to the previous week’s total of AED 7.5 billion.

The reduction in volume could be attributed to seasonal factors or shifting

buyer preferences, though the strong showing in off-plan properties suggests

sustained confidence in Dubai’s long-term development prospects.

Conclusion

Week 47's real estate transactions reflect a solid demand for off-plan

properties, which continue to dominate the market. Notably, Business Bay

and Burj Khalifa remain prominent hotspots for property investment. Despite

a slight dip in total transaction value compared to the previous week, the

market shows resilience, with a balanced interest in both new developments

and established communities.

As we move into the following weeks, monitoring the performance of both off-

plan and ready properties will be key to understanding the evolving trends in

Dubai’s dynamic real estate landscape.

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More

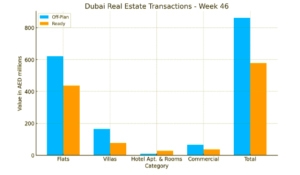

On November 20th, 2024, Dubai's real estate market witnessed transactions

totaling AED 1.44 billion. This impressive figure reflects a mix of both off-plan and

ready property sales, highlighting the diverse opportunities available in the market

for investors and end-users.

Off-Plan vs. Ready Transactions

The overall market volume of AED 1,438,890,073 was split between off-plan and

ready properties:

Off-Plan Properties contributed AED 861.31 million, accounting for 59.9%

of the total transactions. This shows strong investor confidence in the

future developments and prospects of Dubai's property market.

Ready Properties made up AED 577.58 million, representing 40.1% of the

total transactions, demonstrating sustained demand for immediately

available properties.

Off-Plan Property Breakdown

The off-plan segment, totaling AED 861,307,413, was distributed across various

sub-categories as follows:

Flats led the off-plan category with AED 621.90 million, making up 72.2%

of the off-plan transactions. This dominance underscores the continued

appeal of residential apartment developments in upcoming areas.

Villas followed, contributing AED 164.43 million, which represented 19.1%

of off-plan transactions, indicating interest in luxury family housing.

Commercial Units contributed AED 66.10 million, accounting for 7.7% of

off-plan sales, suggesting moderate interest in commercial investment

opportunities.

Hotel Apartments & Rooms had the smallest contribution, with AED 8.87

million, representing 1.0% of the off-plan market, showing a limited but

niche interest in hospitality investments.

Ready Property Breakdown

Ready property transactions amounted to AED 577,582,660 and were broken

down as follows:

Flats dominated the ready segment with AED 436.94 million, which made

up 75.7% of ready transactions. This indicates strong demand for ready-to-

move-in apartments, reflecting a preference for immediate occupancy or

rental income.

Villas contributed AED 77.30 million, or 13.4% of the ready market,

showing steady demand for completed family-oriented residences.

Commercial Units accounted for AED 35.87 million, representing 6.2% of

ready property sales, demonstrating interest in already established

commercial spaces.

Hotel Apartments & Rooms contributed AED 27.47 million, making up

4.8% of ready transactions, reflecting demand for turnkey hospitality

properties.

Key Insights

The data reveals several key trends in Dubai's real estate market on November

20th, 2024:

1. Flats Lead Both Segments: Flats were the most popular choice in both

off-plan and ready categories, highlighting the growing demand for

residential units, whether for personal use or as rental investments.

2. Off-Plan Market Strength: The higher percentage of off-plan transactions

(59.9%) indicates strong investor confidence in Dubai's future

developments, fueled by attractive payment plans and prospects of capital

appreciation.

3. Commercial and Hospitality: While commercial properties and hotel

apartments had smaller contributions compared to residential segments,

their presence in both off-plan and ready transactions reflects a balanced

interest across different asset classes.

Conclusion

Dubai's real estate market continues to demonstrate resilience and growth, with a

total transaction value of AED 1.44 billion on November 20th, 2024. The strong

performance of both off-plan and ready segments indicates a healthy balance of

investor interest in future projects and demand for immediately available

properties. As the city continues to develop and expand, these trends provide a

positive outlook for both investors and end-users seeking to capitalize on Dubai's

dynamic property market.

Dubai Real Estate Market Review 21-Nov-2024

Dubai's real estate market is set for 30% YoY growth by 2024's end. Real estate

sector sees 50% increase in handovers in Q3, 14,900 homes expected to arrive in

Q4.

Dubai realty sets new records with over 50,000 transactions

Dubai's real estate market set a record in Q3 2024 with Dhs141.9 billion sales, a

16.6% QoQ and 37.9% YoY rise, driven by strong demand and relaxed

regulations. Apartments led sales, and the market is projected to surpass Dhs500

billion annually for the first time.

Dubai real estate market on track for 30 percent sales growth by end of 2024

Dubai's real estate market is set for 30% YoY growth by 2024's end, with record-

breaking sales, prices, and new launches. October saw 20,460 deals, the highest

ever, and prices hit AED1,473 per sq ft. Market stability continues with increased

diversity in new projects and high mortgage activity.

Dubai’s Damac to build data centres across Europe and Asia: Report

Damac Properties plans to build data centers in Europe and Asia, owning land in

Greece, Spain, Turkey, Indonesia, and Malaysia. The company is constructing

over 10 centers, with each megawatt costing $10 million. Luxury property demand

in Dubai is rising, especially among wealthy Europeans.

Dubai real estate sector sees 50% increase in handovers in Q3, 14,900

homes expected to arrive in Q4

The Dubai real estate sector saw a surge in new handovers in Q3 2024,

particularly in the apartment segment, which witnessed nearly 50 per cent

increase in completions, according to Asteco’s Q3 2024 real estate report.

Dubai continues to solidify reputation as prime destination for luxury real

estate

Brazilian footballer Neymar Jr. purchased a Dh200 million penthouse in Dubai's

Bugatti Residences, boosting the city's luxury real estate appeal. The project,

targeting the ultra-wealthy, features 182 units with record prices, making it one of

Dubai's most exclusive and sought-after developments.

