Month: November 2024

Dubai, known for its towering skyscrapers, luxurious lifestyle, and diverse culture, has long been a dream destination for many expats. Whether you’re moving for work or seeking adventure, understanding the cost of living is crucial to settling in comfortably. In this guide, we’ll break down what you can expect in terms of cost, comparing two different lifestyles—luxury and budget—to help you decide what’s achievable for your new Dubai experience.

Housing: From Penthouse to Studio

Housing is often the most significant expense for anyone moving to Dubai. For those opting for luxury, properties in upscale areas like Downtown Dubai or Dubai Marina come with stunning views and premium amenities. Rent for a luxurious one-bedroom apartment in these areas can range from AED 10,000 to AED 15,000 per month, depending on location and building amenities. For those looking for more space, renting a villa in Palm Jumeirah can cost upwards of AED 25,000 per month.

However, if you’re on a budget, there are more economical options. Areas like Al Nahda, Deira, or International City offer affordable living, with one-bedroom apartments starting at around AED 3,000 to AED 5,000 per month. These neighborhoods still provide convenient access to amenities but at a fraction of the cost of luxury districts.

Transportation: Public Transport vs. Private Car

Dubai has a highly developed and efficient public transport system. For budget-conscious residents, the Dubai Metro, buses, and trams offer affordable and convenient options to get around the city. A monthly public transport pass costs approximately AED 300, making it a cost-effective choice for daily commutes.

In contrast, those embracing a luxurious lifestyle might prefer owning a private car. Dubai’s car culture is strong, and you’ll see everything from mid-range sedans to high-end sports cars cruising along Sheikh Zayed Road. Owning a luxury car such as a Mercedes-Benz or Lamborghini can cost anywhere from AED 3,000 to AED 10,000 per month in loan payments, not to mention the costs of fuel, insurance, and maintenance. Valet services and premium parking spots are also common expenses for those who prefer convenience.

Dining: Fine Dining vs. Budget-Friendly Eats

Dubai’s food scene is diverse, offering everything from high-end dining experiences to affordable street food. For those enjoying a luxury lifestyle, dining at restaurants like Nobu or Pierchic can easily cost AED 800 or more for two people, especially if you include wine. Dubai’s Michelin-starred restaurants and rooftop lounges are perfect for those who enjoy splurging on fine cuisine.

On the other hand, budget-friendly dining is also widely available. Local cafeterias, food courts in malls, and street food vendors offer delicious meals for as little as AED 20 to AED 50 per meal. Areas like Old Dubai are known for their affordable eateries, where you can enjoy international dishes without breaking the bank.

Entertainment and Leisure: Exclusive Experiences vs. Free Attractions

Entertainment in Dubai can vary greatly depending on your budget. A luxury lifestyle includes exclusive experiences such as yacht rentals, private desert safaris, and memberships at high-end beach clubs. For instance, a private yacht rental can cost anywhere from AED 1,500 to AED 3,000 per hour, while a premium beach club membership can set you back AED 5,000 annually.

For budget-conscious expats, Dubai also offers plenty of affordable or even free attractions. Public beaches like JBR Beach and Kite Beach are free to access, and you can explore cultural sites like the Al Fahidi Historical District or take a ride across Dubai Creek on an abra for just AED 1. Dubai’s many public parks, such as Safa Park and Zabeel Park, offer affordable entry fees and are great for enjoying outdoor activities.

Schools: Private International Schools vs. Public Schools

Education is a key consideration for expat families moving to Dubai. For those seeking a luxurious lifestyle, Dubai offers a wide range of private international schools that provide top-quality education, often following curricula such as the British, American, or International Baccalaureate (IB) systems. Schools like Dubai College and GEMS World Academy are well-known for their facilities and quality of education, but tuition fees can range from AED 50,000 to AED 100,000 per year, depending on the grade level and school. These schools often offer extracurricular activities, state-of-the-art facilities, and a multicultural environment.

On the other hand, budget-conscious families can consider more affordable schooling options. While public schools are generally only available to Emirati nationals, there are private schools with lower fees, typically ranging from AED 10,000 to AED 30,000 per year. These schools still provide a good quality of education, though the facilities and extracurricular options may be more limited compared to the high-end international schools.

Utilities and Other Expenses

Utilities can also vary depending on the type of housing you choose. For a luxury villa, expect to pay between AED 2,000 to AED 5000+ per month for electricity, water, and air conditioning during peak summer months. For budget apartments, utility costs are generally much lower, averaging around AED 800 to AED 1,200 per month.

Conclusion: Finding Your Balance

Ultimately, the cost of living in Dubai can be as extravagant or as economical as you wish. The city offers something for everyone, whether you dream of a luxurious high-rise lifestyle or prefer to manage your budget carefully while still enjoying what Dubai has to offer. Understanding your lifestyle preferences and planning accordingly will help you make the most of your Dubai adventure.

If you’re planning to move to Dubai, it’s essential to budget realistically and decide which aspects of your lifestyle you’d like to prioritize. Whether you’re living the high life or saving smart, Dubai’s unique mix of luxury and accessibility ensures that there’s a place for everyone.

Recent Items

Real estate investment stands as one of the most reliable and rewarding paths to

wealth creation and financial freedom. Whether you’re an experienced investor

looking to diversify your portfolio or a newcomer eager to learn the ropes,

understanding the various strategies available is crucial to your success.

This comprehensive guide takes you through the most effective real estate

investment strategies, dives into the details of execution, and provides actionable

tips to help you make informed decisions. Let’s explore the world of real estate

investing in detail.

Why Invest in Real Estate?

Real estate offers unique benefits that make it a standout investment choice

compared to other asset classes like stocks or bonds. Here’s why:

Key Advantages of Real Estate Investments

- Tangible Asset: Unlike stocks, real estate is a physical asset that holds

intrinsic value and often appreciates over time. - Cash Flow: Rental properties provide steady income, offering a reliable way

to build passive wealth. - Tax Benefits: Deduct expenses like mortgage interest, depreciation, and

property management fees to reduce your taxable income. - Leverage Opportunities: Use mortgages and financing options to acquire

high-value assets with limited upfront capital.

Real estate offers versatility, allowing investors to choose strategies that align with

their goals, risk tolerance, and available resources.

1. Buy-and-Hold Strategy: Building Long-Term Wealth

The buy-and-hold strategy is ideal for investors seeking steady cash flow and long-

term appreciation. This approach involves purchasing properties, renting them out,

and holding onto them for extended periods.

Why It’s a Strong Strategy

- Stable Income: Rental payments provide monthly cash flow, covering

expenses and building wealth. - Appreciation: Over time, properties typically increase in value, creating

equity and long-term profit. - Tax Perks: Depreciation and other write-offs reduce your taxable income.

How to Succeed

- Focus on Location: Choose neighborhoods with job growth, good schools,

and high rental demand. - Screen Tenants Carefully: Reliable tenants ensure consistent income and

minimize headaches. - Plan for Maintenance Costs: Budget for repairs, vacancies, and unexpected

expenses.

Example: Imagine purchasing a $250,000 property with a 20% down payment.

Renting it for $1,800 per month yields a steady income while the property

appreciates, eventually selling for $400,000 ten years later.

2. Fix-and-Flip: Quick Profits with Renovation

Fix-and-flip investing involves buying distressed properties, improving them, and

selling for a profit. While it’s riskier than other strategies, the potential for quick,

significant returns attracts many investors.

Steps to Success

- Find the Right Property: Look for undervalued homes in high-demand areas.

- Budget Accurately: Account for purchase price, renovation costs, and

carrying costs (e.g., mortgage payments during the flip). - Sell Smart: Time your sale to take advantage of favorable market conditions.

Risks and Challenges

- Unforeseen renovation costs can erode profits.

- Market downturns can delay sales and reduce potential returns.

- Poor project management can extend timelines and increase expenses.

Pro Tip: Partner with experienced contractors and use project management tools to keep renovations on track and within budget.

3. Rental Properties: Steady Passive Income

Investing in rental properties is one of the most popular strategies for generating

consistent cash flow while building long-term wealth. Whether it’s residential or

commercial, rental income ensures a steady financial base.

Key Factors to Consider

- Location: High-demand areas with strong employment and amenities

attract quality tenants. - Property Type: Residential properties are easier to manage,

while commercial properties offer higher returns but longer vacancies. - Property Management: You can self-manage or hire a property management company to handle day-to-day operations.

Maximizing Returns

- Use rental income to pay down your mortgage, building equity over time.

- Keep vacancy rates low by maintaining the property and addressing tenant concerns promptly.

- Regularly evaluate rental rates to stay competitive.

Pro Tip: A cap rate (net operating income divided by property value) of 8-12% is

considered a good benchmark for rental properties.

4. Real Estate Investment Trusts (REITs): Hands-Free Investing

REITs allow you to invest in real estate without owning physical property. These

companies own and manage income-generating properties, and you can buy shares just like stocks.

Benefits of REITs

- Liquidity: REIT shares are traded on stock exchanges, making it easy to buy

and sell. - Diversification: Access a variety of property types, such as commercial

buildings, apartments, and shopping centers. - Passive Income: REITs must distribute 90% of their taxable income as

dividends.

Types of REITs

- Equity REITs: Own and manage properties, earning income from rents.

- Mortgage REITs: Invest in mortgages and earn interest income.

- Hybrid REITs: Combine both equity and mortgage strategies.

5. Real Estate Crowdfunding: Investment for the Digital Age

Crowdfunding platforms let multiple investors pool funds to back real estate projects.

It’s an excellent way to get started with real estate investing without requiring

substantial capital.

Why It’s Popular

- Low Entry Barrier: Invest as little as $500 to gain exposure to high-value

projects. - Diversification: Spread your capital across multiple projects for reduced

risk. - Transparency: Platforms provide detailed project breakdowns,

returns, and risks.

What to Watch For

- Platform Reputation: Choose established platforms with strong

track records. - Project Due Diligence: Research project sponsors and their plans

thoroughly. - Investment Horizon: Be prepared for a longer-term commitment, as

projects may take years to mature.

6. Value-Add Strategy: Unlock Hidden Potential

This strategy focuses on acquiring underperforming properties and increasing their value through strategic improvements. It’s perfect for investors who enjoy hands-on projects.

Examples of Value-Add Opportunities

- Renovating interiors or updating outdated features.

- Improving energy efficiency to lower operating costs.

- Rebranding or repositioning the property for a different market.

Pro Tip: Research local trends to identify improvements that offer the best ROI. For example, adding smart home features or creating co-working spaces may appeal to modern tenants.

7. Commercial Real Estate: The Big Leagues

Commercial real estate includes office spaces, retail centers, warehouses, and

multifamily units. While it requires more capital and expertise, the returns can be

significant.

Benefits of Commercial Real Estate

- Higher Returns: Commercial properties often yield higher rents and longer

lease terms. - Diverse Tenant Base: A single property can house multiple tenants, reducing

reliance on one source of income. - Professional Tenants: Businesses tend to take better care of leased spaces

than residential tenants.

Key Consideration: Analyze the local economy and market demand for commercial space before investing.

8. Distressed Properties: High Risk, High Reward

Distressed properties, often in foreclosure or disrepair, are sold below market

value. Investors can rehabilitate these properties to sell or rent at a profit.

Challenges to Consider

- Inspection Risks: These properties may require costly repairs.

- Legal Complexities: Ensure a clean title before purchasing.

- Financing: Many traditional lenders avoid distressed properties, requiring

cash or alternative financing.

Pro Tip: Work with local real estate agents specializing in foreclosures to find the

best deals.

9. Due Diligence: The Foundation of Success

No matter the strategy, thorough due diligence is non-negotiable.

Steps to Conduct Proper Due Diligence

- Market Research: Study local job growth, population trends, and property

demand. - Financial Analysis: Use metrics like cap rate, cash-on-cash return, and ROI to

assess profitability. - Property Inspection: Uncover hidden issues before closing the deal.

Conclusion: Choosing Your Path

Real estate offers a world of opportunity for investors willing to put in the time and effort. Whether you’re building passive income with rentals, flipping properties for quick cash, or investing through REITs, success depends on strategy, market research, and disciplined execution.