GJ Properties sets record sales of AED 550mln at Ajman Sales Event

GJ Properties Investments LLC achieved AED 550 million in sales at the Ajman

Sales Event, selling 837 units, including Al Ameera Village and Nuaimia Two

Tower. The developer also launched Biltmore Residences Sufouh in Dubai, a

luxury project set for completion in early 2026, offering premium living options.

Deyaar’s first residential project in Abu Dhabi is sold out

Located on Al Reem Island, Rivage offers 1-, 2- and 3-bedroom apartments, Sky

Villas and Sky Palaces with prices starting $320,000.

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More

Staff Reporter, Gulf Today

The real estate market in Dubai continues to grow at an exponential rate, driven by increasing demand as an investment destination, relaxing land ownership regulations, the increasing inflow of expats to the Emirate and convenient payment plans offered by developers.

The sustained demand for real estate in Dubai, especially from domestic and international investors, is demonstrated by this upsurge in activity which has been a consistent trend in the post-pandemic market. 50,423 sales transactions in the third quarter represented a 16.6% increase QoQ and a 37.9% YoY increase in volume of sales

Breaking records in standard Dubai style, sales of real estate in the third quarter of 2024 achieved an unmatched milestone, with a total value of almost Dhs141.9 billion ($38.7 billion).

This surpasses the previous record of Dhs 124.07 billion ($33.8 billion) set in the second quarter of this year, a 14.4% QoQ increase, making this the largest quarterly sales amount ever attained. This strong performance record is a 30.1% value increase YoY, with first-sale properties taking the helm.

The apartment segment continued to lead the way, with 77% of all transactions in Q3 recording an impressive 39,054 sales transactions valued at around Dhs 70.5 billion ($19.2 billion). This number is a staggering 43.9% increase in volume compared to the same quarter in the previous year. Villa sales took the second spot with a substantial contribution of 8,156 units, sold for over Dhs 39.2 billion ($10.7 billion), demonstrating an increase of 16.6% YoY and 18.4% over the Q2.

Sales of land plots surged, Dhs 29.9 billion ($8.1 billion) recorded from 2,102 transactions, indicating a 45.9% YoY increase in volume and a 42.3% increase from the previous quarter. A 12.1% rise in volume over Q3 2023 was recorded in the commercial real estate sector, which also did strongly, recording 1,112 sales valued at almost Dhs2.3 billion ($626 million).

Palm Jumeirah continues to hold its position in the luxury property market, with an apartment in the neighbourhood selling for an astounding Dhs 275 million ($75 million) in Q3, making it the most expensive single property sold.

Jumeirah Village Circle continued to top the list of the top five performing locations in Dubai in Q3 2024.

JVC: 4,467 transactions valued at roughly Dhs 5.33 billion ($1.45 billion). Dubai South: 2,910 transactions valued at Dhs 8.25 billion ($2.25 billion) 3.Wadi Al Safa 5 (Dhs 5.3 billion, $1.44 billion). Business Bay (Dhs 7.22 billion, $1.96 billion) 5.Dubai Hills Estate (Dhs 7.38 billion, $2.01 billion) Overall, the larger portion of transactions, 31%, were houses priced between Dhs 1-2 million ($272,000 and $544,000). Twenty-nine per cent of properties were below Dhs 1 million ($272,000), while 18% were between Dhs 2-3 million ($544,000 and $816,000). The trajectory for higher-valued properties continued, with 14% of all sales were for residences valued between Dhs 3-5 million ($816,000 and $1.36 million), and 8% were for properties priced beyond Dhs 5 million ($1.36 million).

In light of the staggering growth in Dubai’s real estate market, the 21st edition of IPS Congress, the leading international property sales event in the middle east, ramps up to bring together major stakeholders in this booming industry, from April 14 to 16, 2025. With an expected attendance of over 16,000 visitors and more than 150 exhibitors from over 45 countries, this event aims to strengthen Dubai’s global leadership in this industry by fostering collaboration with the private sector and international firms aligning with Dubai’s Real Estate Strategy 2033.

Key themes of IPS Congress 2025 will include IPS Real Estate: Highlighting the latest trends across the real estate sector; IPS Future Cities: Focusing on the development of sustainable urban environments; IPS Proptech Startups: Exploring technological innovations in the real estate space; IPS Design: Celebrating creativity in architectural aesthetics, and IPS Service: Elevating property management and hospitality standards.

Dubai’s buoyant real estate market is on course to surpass annual sales of more than Dhs500 billion for the first time following another record-breaking month.

Total sales in 2024 up to the end of October amount to Dhs435.6 billion from 150,651 transactions, eclipsing the previous high of Dhs409.8 billion from 132,628 property sales set last year.

Based on average monthly sales for the year to date of Dhs43.56 billion, the final value of sales in 2024 could soar past the Dhs500 billion milestone as Dubai real estate continues to attract waves of local and international investors.

A market update issued today by fäm Properties underlined the huge increase in Dubai real estate activity over the last five years, with a record Dhs 61.1 billion in sales from 20,461 transactions in October representing an 798% increase in value over the same month in 2020.

The total of 3,830 villa sales for AED20.5 billion last month was 102% up in volume on October 2023, while apartment sales worth AED28.1 billion rose 67.2% in volume to 15,662 compared with the same month last year.

The 424 commercial property transactions last month amounted to Dhs 916.2 million, a slight drop of 1.9% in volume compared to October 2023, although the average price per sq ft rose 7.1% to Dhs1,585.

Staff Reporter, Gulf Today

The real estate market in Dubai continues to grow at an exponential rate, driven by increasing demand as an investment destination, relaxing land ownership regulations, the increasing inflow of expats to the Emirate and convenient payment plans offered by developers.