Your next step? Identify a strategy that aligns with your goals and start planning

your entry into the real estate market. With patience and perseverance, real estate can become a powerful tool in your journey to financial freedom.

Happy investing!

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More

Comprehensive Steps to Start a New Life

Moving to Dubai is a big decision filled with excitement, promise, and new

beginnings. With its tax-free income, thriving economy, and luxurious lifestyle,

Dubai is one of the most sought-after destinations for expats worldwide. But

relocating to this fast-paced, culturally rich city requires careful preparation.

This in-depth guide covers everything you need to know—from securing visas and

finding the perfect home to understanding cultural norms, budgeting, and

navigating the city’s systems. Let’s dive in!

1. Why Dubai is a Top Destination for Expats

Comprehensive Steps to Start a New Life

- Tax-Free Income: Dubai is one of the few cities

worldwide with no personal income tax,

allowing you to keep more of your earnings. - Thriving Economy: Home to booming

industries like real estate, tourism, finance, and

technology. - Modern Lifestyle: From skyscrapers like the

Burj Khalifa to luxury malls and five-star dining,

Dubai offers unparalleled modernity. - Cultural Diversity: Expats make up about 85%

of the population, creating a vibrant mix of

nationalities, languages, and cuisines. - Safety: Consistently ranked among the safest cities in the world with strict laws

and a high standard of living.

Challenges to Consider

- High Cost of Living: Luxury comes at a price, with housing, schooling, and

lifestyle expenses higher than in many cities. - Cultural Adaptation: While Dubai is cosmopolitan, respecting Islamic traditions

and laws is crucial.

2. Understanding Dubai’s Culture and Laws

Respecting the local culture and laws is

essential for a smooth transition.

Cultural Norms

- Dress Modestly: In public places, ensure your attire respects local customs. Swimsuits are fine at the beach or pools but not in malls or government buildings.

- Alcohol Consumption: Permitted only in licensed venues, with public intoxication strictly prohibited.

- Public Behavior: Avoid public displays of affection, swearing, or inappropriate gestures —these can result in fines or jail time.

- Gender Norms: Men should avoid initiating handshakes with women unless the woman offers first.

Strict Laws

- Defamation: Speaking ill of individuals or institutions can lead to legal issues.

- Drugs: Even small amounts of illegal substances carry severe penalties.

- Social Media: Posting offensive or culturally insensitive content is punishable by law.

3. Visa and Residency Requirements

To move to Dubai, a valid visa is mandatory.

Here’s what you need to know:

Types of Visas

- Employment Visa: Sponsored by your employer; valid for 1-3 years.

- Golden Visa: For investors, entrepreneurs, or specialized

professionals; valid for up to 10 years. - Freelancer Visa: Ideal for self-employed individuals; allows you to work independently.

- Family Visa: Enables residents to sponsor immediate family members.

- Investor Visa: For individuals establishing or investing in a business.

Steps to Secure Residency

- Entry Permit: Issued to begin your residency process; typically valid for

60 days. - Medical Examination: Includes blood tests and chest X-rays to ensure

you’re fit for residency. - Residency Visa Stamping: Finalized by immigration authorities.

- Emirates ID: Required for accessing government services, banking, and

healthcare.

Can You Move Without a Job? Yes! Options like the Freelancer Visa or Green Visa

allow individuals to move without traditional employment.

4. Budgeting for Dubai: Cost of Living Insights

Dubai is a global hub, and its cost of living reflects that status. Proper budgeting is critical to ensure financial stability.

Key Living Expenses

1. Housing:

Rent: AED 4,500/month for budget areas like International City.

Luxury Rentals: AED 15,000+/month in Palm Jumeirah or Downtown Dubai.

Consider short-term rentals initially for flexibility.

2. Utilities:

Water, electricity, and cooling via DEWA: AED 600–800/month for a two-

bedroom apartment.

3. Transportation:

Public Transport: AED 300–500/month for Metro, buses, and trams.

Driving: Owning a car requires a local driving license and additional costs

for insurance, fuel, and registration.

4.Food:

Groceries for a family of four: AED 2,000–3,000/month.

Dining out varies: AED 30 for casual meals to AED 500+ at fine dining

restaurants.

5. Education:

Private schools: AED 14,000–122,000 annually, depending on the

curriculum.

Public schools are available but primarily cater to Emirati nationals.

6. Healthcare:

Basic insurance: AED 500–1,000/year.

High-end plans: AED 5,000+ for comprehensive coverage.

Suggested Monthly Income To live comfortably, aim for an income of AED

18,000–30,000.

6. Housing Options: Renting or Buying

Renting a Home

Short-Term Rentals: Great for newcomers adjusting to the city; available

weekly or monthly.

Long-Term Leases: Requires a 12-month commitment with upfront

payments (often in 1-4 checks).

Buying Property

Freehold Areas: Expats can buy properties in designated zones like Palm

Jumeirah and Dubai Marina.

Mortgage Financing: Available for primary and secondary properties;

down payment typically starts at 20%.

Popular Communities

For Singles and Professionals: Downtown Dubai, Jumeirah Lake Towers

(JLT).

For Families: Arabian Ranches, Mirdif.

7. Daily Life Setup: Essentials for Your First Week

Mobile and Internet

Providers like Etisalat, Du, and Virgin Mobile offer packages for calls and

data.

Required documents: Visa copy and passport.

Banking

Open a local account to manage salaries and bills.

Popular banks: Emirates NBD, ADCB, and FAB.

Transportation

Nol Card: Your ticket for public transport; discounted fares apply.

Driving: Convert your home country license (if eligible) or complete a

driving test.

Healthcare

Ensure you have valid insurance—provided by employers or purchased

independently.

Education

Start school applications early; some schools have waitlists of up to a year.

8. Entertainment and Leisure

Dubai offers endless activities for

every lifestyle:

Iconic Attractions: Burj Khalifa, Palm Jumeirah, Dubai Marina.

Adventure Parks: IMG Worlds of Adventure, Ski Dubai.

Shopping: Dubai Mall, Mall of the Emirates.

Beaches: JBR Beach, Kite Beach.

For nature lovers, visit Zabeel Park or Dubai Miracle Garden.

Final Thoughts: Is Moving to Dubai Worth It?

Moving to Dubai is a transformative experience, offering unmatched

professional opportunities and a luxury lifestyle. While the city has a high cost of

living and cultural norms to adapt to, careful planning ensures you’ll thrive.

Whether you’re moving for work, family, or adventure, Dubai has something to

offer everyone. Use this guide as your roadmap for a seamless transition!

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More

Dubai’s Rental Market: A 2025 Forecast

The year 2025 is an exceptional year for Dubai investors and homeowners. Business executives expect that rentals in the city will rise by 18% for short-term and long-term leases, and up to 13% for long-term leases. This boost in efficiency is being stimulated by a large number of experts, rising property prices, and the launch of modern technology.

A Booming Rental Market

As Dubai develops as a leading global economy and tourism hub, buyer demand for rental apartments remains higher. According to business experts, the expected rental rise will benefit landlords and investors looking to capitalize on increasing demand for short- and long-term rentals.

According to Mr Fasih, Co-Founder & Sales Manager of a Famous Real Estate Agency in Business Bay Dubai, “Our projections for 2025 indicate an 18% surge in short-term rentals compared to 2024, while rentals for longer terms are expected to increase by almost 13%.” This increased trend is directly related to the region’s rising property values, which are expected to continue increasing.

Key Drivers of Rental Increases

The surge of overseas professionals seeking rich employment opportunities and a good standard of living in Dubai is a major driver of growing rental prices. Imran Hussain, Co-Founder of a Well-known Real Estate Agency in Dubai, stated that certain areas could see rental prices rise by up to 25%. With growing numbers of citizens relocating to Dubai, demands for stable, long-term apartments are projected to skyrocket,

The Dubai real estate market is already showing indicators of growth, with rental rates predicted to go up by 13.5% in the first half of 2024 only. Rental liabilities are predicted to rise by about 20% by the end of 2024, developing the way for more increases in 2025.

Market Dynamics and New Developments

The anticipated rise in rental rates is strongly tied to Dubai’s overall trends of urbanization and population growth. As new residential construction develops, around 182,000 units are estimated to be built between 2025 and 2026, alleviating some pressure on rental markets.

Particularly, the demand for adjustable living structures among expats and professionals has resulted in a strong short-term rental market. Large exhibitions and events in Dubai have increased demand, with certain apartments in prime locations fetching exorbitant weekly rates.

Implications for Tenants and Investors

For existing tenants or those planning to move to Dubai, the projected rental increases necessitate careful financial planning. Mr. Imran Hussain advises tenants to prepare for potential hikes in rental expenses, recommending that they review their budgets to accommodate these changes.

For investors, these rising rental costs present a mixed bag of opportunities and challenges. While there are lucrative prospects in developing rental properties, potential economic fluctuations and regulatory changes could impact overall rental yields. Developing a proactive and flexible outlook will be crucial for both renters bargaining leases and investors navigating a rapidly evolving market situation.

The Dubai real estate market is balanced for significant growth in 2025, driven by a confluence of increasing property values, a steady inflow of professionals, and a thriving tourism sector. As rental costs rise, tenants and landlords must be proactive in adapting to fluctuating terms. With the correct attitude, both groups can negotiate the expected changes and capitalize on the opportunities given by this thriving sector.

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More

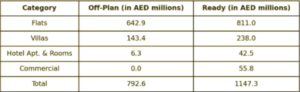

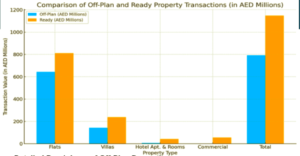

On November 28, 2024, Dubai's real estate market recorded a total

transaction value of AED 1,939,840,219. This total is comprised of both off-

plan and ready property transactions, each contributing significantly to the

market's dynamic landscape.

Off-Plan vs. Ready Property Breakdown

The total value of transactions for off-plan properties reached AED

792,554,220, accounting for approximately 40.9% of the total transactions for

the day. Meanwhile, ready properties generated a total of AED 1,147,285,999,

contributing 59.1% of the overall market transactions. These figures indicate a

strong preference for ready properties, which provided a greater share of the

market activity, emphasizing buyer confidence in completed and available

properties.

Detailed Breakdown of Off-Plan Properties

The off-plan segment was mainly driven by flats, which brought in AED

642,860,421, contributing 81.1% to the total off-plan transactions. Villas

followed with AED 143,442,834, representing 18.1% of the off-plan market,

while hotel apartments and rooms contributed AED 6,250,965, which made

up only 0.8% of the total off-plan transactions. This highlights the continuing

demand for residential flats among investors looking for newer properties at

the development stage.

Ready Property Transactions

The ready property segment saw a notable contribution from flats, which

amounted to AED 810,963,328, making up 70.7% of the total ready

transactions. Villas followed with AED 238,014,744, contributing 20.7%, while

hotel apartments and rooms and commercial properties contributed AED

42,478,385 and AED 55,829,541 respectively, representing 3.7% and 4.9% of

the ready transactions. The predominance of flats within the ready category

underlines a high level of market activity for readily available residential units.

Market Insights

These figures illustrate the continued strength of Dubai's real estate market,

with a clear inclination towards ready properties. The larger contribution from

flats across both off-plan and ready categories indicates sustained demand for

compact residential units, likely driven by investors and end-users attracted to

the lifestyle and investment potential that Dubai's apartment market offers.

The healthy contribution from villas also signals robust interest in more

spacious residential options, particularly among families and high-net-worth

individuals seeking both comfort and luxury. Furthermore, the commercial

properties' share, although smaller, highlights ongoing business confidence in

Dubai as a thriving hub for enterprises.

Conclusion

Overall, the transactions recorded on November 28, 2024, portray a balanced

demand for both off-plan and ready properties, with a clear edge for ready

units. The data indicates that Dubai continues to be a key destination for real

estate investments, driven by diverse buyer preferences across residential and

commercial segments. Investors looking at Dubai are seeing opportunities in

both emerging off-plan developments and established ready properties,

suggesting a well-rounded and resilient market.

Dubai Real Estate Market Review 29-Nov-2024

Dubai real estate outperforms London and New York. Dubai South sells out south

living project. UAE’s net wealth reaches $2.9 trillion in 2023, financial wealth grows

10 percent.