The sustained demand for real estate in Dubai, especially from domestic and international investors, is demonstrated by this upsurge in activity which has been a consistent trend in the post-pandemic market. 50,423 sales transactions in the third quarter represented a 16.6% increase QoQ and a 37.9% YoY increase in volume of sales

Breaking records in standard Dubai style, sales of real estate in the third quarter of 2024 achieved an unmatched milestone, with a total value of almost Dhs141.9 billion ($38.7 billion).

This surpasses the previous record of Dhs 124.07 billion ($33.8 billion) set in the second quarter of this year, a 14.4% QoQ increase, making this the largest quarterly sales amount ever attained. This strong performance record is a 30.1% value increase YoY, with first-sale properties taking the helm.

The apartment segment continued to lead the way, with 77% of all transactions in Q3 recording an impressive 39,054 sales transactions valued at around Dhs 70.5 billion ($19.2 billion). This number is a staggering 43.9% increase in volume compared to the same quarter in the previous year. Villa sales took the second spot with a substantial contribution of 8,156 units, sold for over Dhs 39.2 billion ($10.7 billion), demonstrating an increase of 16.6% YoY and 18.4% over the Q2.

Sales of land plots surged, Dhs 29.9 billion ($8.1 billion) recorded from 2,102 transactions, indicating a 45.9% YoY increase in volume and a 42.3% increase from the previous quarter. A 12.1% rise in volume over Q3 2023 was recorded in the commercial real estate sector, which also did strongly, recording 1,112 sales valued at almost Dhs2.3 billion ($626 million).

Palm Jumeirah continues to hold its position in the luxury property market, with an apartment in the neighbourhood selling for an astounding Dhs 275 million ($75 million) in Q3, making it the most expensive single property sold.

Jumeirah Village Circle continued to top the list of the top five performing locations in Dubai in Q3 2024.

JVC: 4,467 transactions valued at roughly Dhs 5.33 billion ($1.45 billion). Dubai South: 2,910 transactions valued at Dhs 8.25 billion ($2.25 billion) 3.Wadi Al Safa 5 (Dhs 5.3 billion, $1.44 billion). Business Bay (Dhs 7.22 billion, $1.96 billion) 5.Dubai Hills Estate (Dhs 7.38 billion, $2.01 billion) Overall, the larger portion of transactions, 31%, were houses priced between Dhs 1-2 million ($272,000 and $544,000). Twenty-nine per cent of properties were below Dhs 1 million ($272,000), while 18% were between Dhs 2-3 million ($544,000 and $816,000). The trajectory for higher-valued properties continued, with 14% of all sales were for residences valued between Dhs 3-5 million ($816,000 and $1.36 million), and 8% were for properties priced beyond Dhs 5 million ($1.36 million).

In light of the staggering growth in Dubai’s real estate market, the 21st edition of IPS Congress, the leading international property sales event in the middle east, ramps up to bring together major stakeholders in this booming industry, from April 14 to 16, 2025. With an expected attendance of over 16,000 visitors and more than 150 exhibitors from over 45 countries, this event aims to strengthen Dubai’s global leadership in this industry by fostering collaboration with the private sector and international firms aligning with Dubai’s Real Estate Strategy 2033.

Key themes of IPS Congress 2025 will include IPS Real Estate: Highlighting the latest trends across the real estate sector; IPS Future Cities: Focusing on the development of sustainable urban environments; IPS Proptech Startups: Exploring technological innovations in the real estate space; IPS Design: Celebrating creativity in architectural aesthetics, and IPS Service: Elevating property management and hospitality standards.

Dubai’s buoyant real estate market is on course to surpass annual sales of more than Dhs500 billion for the first time following another record-breaking month.

Total sales in 2024 up to the end of October amount to Dhs435.6 billion from 150,651 transactions, eclipsing the previous high of Dhs409.8 billion from 132,628 property sales set last year.

Based on average monthly sales for the year to date of Dhs43.56 billion, the final value of sales in 2024 could soar past the Dhs500 billion milestone as Dubai real estate continues to attract waves of local and international investors.

A market update issued today by fäm Properties underlined the huge increase in Dubai real estate activity over the last five years, with a record Dhs 61.1 billion in sales from 20,461 transactions in October representing an 798% increase in value over the same month in 2020.

The total of 3,830 villa sales for AED20.5 billion last month was 102% up in volume on October 2023, while apartment sales worth AED28.1 billion rose 67.2% in volume to 15,662 compared with the same month last year.

The 424 commercial property transactions last month amounted to Dhs 916.2 million, a slight drop of 1.9% in volume compared to October 2023, although the average price per sq ft rose 7.1% to Dhs1,585.

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More

Dubai’s luxury real estate market is making headlines for all the right reasons. Even with past cycles of volatility, experts agree: this isn’t just a short-term surge. Let’s dive into why this boom is built to last—and how it’s redefining the global property scene.

It’s Not Speculation—It’s Serious Home Ownership

You might assume that Dubai’s hot market is driven by speculation, but think again. Faisal Durrani, Head of Research for MENA at Knight Frank, explains that this cycle is different. It’s underpinned by “genuine end users of real estate,” not speculative investors.

Consider this: Over the last 12 months, Dubai has closed almost as many $10 million-plus home sales as London and New York combined. That’s a stunning statistic for a market that’s relatively young compared to these established cities. According to Knight Frank’s latest Destination Dubai report, these sales are fueled by high-net-worth individuals (HNWI) seeking prime, luxury beachfront properties.

Dubai’s Prime Real Estate: Exclusive and In Demand

So, what qualifies as “prime” real estate in Dubai? It’s not a straightforward definition. Globally, prime residential areas are usually centered around or near a city’s business districts. Dubai is unique because it has five CBDs. Knight Frank analyzed 22 years of residential transactions and pinpointed four neighborhoods where at least 10% of sales consistently surpassed AED 10 million for three years.

These prime areas are The Palm Jumeirah, Emirates Hills, Jumeirah Bay Island, and, as of Q1 this year, Jumeirah Islands. The exclusivity of these neighborhoods is driving demand to new heights.

The Pandemic Sparked a Luxury Boom

To understand why the luxury market is thriving, you need to look back at the pandemic. Dubai stood out on the global stage with a world-class response, becoming one of the first cities to fully reopen. The UAE led in vaccination rates, often being the most vaccinated nation worldwide. This quick reopening meant that Dubai was uniquely positioned to attract a wave of people seeking a safe, open, and luxurious environment.

These new residents discovered Dubai’s “softer” lifestyle benefits: year-round sunshine, stunning beachfronts, and world-class amenities. And they didn’t just come for a visit—they stayed and invested.

Supply Is Down, Demand Is Off the Charts

Here’s where it gets interesting: Supply can’t keep up with demand. Across Dubai, home listings dropped 23% year-over-year. But the ultra-luxury market has seen an even more dramatic decline, with listings for $10 million-plus homes down 50% from last year. Developers are racing to build new properties, but it’s not enough to meet the appetite for high-end homes.

What’s driving this demand? It’s not flippers or speculators. The majority of these buyers are end users, people who plan to live in these properties rather than resell them quickly. This stability is a major reason why experts believe the current cycle is more sustainable.

Dubai: A Playground for the Global Elite

Dubai’s appeal to the world’s wealthiest individuals is undeniable. The city has become a hotspot for global elites looking for luxury and convenience. In 2022, Indian billionaire Mukesh Ambani made headlines with his $163 million mansion on Palm Jumeirah, setting a new record in the region. And recently, Brazilian soccer star Neymar Jr. bought a $54 million penthouse in the Bugatti Residences by Binghatti in Business Bay.

So, why are the ultra-rich flocking here? Dubai’s tax regime is highly favorable. It’s easy to do business, and the evolving visa rules—especially the coveted Golden Visa—make it an expat paradise. This is reminiscent of Monaco, which has long drawn the global elite with its tax advantages.

Big Investments Fuel Confidence

Dubai’s ambitions go beyond luxury living. The city is investing massively in infrastructure, with a $7.8 trillion plan in the works. Projects like the $34 billion expansion of Al Maktoum International Airport are already making waves. Once completed, this will be the world’s largest airport, reinforcing Dubai’s position as a global travel and logistics hub.

Why does this matter for real estate? It’s simple: investor confidence. In a sentiment-driven market, these big-ticket projects reassure investors that Dubai’s growth is sustainable. According to Knight Frank, this optimism is reflected in the UAE’s Purchasing Managers’ Index (PMI), which recently recorded the highest rating worldwide, thanks to strong job creation rates at an 8-year high.

Office Space Crisis: A New Challenge

It’s not just residential real estate that’s in high demand. Dubai’s office space market is also heating up. Along with Abu Dhabi and Riyadh, Dubai is facing a shortage of prime office spaces. Despite 4.2 million square feet of new office space expected over the next five years, most of it is already pre-leased. Companies are waiting in line for prime office spots, a sign of the city’s robust business environment.

Market Performance: 20% Growth and Counting

Dubai’s real estate market is up 20% year-over-year, and prices are now 6.5% higher than the 2014 market peak. This growth is significant, especially given that it’s spread across the city. Some areas have outperformed this average by a wide margin. Initially, experts predicted a 3.5% growth for 2024, but given the current momentum, even that figure might be too conservative.

What Could Derail the Boom?

Of course, no market is without risks. Dubai’s economy is globally connected, making it susceptible to external shocks. A major concern is the risk of a global economic slowdown. If oil prices become volatile, it could have a ripple effect across the Middle East. While Dubai’s economy isn’t directly tied to oil, the wider region’s fortunes are. A significant drop in oil prices could impact business sentiment.

And there’s a flip side. A sudden spike in oil prices, perhaps due to geopolitical tensions, could have its own negative impact. According to the International Monetary Fund (IMF), every 10% increase in oil prices leads to a 0.1% decrease in global economic growth and a 0.4% increase in global inflation. Both scenarios could affect Dubai’s market, but for now, the fundamentals remain strong.

The Takeaway: Dubai Is Built for Long-Term Success

Dubai’s real estate market isn’t a repeat of past cycles. It’s evolving, grounded in real demand and supported by strategic, future-focused investments. While there are vulnerabilities—like the risk of a global slowdown—Dubai’s resilience and appeal make it one of the most exciting real estate markets to watch.

So, whether you’re considering an investment or just fascinated by global property trends, keep your eyes on Dubai. The story is far from over, and the future looks bright.

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More

Dubai’s luxury real estate market shows strong growth, driven by genuine end users. Demand for high-value homes outstrips supply, with Dubai emerging as a top market for $10M+ home sales, comparable to London and New York. Favourable conditions and foreign interest fuel the trend.

Why Dubai’s current real estate boom is here to stay

Knight Frank official says buying patterns point towards genuine end users rather than speculative investors

As Dubai’s luxury real estate market continues to defy expectations of a slowdown, experts are more confident than ever that the ongoing cycle may not be a mere bubble or a short-term trend.

Buying patterns point towards “genuine end users of real estate rather than speculative investors”, stated Faisal Durrani, Partner – Head of Research, MENA at Knight Frank, the global real estate consultancy.

“Over the last 18-24 months, Dubai has emerged as the world’s deepest market for $10 million-plus home sales, with high net worth individuals (HNWI) looking for prime luxury beachfront villas,” Durrani told Business Recorder during a conversation in Dubai.

In fact, over the last 12 months, Dubai has recorded almost the same number of 10 million home sales as London and New York combined, according to Knight Frank’s recent Destination Dubai report, which highlighted all the factors that make the emirate an attractive place to live, work and invest in.

“This is a remarkable achievement for a market as young as Dubai,” said Durrani.

“It gives you a good idea of the appetite for luxury residential real estate from overseas investors, in particular.

“In any market property cycles, especially in young emerging markets, there tends to be greater volatility, but this time around, the fundamentals underpinning house price growth are very different to the past.