Dubai Real Estate: Property Rentals Set to Surge 18% in 2025

Dubai's rental market is projected to grow in 2025, with short-term rentals up 18%

and long-term leases up 13%. Drivers include rising property values, population

growth, and increased demand from professionals. Tenants should prepare for

higher costs, while investors have opportunities amid market growth.

Dubai real estate outperforms London and New York with superior 7%

investment yields and double-digit price increases

Dubai real estate investments outperform London and New York markets as price

rises, investor-friendly policies and future-proof market lure home-buyers and

speculators.

Dubai losing its lustre for squeezed expat middle classes

Dubai's rising living costs are straining middle-income expatriates, with rent

increasing by 15% and inflation forecast at 3.5%. Despite limited salary growth,

Dubai remains attractive due to high wages and stability. However, affordability

concerns persist, with efforts underway to increase supply and affordable retail

options.

ValuStrat’s latest report reveals that Qatar’s real estate market remained

steady in Q3

Qatar's Q3 real estate market remained stable, with no significant price shifts. Sales

and mortgage transactions declined, while tourism grew by 25.6%. The office and

industrial sectors were steady, with minor declines in retail. The outlook suggests

continued stability with selective growth opportunities.

Why Dubai’s Tax-Free Haven is Attracting Wealthy Investors Like Never Before

Dubai's tax-free policies, evolving regulations, and ongoing mega-projects make it

attractive for high-net-worth individuals and investors. The UAE's diversification into

tech, renewable energy, and healthcare enhances investment appeal. However,

challenges include regulatory changes, market volatility, and gaps in risk

management culture.

Dubai South sells out south living project, confirms huge demand for spacious

units in area

Dubai South Properties has sold out its luxury South Living Tower project, featuring

209 spacious apartments with modern amenities. Construction is underway, with

completion expected in Q1 2027. The project aims to attract new residents to Dubai

South, aligning with plans to expand the area's population.

Dubai emerges as the global real estate standout against London and New

York

Dubai offers exceptional value with an average property price of $438 per square

foot, high gross yields (7.0%), and strong price growth (16.5%). Pro-investor policies,

modern infrastructure, and stability make it attractive compared to London and New

York, providing an affordable yet luxurious lifestyle and promising long-term growth.

Dubai real estate: Rove Home Dubai Marina launches new residential complex

The project, located near Dubai Marina Mall and key transport links, offers fully-

furnished studio and one-bedroom apartments with the option to combine units.

UAE’s net wealth reaches $2.9 trillion in 2023, financial wealth grows 10

percent: Report

The UAE's net wealth reached $2.9 trillion in 2023, driven by a surge in financial and

real asset growth. The country is poised to become the sixth-largest global booking

center by 2028. With high UHNW individual concentration and growing wealth,

massive opportunities await wealth managers, especially with GenAI adoption.

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More

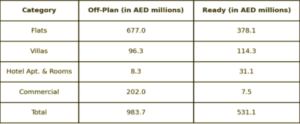

The Dubai real estate market witnessed remarkable activity on 27th November 2024,

with a total transaction value reaching AED 1.51 billion. This significant figure is a

reflection of the robust demand for both off-plan and ready properties across Dubai.

Below is a detailed breakdown of these transactions, including the contribution of

each subcategory within the broader property segments.

Off-Plan vs. Ready Properties

The total market transactions were split between off-plan and ready properties, with

off-plan properties dominating the day. The off-plan segment accounted for AED

983.66 million, which represented 64.9% of the total transaction value. On the other

hand, ready properties contributed AED 531.07 million, making up 35.1% of the total

value. This highlights the ongoing popularity of off-plan projects as investors and

homebuyers continue to be drawn to the promise of new developments and their

attractive payment plans.

Breakdown of Off-Plan Transactions

The off-plan property segment showed strong performance across several

subcategories:

Flats were the leading contributor in the off-plan segment, with a total

transaction value of AED 677.01 million, accounting for 68.8% of all off-plan

transactions. This underlines the high demand for new residential apartments

in Dubai.

Commercial Properties came next, with a total transaction value of AED

201.99 million, representing 20.5% of off-plan transactions. This indicates

substantial interest in commercial real estate, driven by a growing economy

and business opportunities.

Villas contributed AED 96.34 million, making up 9.8% of the off-plan

transactions. Villas continue to attract buyers seeking larger living spaces in

suburban communities.

Hotel Apartments and Rooms recorded transactions worth AED 8.31

million, which equates to 0.8% of the off-plan total, indicating a niche yet

steady interest in hospitality investments.

Breakdown of Ready Property Transactions

The ready property segment also demonstrated a diverse mix of activity:

Flats led the ready segment, with transactions totaling AED 378.07 million,

representing 71.2% of the ready property transactions. This reinforces the

high demand for already completed and move-in ready apartments, driven by

residents looking for immediate occupancy.

Villas followed with AED 114.34 million in transactions, accounting for 21.5%

of the ready market. This reflects consistent demand for established villa

communities that offer an immediate lifestyle upgrade.

Hotel Apartments and Rooms saw transactions totaling AED 31.10 million,

making up 5.9% of the ready segment, showing that ready hospitality units

continue to appeal to investors interested in steady rental income.

Commercial Properties recorded AED 7.55 million in transactions,

representing a modest 1.4% of the ready property segment, suggesting that

businesses are more focused on new commercial developments.

Key Insights

The real estate market on 27th November 2024 clearly demonstrates the ongoing

attractiveness of off-plan properties, particularly flats, which dominated both the off-

plan and overall market segments. Investors and buyers are increasingly leaning

towards new projects, perhaps due to innovative community offerings, flexible

payment plans, or potential capital appreciation.

Meanwhile, ready properties also showed strong activity, with a notable preference

for apartments. This indicates that end-users and investors alike are still keen to

capitalize on available opportunities in established communities.

The data also suggests a healthy balance between residential and commercial

transactions, highlighting Dubai’s continued growth as a global destination for both

living and business.

Dubai Real Estate Market Review 28-Nov-2024

Palm Jumeirah and Jumeirah Bay Island lead Dubai's super-luxury real estate

market, making up 48% of transactions over AED 50 million in 2024. Market

positioned for robust growth in the last quarter.