How is prime property defined in Dubai?

Prime residential real estate around the world is not necessarily easy to identify, according to Durrani, as they are either in the central business district of a city or immediately adjacent to a central business district.

Dubai has five central business districts, so in order to assess this, Knight Frank looked at every single residential transaction going back 22 years in order to identify neighborhoods where 10% of deals taking place at more than DHS10 million, and that were consistent for three years.

Currently, only four neighborhoods qualify — The Palm Jumeirah, Emirates Hills, Jumeirah Bay Island and as of Q1 this year, Jumeirah Islands, according to Knight Frank.

Luxury market for the win

One will need to go back to the start of the pandemic to understand why the luxury market has done so well.

“UAE’s response to the pandemic definitely helped. It was routinely the world’s most vaccinated nation, and that accolade resulted in Dubai being one of the first cities in the world to open.

“A lot of these people got to experience the softer factors that make Dubai an attractive place to live and work.”

Demand outstrips supply

This has resulted in a city-wide glut.

“We have also started tracking the volume of home listings across Dubai, across the entire city, across neighbourhoods and price points were down about 23% YoY, but if we jump to the $10-million market, the number of homes for sale today is down 50% YoY.

“Developers are racing to keep up. People who are purchasing the homes are not doing so because they want to flip them. They are purchasing them to use for personal reasons.”

Knight Frank’s Destination Dubai report earlier this year found in a survey of global HNWI, that 49% of those with a personal net worth in excess of $20 million (UHNWI) would like to make a real estate investment in the UAE in 2024.

A further 30% would like to acquire property in the country over the next 2-5 years.

‘Lifestyles of the Rich and Famous’

That Dubai is a magnet for the global wealthy is no secret.

In 2022, Indian billionaire Mukesh Ambani set a new record in the Persian Gulf emirate with his $163 million Palm Jumeirah mansion.

On Monday, it was reported that Brazilian soccer player Neymar Jr bought a $54 million penthouse in the Bugatti Residences by Binghatti, located in Business Bay.

Dubai’s favourable tax regime, ease of doing business, and evolving visa restrictions regarding its coveted Golden Visa, have made it an expat haven and has drawn much foreign investment over the years. This is not quite unlike from the tiny French principality of Monaco, whose legendary tax-free regime has been attracting the global rich for decades to reside and park wealth.

Dubai is also on track to becoming fourth largest financial center globally, behind London, New York and Singapore, crucially overtaking Hong Kong, according to Knight Frank data.

“This pole initiative is expecting to cost somewhere in the range of $7.8 trillion, and we already see that investment rolling out, for example, the commitment to expand the $34-billion Al Maktoum International airport, making it the largest in the world,” said Durrani.

“In a sentiment-driven market, these developments are so important, because there is such a close correlation between how people feel and how much activity there is in the real estate market.

“This is of course, intangible, but if you look at the Purchasing Managers’ Index (PMI) readings for the UAE, it recorded the highest rating for anywhere in the world underpinned by job creation rates that had hit an 8-year high,” Durrani explained.

These effects were also felt in the market for office space, with long waitlists for prime office spaces already in play.

“Dubai, Abu Dhabi, Riyadh — these three cities are quite anomalous on the world stage at the moment, especially Dubai in that we have virtually run out of prime office space,” said Durrani. “There is 4.2 million square feet of new space coming in next 5 years, most of which is pre-leased.”

Future outlook

As things stand, the real estate market is up 20% YoY, according to Durrani.

“We are now 6.5% above 2014 market peak, and that’s just a citywide average. Clearly, there are locations that have done much better than that. Last year we were forecasting price growth of 3.5% for 2024, and this year is expected to end the year higher as the market has continued to grow and expand not as originally forecast.”

Vulnerabilities

As with anything else, the market is still prone to vulnerabilities and external influences, the biggest risk being the risk of a global economic slowdown.

“Dubai is a global city and anything that affects the world affects the city,” cautioned Durrani, indicating that fluctuations in oil prices could also affect Dubai’s growth.

“A severe decline in oil prices could curb economic growth in other economies in the region. Dubai’s economy isn’t underpinned by oil, but if other regional economies become affected by falling oil prices, that may hurt overall business sentiment across the Middle East.

But each 10% increase in oil prices sees a 0.1% decline in global economic growth, and a 0.4% increase in global inflation, according to the International Monetary Fund (IMF).

“If we have a sudden spike in oil prices, due to regional unrest, there is a subsequent knock-on impact on global economic growth, and also a knock-on impact on global inflation levels.”

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More

Anax Developments, a subsidiary of Dubai-based investment company Anax Holding, has announced the launch of its second project, Evora Residences, within the Al Furjan community development.

Designed as a tranquil retreat that embodies an urban lifestyle while providing excellent connectivity to the city, the Evora Residences are scheduled for completion in Q3 2026, said the company in a statement.

The tower features 10 residential floors and offers a range of one-, two-, and three-bedroom apartments; each one featuring spacious balconies with a fusion of modern elegance and contemporary design throughout its layout.

It will be located within the rapidly growing, lush green expanse of Al Furjan, minutes away from Dubai’s landmarks, including Legoland, IMG Worlds of Adventure, and Ibn Battuta Mall.

The project was unveiled at a first-of-its-kind gala event at the Jumeirah Beach Hotel, in the presence of VIP guests, stakeholders and media representatives.

According to Anax, the tower embodies its ethos of “Live Large”, embracing a life of impact and abundance.

The philosophy is extended to creating spaces with purpose – designed for residents to live well, enjoy robust investments, and expansive amenities.

Evora Residences will offer an end-user focused 30/70 payment plan with prices starting at AED1,068,777 ($290,959) for one-bedroom apartments, it stated.

Evora Residence also ensures that sustainability is a key feature amidst the modern comforts and serene living, with solar panels to support energy consumption, and the highest standards of Smart Home Automation.