Dubai real estate does not show any signs of slowing down

Dubai’s real estate market showed significant growth in 2024, with Deyaar launching

Park Five, a Dh1.5 billion luxury community. CEO Saeed Mohammed Al Qatami

remains optimistic about market expansion, especially in suburban areas, and

emphasizes smart living and community-focused development.

Dubai real estate: Expo City launches Sidr Residences phase 2; homes

available from $512,000

Real estate developer Expo City Dubai has unveiled phase two of its Sidr

Residences apartment development following the success of the first tranche and

with units across all its residential projects selling out fast.

Arabian Hills Estate unveils second phase after remarkable success of Phase

One

Arabian Hills Real Estate launched Phase Two of Arabian Hills Estate, a Dh22 billion

sustainable community project on Dubai-Al Ain Road. The new phase offers

integrated living, recreational, educational, and commercial facilities, enhancing

quality of life for residents.

Palm Jumeirah And Jumeirah Bay Island Contribute 48% Of Dubai’s AED 50M+

Property Transactions

Palm Jumeirah and Jumeirah Bay Island lead Dubai's super-luxury real estate

market, making up 48% of transactions over AED 50 million in 2024. The market saw

growth, fueled by UHNWIs relocating, increased investor confidence, and Dubai's

global appeal.

Azizi unveils 109-unit waterside living project in Dubai South

Azizi Developments launched Monaco Mansions, an ultra-luxury waterside project

with 109 mansions in Dubai South’s Azizi Venice. Featuring eight architectural styles,

these bespoke homes offer six to eight bedrooms, private amenities, and lagoon

views, embodying high-end waterfront living.

Dubai real estate: Buyers split budget to acquire more units for self-use,

rentals

The current shift to affordable housing options in Dubai’s residential real estate is

taking interesting turns, with buyers with substantial budgets are seen splitting them

to acquire two properties rather than one – one for self-use and the other for renting

out, industry insiders said.

UAE real estate market positioned for robust growth in the last quarter as

demand surges for prime assets: JLL

UAE’s real estate market showed resilience in Q3 2024, driven by economic

fundamentals and investor confidence. Strong demand boosted residential,

commercial, hospitality, and industrial sectors, with notable increases in transactions,

rents, and new developments, despite global uncertainties.

The Rising Star Of UAE Real Estate: Ras Al Khaimah’s Transformation

Ras Al Khaimah (RAK) is emerging as a promising UAE real estate hotspot,

attracting investors with affordable prices, strong ROI, and ambitious developments.

Flagship projects, thriving tourism, and government initiatives are driving growth,

making RAK a compelling alternative to more saturated markets like Dubai and Abu

Dhabi.

Majid Al Futtaim announces sell-out of Lacina, phase two of Ghaf Woods

Majid Al Futtaim's Ghaf Woods project in Dubai, featuring sustainable forest-living,

saw sell-out success for its second phase, Lacina. The community offers nature-

integrated living with 35,000 trees, diverse amenities, and customizable interiors,

highlighting the demand for environmentally conscious and high-quality urban living.

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More

Dubai real estate does not show any signs of slowing down

On Wednesday, Deyaar launched launch Park Five, a luxury residential community at Dubai Production City. — Supplied photo.

Dubai’s real estate market has been consistently showing remarkable growth, with over 163,000 transactions amounting to more than Dh544 billion in the first nine months of 2024, and shows promising signs for the year ahead, an industry veteran said.

“Looking ahead to the new year, I am optimistic that the market will continue to thrive. We can expect to see further developments taking shape, with growth extending into the suburban areas of Dubai as demand diversifies and expands,” Saeed Mohammed Al Qatami, CEO of Deyaar Development, told Khaleej Times in an interview.

On Wednesday, Deyaar launched launch Park Five, a luxury residential community at Dubai Production City. Valued at Dh1.5 billion, this project will be completed in multiple phases and will feature several buildings. The new development focuses on wellness-centric living and community engagement, offering residents an urban sanctuary with meticulously planned amenities and competitive pricing.

“As part of phase 1, we are now unveiling two splendid buildings, Elm and Ember, which will form an inclusive, self-sustaining community. These buildings represent a new era in urban living, offering smart home residences designed for modern lifestyles. The development will include a mix of spacious studios, one-, two-, and three-bedroom residences, with attractive payment plan 50/50,” Al Qatami said.

Park Five’s strategic location in Dubai Production City, gives residents easy access to world-class shopping and dining, lush parks, golf clubs, top-tier schools, and renowned hospitals within minutes. Located near Sheikh Mohammed bin Zayed Road and Al Khail Road, Park Five is just minutes away from City Centre Me’aisem and is in close proximity to key locations, including the Dubai Exhibition Centre, Al Maktoum International Airport, and Expo 2020.

Park Five is offered at attractive payment plan to accommodate a wide range of buyers, with Phase 1 scheduled for completion in Summer 2027.

Saeed Mohammed Al Qatami, CEO of Deyaar Development

Since its initial public offering (IPO) in 2007, Deyaar has expanded into different business units, including property development and management, hospitality, as well as facility management, which wss recently rebranded as Ontegr

“Over the years, we have made significant progress with project launches, including Midtown in Dubai Production City, the Mar Casa in Dubai Maritime City, Regalia in Business Bay, Tria in Dubai Silicon Oasis, our hospitality project Millennium Talia Residences in Al Furjan, as well as our latest projects, ELEVE in Downtown Jebel Ali and Rivage in Abu Dhabi,” Al Qatami said.

The Deyaar CEO sees significant growth in areas such as Dubai South, Nad Al Sheba, Jabel Ali, and Mohammed Bin Rashid City, and Dubai Land, which are poised for further development. “Business Bay will also continue to mature as it fills in its remaining plots. Additionally, areas like Dubai Silicon Oasis and the surrounding neighborhoods along the Dubai-Al Ain Road are expected to see continued expansion and growth,” he added.

Deyaar has fortified itself against surging land prices with an exceptional land bank and a strong portfolio of projects. “Our focus remains on maximising the potential of our current assets and delivering value. While we continuously assess market conditions and potential opportunities, any decisions regarding the expansion of our land bank will be made strategically, ensuring alignment with our future goals and growth objectives,” Al Qatami said.