Residents will get to enjoy amenities designed to elevate their living experience. Each apartment is equipped with top-of-the-range fittings like Bosch kitchen appliances, and sanitary ware by Teka, it added.

Satish Sanpal, the Chairman of Anax Holding, said: “Upholding our philosophy, our vision is to create spaces which allow residents to live large, create impact and where one truly feels at home. With Evora Residences, given its location in the family-friendly Al Furjan community, our priority is to combine urban living and peaceful surroundings.”

According to Anax, the development beautifully integrates lush greenery with urban panoramas within the vibrant Al Furjan community.

Residents will benefit from an extensive network of modern amenities, including retail hubs, adventure parks, fitness clubs, a well paved jogging track around the residences and other recreational areas, ensuring a harmonious lifestyle, stated the developer.

“We have strived to capture this essence throughout our design process, a philosophy that will continue to dominate across all our future projects as we continue to build with Anax Developments and bring more than 2,000 homes to the market in the next twelve months,” he noted.

With a pipeline of upcoming projects, Anax is planning to bring in a cumulative project value of $1 billion to the market in the next year, he added.

On the launch, Ravi Bhirani, Managing Director of Anax Developments, said: “This project, along with our upcoming developments in Meydan, and Dubai Islands reinforces our commitment to enhancing Dubai’s residential landscape with elevated living across each of our new ventures.”

“We strive to cater to a diverse audience at various price points ensuring that exceptional residential experiences are accessible to a broad spectrum of investors and home buyers,” stated Bhirani.

“With Al Furjan being an emerging and highly desirable destination for families seeking a peaceful environment with green spaces and modern amenities, along with a promising ROI, launching a project here was a strategic decision to steer our efforts towards our goals,” he added.