The increasing frequency of projects in Dubai will be something to watch closely, Al Qatami said. “It will be interesting to see how demand evolves and how developers, especially new ones ensure their projects meet customer expectations. With many new players entering the market, there could be pressure to deliver projects on time and to the high standards expected, which I believe could present both opportunities and challenges for the industry,” Al Qatami said.

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More

Sharjah reduces property transaction fees at ACRES 2025, enhancing emirate’s real estate sector

SHARJAH: The Organising Committee of the Sharjah Real Estate Exhibition – ACRES announced that Sharjah Executive Council’s (SEC) decision to reduce property transaction fees at ACRES 2025 will significantly enhance the emirate’s real estate sector.

H.H. Sheikh Sultan bin Mohammed bin Sultan Al Qasimi, Crown Prince, Deputy Ruler of Sharjah and Chairman of the SEC, approved the reduction in sale and purchase fees for transactions at the exhibition, strengthening Sharjah’s position as a leading real estate investment destination.

Organised by the Sharjah Chamber of Commerce and Industry in collaboration with the Sharjah Real Estate Registration Department, the event will run from 22nd to 25th January 2025, at Expo Centre Sharjah. It will feature a range of developers and investment companies, showcasing groundbreaking projects and offering exclusive deals.

SEC’s decision includes a 0.5 percent reduction in selling fees for developers and discounts on purchase fees: 1 percent for UAE and GCC citizens and 2 percent for other nationalities. This move is expected to boost sales, attract investors, and elevate Sharjah’s real estate market.

The exhibition will also introduce pioneering projects and trends, further cementing Sharjah’s role as a global real estate hub.

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More

Dubai, UAE: The World Realty Congress & Awards 2024 will bring together global leaders in real estate, PropTech, development, and sustainability from December 9th to 13th at the Palazzo Versace, Dubai. The landmark event, which will consist of a conference and then an award ceremony, is set to establish critical dialogues around the role of the real estate sector in supporting the UAE’s Vision 2033, which emphasizes innovation, sustainability, and long-term economic growth.

As the UAE continues its transformation into a hub for cutting-edge urban development, this congress will serve as a key platform to discuss the integration of green building practices, and focus on delivering actionable outcomes, PropTech advancements, and present sustainable frameworks to foster a collaborative movement within the industry. Industry experts will share insights on the pressing issues and opportunities reshaping real estate.

“The UAE’s Vision 2033 lays out an ambitious blueprint for sustainability and innovation in real estate,” said Jatin Deepchandani, CEO of Plan3 Media, the event’s organizer. “The World Realty Congress will not only highlight current trends but also catalyze discussions that will help shape the future of real estate development in the region. Real estate isn’t just an industry – it’s a driver of economic growth, community development, and environmental responsibility. And that’s exactly what this event is going to showcase.”

The Congress will host a distinguished lineup of speakers, including Michael Belton, CEO of MERED, Madhav Dhar, Co-founder and COO of ZāZEN Properties, Stuart Harrison, CEO of Emrill Services, Hamdan Mohamed Al Kaitob, Head of Property & Community Development at DEYAAR DEVELOPMENT PSJC, Francis Giani, Chief Community Management Officer at Dubai Holding Community Management, and Imran Farooq, CEO of Samana Group.

The event will feature panel discussions, masterclasses, and roundtable sessions on pivotal topics such as smart city development, energy efficiency, and investment strategies. PropTech innovations will also be a major focus, offering attendees insights into the tools and technologies redefining real estate practices globally.

Sustainability will be woven throughout the congress, reflecting the UAE’s broader push toward an environmentally responsible future. “It’s no longer just about adopting sustainable practices – it’s about embedding them into every facet of development,” added Deepchandani. “We’ll be addressing how developers, investors, and governments can work together to implement sustainable practices that ensure long-term growth, in line with the UAE’s vision for the future.”

The event will culminate on December 13th with the Awards Gala, where over 312 nominees will compete for recognition across categories celebrating innovation, leadership, and the adoption of future-forward real estate practices. These awards will honor not just individual achievements but the wider contributions to economic development and community building..

Backed by nine international industry associations, the World Realty Congress is set to be the largest gathering of its kind in the region, drawing delegates from across the globe. It will offer unparalleled opportunities for networking, knowledge sharing, and collaborative engagement across the entire spectrum of the real estate sector. The event will be supported by LOAMS, as the “Powered By” sponsor, Berkeley Services as the Platinum sponsor in sustainable facilities management, and Elevision, as the Presenting Sponsor for the Awards.

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More

On 25th November 2024, the total value of real estate transactions in Dubai

reached an impressive AED 1.29 billion. This figure encompasses both off-

plan and ready properties, providing an insightful snapshot into the dynamics

of Dubai's real estate market. Below, we analyze the contributions from off-

plan and ready properties as well as the distribution across various property

sub-categories.

Breakdown of Off-Plan vs Ready Properties

Out of the AED 1.29 billion total, off-plan transactions accounted for AED

663.8 million, representing 51.4% of the total transactions. Meanwhile, ready

properties contributed AED 628.4 million, making up 48.6% of the total. This

near-even split highlights a balanced market where both new developments

and existing properties are seeing substantial activity.

Off-Plan Property Contributions

The total value of off-plan transactions was AED 663.8 million. Breaking down

this category:

Flats were the dominant contributor, totaling AED 582.5 million, which

equates to 87.7% of the total off-plan transactions. This reflects the

continuing strong demand for residential apartments in developing

projects.

Villas contributed AED 60.9 million, representing 9.2% of off-plan

transactions. This suggests a steady interest in larger properties in the

early stages of development.

Hotel Apartments & Rooms accounted for AED 13.1 million, which is

2.0% of the off-plan market, showing moderate interest in tourism-

focused properties.

Commercial properties contributed AED 7.3 million, equaling 1.1% of

the off-plan total, indicating a smaller but still active interest in

commercial investments.

Ready Property Contributions

For ready properties, the total transaction value stood at AED 628.4 million.

The breakdown is as follows:

Flats were also the leading contributor among ready properties, with

transactions worth AED 426.2 million, making up 67.8% of the total

ready property transactions. This underlines a high preference for

immediate residential occupancy.

Villas contributed AED 124.1 million, representing 19.8% of ready

transactions, indicating solid demand for ready-to-move-in spacious

residences.

Hotel Apartments & Rooms accounted for AED 18.6 million, which is

3.0% of the ready property market, reflecting a niche but consistent

demand for investment in hospitality.

Commercial properties contributed AED 59.4 million, representing

9.5% of the total ready property transactions, showing notable interest

in immediately available business spaces.

Market Insights

The real estate market in Dubai continues to exhibit resilience and balanced

growth, as evidenced by the almost equal distribution of value between off-

plan and ready properties. The predominance of flats in both segments

indicates that apartments remain a favorite for both investors and end-users,

while villas also show steady traction, particularly among buyers looking for

larger living spaces.

Commercial and hospitality segments, while smaller in terms of total value,

are significant contributors that indicate investor confidence in Dubai's long-

term growth, especially in areas tied to tourism and business activities. The

emergence of such balanced contributions from various property types points

to the robustness of Dubai's diverse real estate offerings.

This performance provides a solid foundation as the emirate continues to

attract both local and international buyers, driven by favorable government

policies, innovative projects, and a thriving economic environment.

Dubai Real Estate Market Review 26-Nov-2024

Dubai real estate market has seen more than 188k transactions and passed

AED625bn ($170.2bn) so far this year. Dh4 million annual rent for a penthouse.

Record growth in 2024, a 13.4% rise from 2023.

Sheikh Hamdan highlights Dubai real estate market’s importance as

transactions pass $170bn in 2024

The thriving Dubai real estate market has seen more than 188,000

transactions and passed AED625bn ($170.2bn) so far this year, according to

Land Department data.

Dubai real estate sector recorded $4.5bn of transactions last week,

including Business Bay apartment sold for $25m

The Dubai real estate sector recorded AED16.55bn ($4.5bn) of transactions

last week, according to data from the Land Department.

Dubai Property Buyers Eye Creative Ways to Pile In

Dubai's soaring property prices are driving increased interest in real estate

investment trusts (REITs) and fractional ownership apps, allowing investors to

enter the market with lower costs. REITs offer accessible real estate

exposure, while tech platforms like Stake enable small-scale property

investments, catering to the rising demand.

Global real estate leaders to convene in Dubai for World Realty

Congress 2024 in December

The World Realty Congress & Awards 2024 will gather global real estate

leaders in Dubai (Dec 9-13) to discuss sustainability, innovation, and

PropTech. It aims to align real estate with UAE Vision 2033, culminating in an

awards gala recognizing contributions to development and sustainability.

Dh4 Million Penthouse Sets New Standard for Dubai Rent

Dubai's luxury rental market is booming, with high-end properties like One at

Palm Jumeirah setting records. The Dh4 million annual rent for a penthouse

highlights rising demand for exclusive rentals, attracting global attention and

reinforcing Dubai's reputation as a luxury real estate hub.

Dubai’s real estate market sees notable growth, enhancing 2033

strategy goals

Dubai's real estate market saw record growth, with over 151,000 sales in

2024's first 10 months—a 13.4% rise from 2023. October alone hit 20,460

sales, the highest ever recorded. New projects focus on diverse price points,

supporting Dubai's goal of a 70% transaction increase by 2033.

What is spurring rising demand for Dh100m homes in the UAE?

Dubai's luxury property market is booming, driven by ultra-wealthy buyers

seeking prime locations like Palm Jumeirah. Demand for Dh100 million-plus

homes remains strong, fueled by Dubai's lifestyle appeal and favorable tax

environment. The market continues to see record transactions, with limited

supply creating high competition for luxury properties.

Revealed: UK non-dom tax changes trigger large-scale property sales

by long-term GCC investors, experts say

The London and also the wider UK real estate market of late is seeing a mad

rush for liquidation of residential assets by long-term GCC owners due to tax

implications in the wake of the British government’s move to amend non-dom

rules, industry insiders said.

K-Mavins Group hands over $109mln Dubai residential project

K-Mavins has handed over its AED400 million Terrases Marassi Drive project

in Dubai's Business Bay. Featuring luxury amenities, the project reflects

growing confidence in Dubai's real estate market. The group plans a new

AED340 million project in Al Jaddaf and is expanding its retail portfolio with

The Villa Square and Liwan Mall.

Avighna Group acquires Emaar Business Park 3 for Dh240 million

Avighna Group acquired Emaar Business Park – Building 3 for Dh240 million.

The Grade-A property in The Greens offers 150,000 sq. ft. of commercial

space. The acquisition aligns with Avighna's global expansion, reflecting

confidence in Dubai’s thriving market for premium commercial real estate

amid limited supply and rising demand.

Dubai real estate: SOL Properties, Fairmont announce largest triplex

sky mansion

SOL Properties and Fairmont Hotels & Resorts have unveiled a 20,000-

square-foot triplex sky mansion in Downtown Dubai, situated atop the

Fairmont Residences Solara Tower Dubai.

How Dubai architects are designing world's second-tallest tower with

vertical mall, 7-star hotel

Burj Azizi, a 725m skyscraper on Sheikh Zayed Road, will be the world's

second-tallest structure after Burj Khalifa. Scheduled for 2028 completion, the

Dh6-billion project will feature luxury amenities, a vertical shopping mall, and

multiple world-record elements, showcasing Dubai's continued innovation and

architectural ambition.

Recent Items

Discover Dubai Marina: A Complete Guide to Waterfront Luxury

Dubai Marina, one of Dubai’s most iconic neighborhoods, offers a lifestyle that blends urban sophistication... Read More

What are the legal requirements for foreigners purchasing pr

Foreigners can purchase property in Dubai’s designated freehold areas. The process involves legal requirements, fees,... Read More

Major Legal Changes in the UAE Since 2004: A Comprehensive O

The United Arab Emirates (UAE) has undergone a remarkable transformation over the past two decades.... Read More

UAE: Why property buyers with a mortgage should have term in

Property buyers in the UAE who opt for a mortgage, should take term insurance, an... Read More

Dubai’s off-plan property rules: Can buyers get refund

Off-plan properties have long been seen as lucrative real estate investment opportunities, particularly in a... Read More