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More

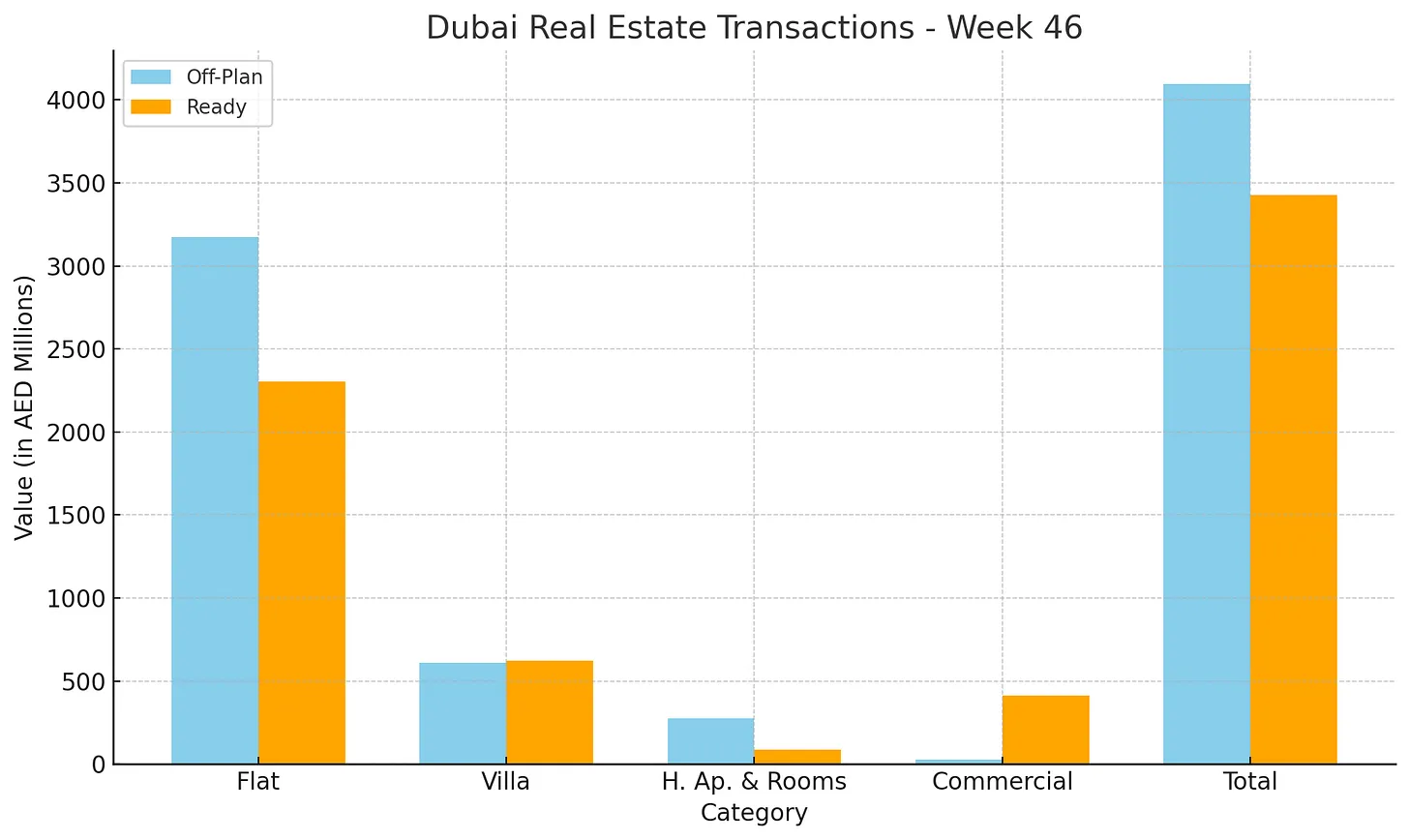

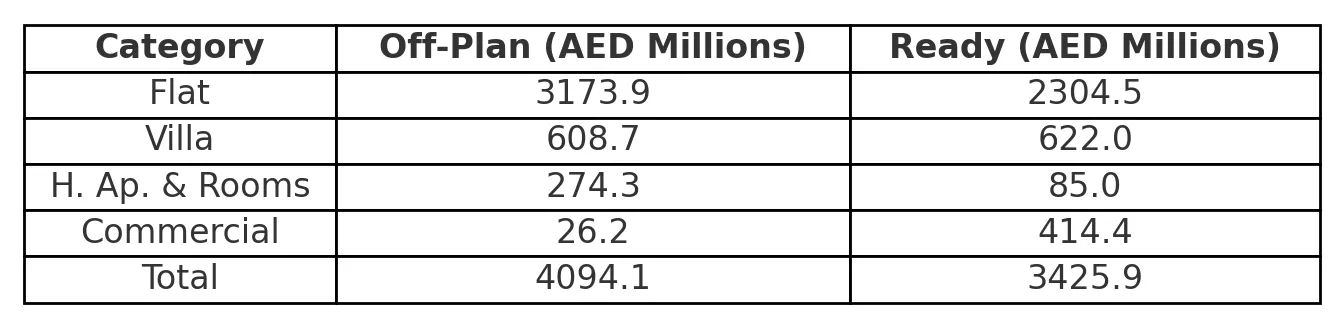

The total value of real estate transactions in Dubai for Week 46 amounted to AED 7.52 billion, which shows a slight decline from the previous week’s figure of AED 7.8 billion. This report breaks down the transactions between Off-Plan and Ready properties and provides insights into the most active areas by value traded, making it clear and easy for readers to understand.

Off-Plan vs Ready Property Transactions

Off-Plan Breakdown:

Flats dominated the Off-Plan category with a contribution of 77.5% of the Off-Plan value, amounting to AED 3.17 billion. This highlights a sustained preference for apartments in this segment.

Villas accounted for 14.9% of the Off-Plan total, with transactions worth AED 608.7 million, showing that investors continue to value villa projects.

Hotel Apartments & Rooms contributed AED 274.3 million, comprising 6.7% of the total Off-Plan transactions, while Commercial properties added AED 26.2 million, or 0.6%, indicating limited Off-Plan commercial activity.

Ready Breakdown:

Flats also led in the Ready segment, making up 67.3% of the value with AED 2.30 billion in transactions, suggesting consistent demand for completed apartments.

Villas followed closely with a value of AED 622.0 million, contributing 18.2% to the Ready segment total, demonstrating the ongoing interest in move-in ready villa units.

Hotel Apartments & Rooms accounted for 2.5% of the Ready transactions, amounting to AED 85.0 million, whereas Commercial properties added a significant AED 414.4 million, making up 12.1% of the Ready segment.

Area Analysis: Most Active Locations by Value

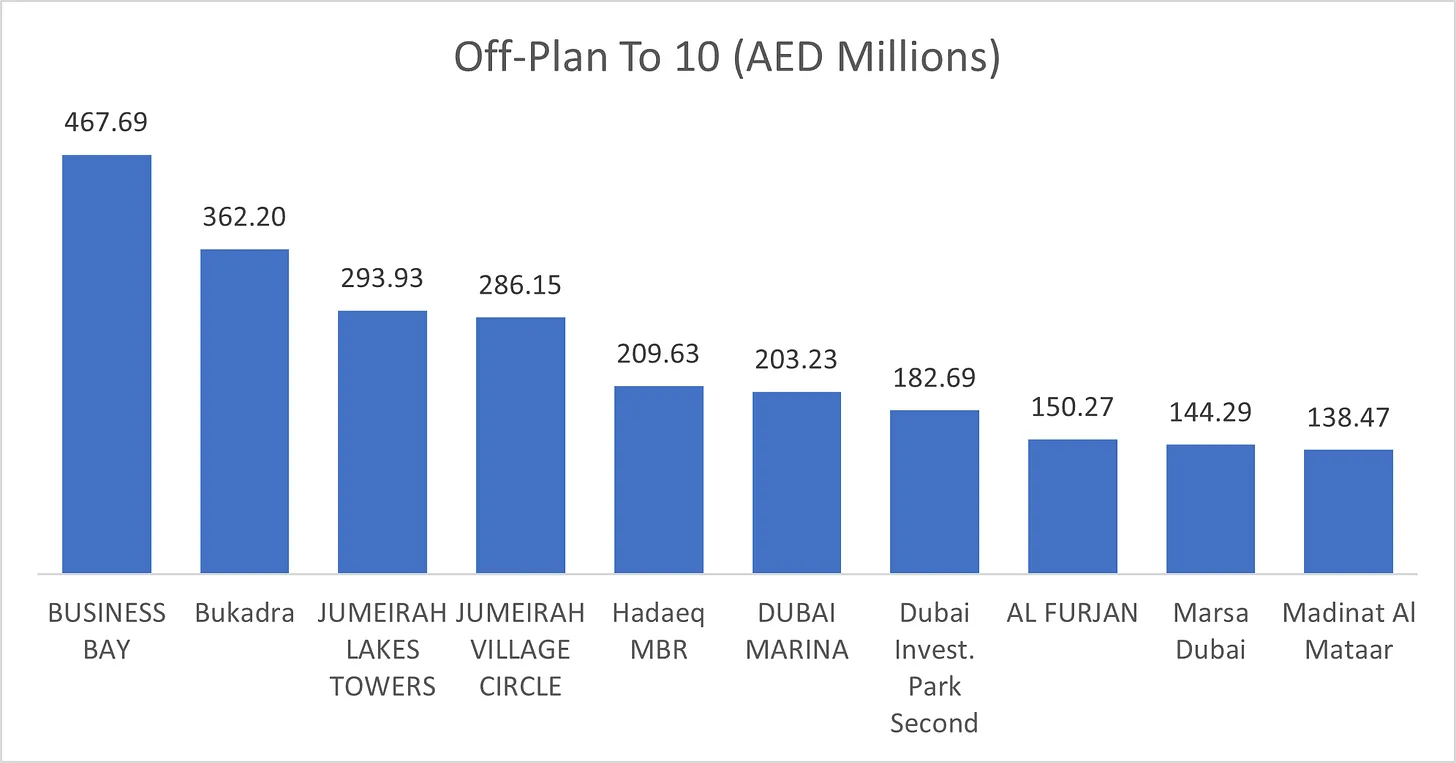

Off-Plan Segment:

Business Bay topped the list for Off-Plan transactions with AED 467.7 million, signaling investor confidence in this bustling business and residential hub.

Bukadra was the second most active area, recording AED 362.2 million in Off-Plan deals, followed by Jumeirah Lakes Towers with AED 293.9 million.

Jumeirah Village Circle and Hadaeq Sheikh Mohammed Bin Rashid saw notable activity, with values of AED 286.1 million and AED 209.6 million, respectively.

Dubai Marina, with AED 203.2 million, remained a popular choice for Off-Plan investment, highlighting the attractiveness of waterfront living.

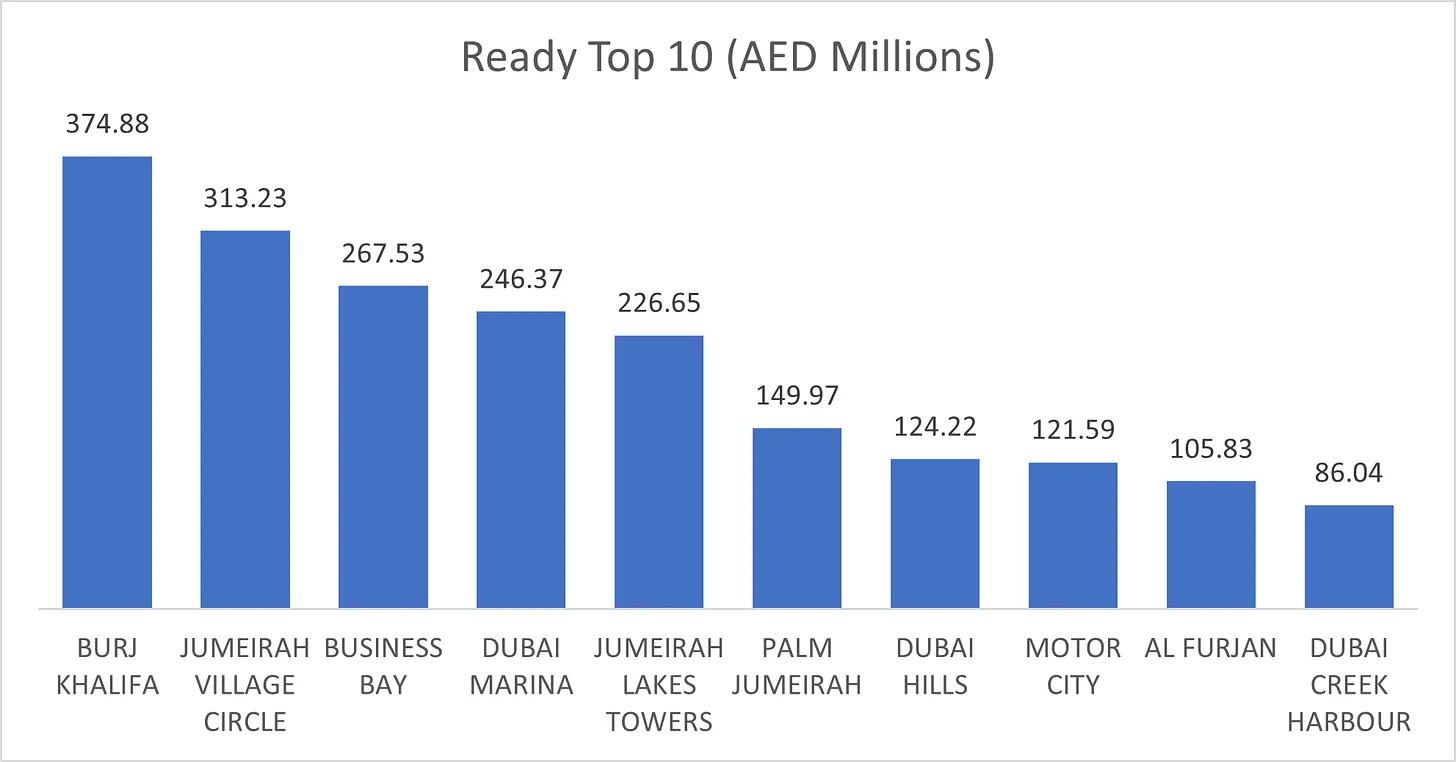

Ready Segment:

The Burj Khalifa area led the Ready segment with a transaction value of AED 374.9 million, showcasing the ongoing demand for premium properties in this iconic district.

Jumeirah Village Circle and Business Bay followed, with transactions of AED 313.2 million and AED 267.5 million, respectively.

Dubai Marina and Jumeirah Lakes Towers also saw strong activity, with values of AED 246.4 million and AED 226.7 million.

Other notable areas included Palm Jumeirah (AED 150.0 million), Dubai Hills (AED 124.2 million), and Motor City (AED 121.6 million), indicating a diverse interest across a variety of neighborhoods.

Summary

Week 45 saw a total transaction value of AED 7.52 billion, a slight decline from AED 7.8 billion the previous week. The Off-Plan properties contributed significantly more than Ready properties, reflecting continued investor appetite for future developments. Flats were the most transacted property type in both segments, and areas like Business Bay, Jumeirah Village Circle, and Dubai Marina were highly active, illustrating their appeal to investors.

While the market showed a small dip, the consistent activity in key areas suggests sustained interest and confidence in Dubai’s real estate market, particularly in Off-Plan investments and premium Ready properties.

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More

The real estate industry, a cornerstone of global economies, has undergone a significant transformation over centuries. From traditional brick-and-mortar practices to the digital age of PropTech, this sector has continuously adapted to technological advancements. Let’s delve into a historical journey to understand this evolution.

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More